Question: Problem 12-5 (similar to) Question Help (Operating leverage) The Quarles Distributing Company manufactures an assortment of cold air intake systems for high-performance engines. The average

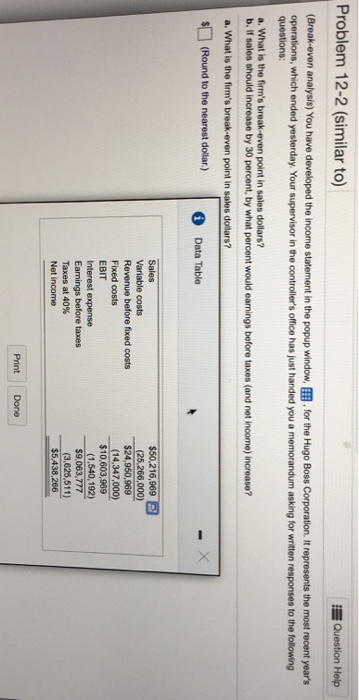

Problem 12-5 (similar to) Question Help (Operating leverage) The Quarles Distributing Company manufactures an assortment of cold air intake systems for high-performance engines. The average selling price for the various units is $600. The associated variable cost is $200 per unit. Fixed costs for the firm average $200,000 annually. a. What is the break-even point in units for the company? b. What is the dollar sales volume the firm must achieve to reach the break-even point? c. What is the degree of operating leverage for a production and sales level of 6,000 units for the firm? (Calculate to three decimal places.) d. What will be the projected effect on eanings before interest and taxes if the firm's sales level should increase by 20 percent from the volume noted in part (e)? Problem 12-2 (similar to) EQuestion Help (Break-even analysis) You have developed the income statement in the popup window, . for the Hugo Boss Corporation. It represents the most recent year's operations, which ended yesterday. Your supervisor in the controller's office has just handed you a memorandum asking for written responses to the following questions: a. What is the firm's break-even point in sales dollars? b. If sales should increase by 30 percent, by what percent would earnings before taxes (and net income) increase? a. What is the firm's break-even point in sales dollars? (Round to the nearest dollar.) Data Table Sales $50,216,969 Variable costs Revenue before fixed costs (25,266,000 $24,950,969 Fixed costs EBIT (14,347,000) $10,603,969 (1,540,192) $9,063,777 Interest expense Eamings before taxes (3,625,511) $5.438.266 Taxes at 40% Net income Print Done (Break-even point and selling price) Simple Metal Works, Inc. will manufacture and sell 160,000 units next year. Fixed costs will total $340,000, and variable costs will be 55 percent of sales. a. The firm wants to achieve a level of earnings before interest and taxes of $250,000. What selling price per unit is necessary to achieve this result? b. Set up an analytical income statement to verity your solution to part (a). a. What selling price per unit is necessary to achieve a level of earnings before interest and taxes of $250,000? (Round to three decimal places.) Problem 12-5 (similar to) Question Help (Operating leverage) The Quarles Distributing Company manufactures an assortment of cold air intake systems for high-performance engines. The average selling price for the various units is $600. The associated variable cost is $200 per unit. Fixed costs for the firm average $200,000 annually. a. What is the break-even point in units for the company? b. What is the dollar sales volume the firm must achieve to reach the break-even point? c. What is the degree of operating leverage for a production and sales level of 6,000 units for the firm? (Calculate to three decimal places.) d. What will be the projected effect on eanings before interest and taxes if the firm's sales level should increase by 20 percent from the volume noted in part (e)? Problem 12-2 (similar to) EQuestion Help (Break-even analysis) You have developed the income statement in the popup window, . for the Hugo Boss Corporation. It represents the most recent year's operations, which ended yesterday. Your supervisor in the controller's office has just handed you a memorandum asking for written responses to the following questions: a. What is the firm's break-even point in sales dollars? b. If sales should increase by 30 percent, by what percent would earnings before taxes (and net income) increase? a. What is the firm's break-even point in sales dollars? (Round to the nearest dollar.) Data Table Sales $50,216,969 Variable costs Revenue before fixed costs (25,266,000 $24,950,969 Fixed costs EBIT (14,347,000) $10,603,969 (1,540,192) $9,063,777 Interest expense Eamings before taxes (3,625,511) $5.438.266 Taxes at 40% Net income Print Done (Break-even point and selling price) Simple Metal Works, Inc. will manufacture and sell 160,000 units next year. Fixed costs will total $340,000, and variable costs will be 55 percent of sales. a. The firm wants to achieve a level of earnings before interest and taxes of $250,000. What selling price per unit is necessary to achieve this result? b. Set up an analytical income statement to verity your solution to part (a). a. What selling price per unit is necessary to achieve a level of earnings before interest and taxes of $250,000? (Round to three decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts