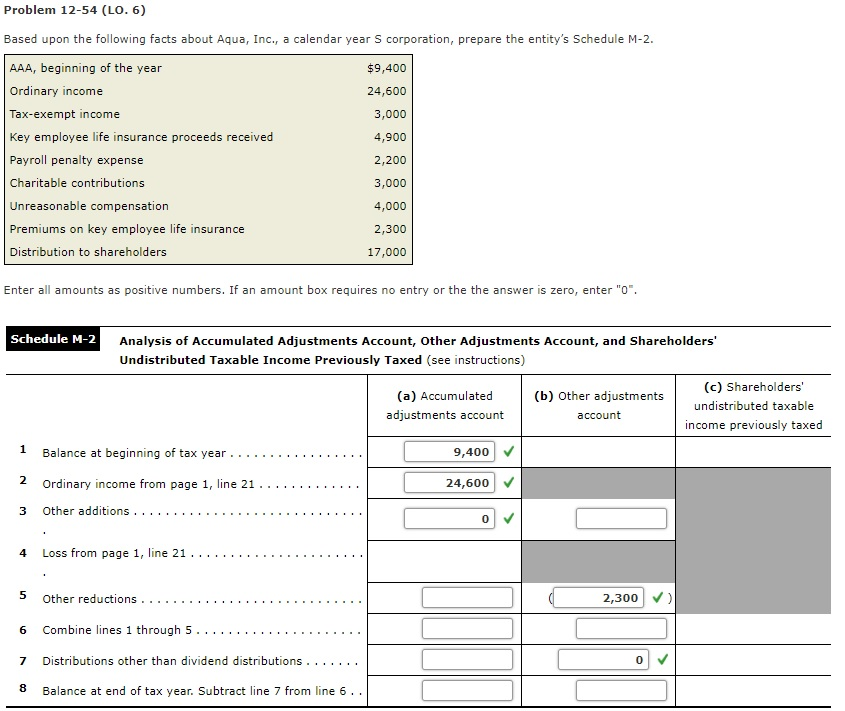

Question: Problem 12-54 (LO. 6) Based upon the following facts about Aqua, Inc., a calendar year S corporation, prepare the entity's Schedule M-2. AAA, beginning of

Problem 12-54 (LO. 6) Based upon the following facts about Aqua, Inc., a calendar year S corporation, prepare the entity's Schedule M-2. AAA, beginning of the year Ordinary income Tax-exempt income Key employee life insurance proceeds received Payroll penalty expense Charitable contributions Unreasonable compensation Premiums on key employee life insurance Distribution to shareholders $9,400 24,600 3,000 4,900 2,200 3,000 4,000 2,300 17,000 Enter all amounts as positive numbers. If an amount box requires no entry or the the answer is zero, enter "O Schedule M-2 Analysis of Accumulated Adjustments Account, Other Adjustments Account, and Shareholders Undistributed Taxable Income Previously Taxed (see instructions) (a) Accumulated adjustments account (c) Shareholders undistributed taxable income previously taxed (b) Other adjustments account 9,400 Ordinary income from page 1, line 21.. 24,600 V 3 Other additions 0 4 Loss from page 1, line 21 2,300 ) 7 Distributions other than dividend distributions. .. .. 0 8 Balance at end of tax year. Subtract line 7 from line 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts