Question: Problem 12.6A (Static) Recording adjustments and completing the worksheet. LO 12-1, 12-2, 12-3, 12-4 Enoteca Fine Wines is a retail store selling vintage wines. On

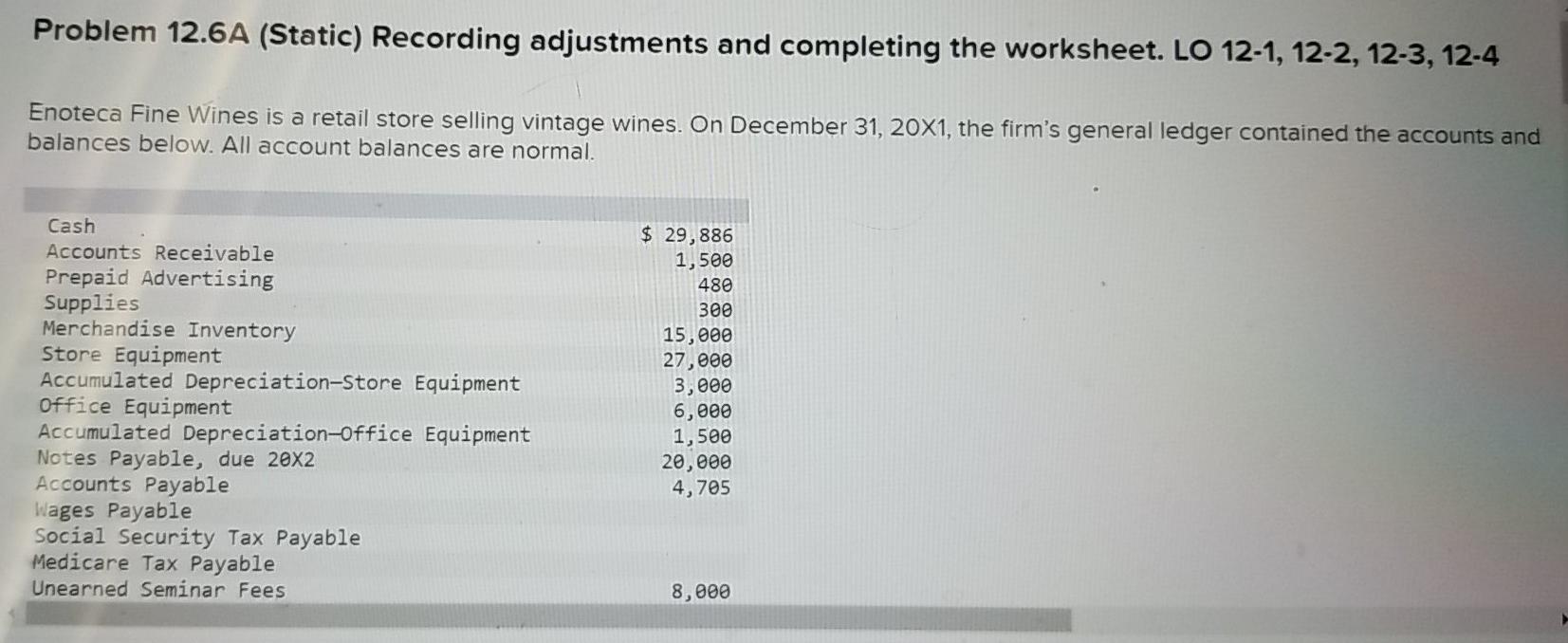

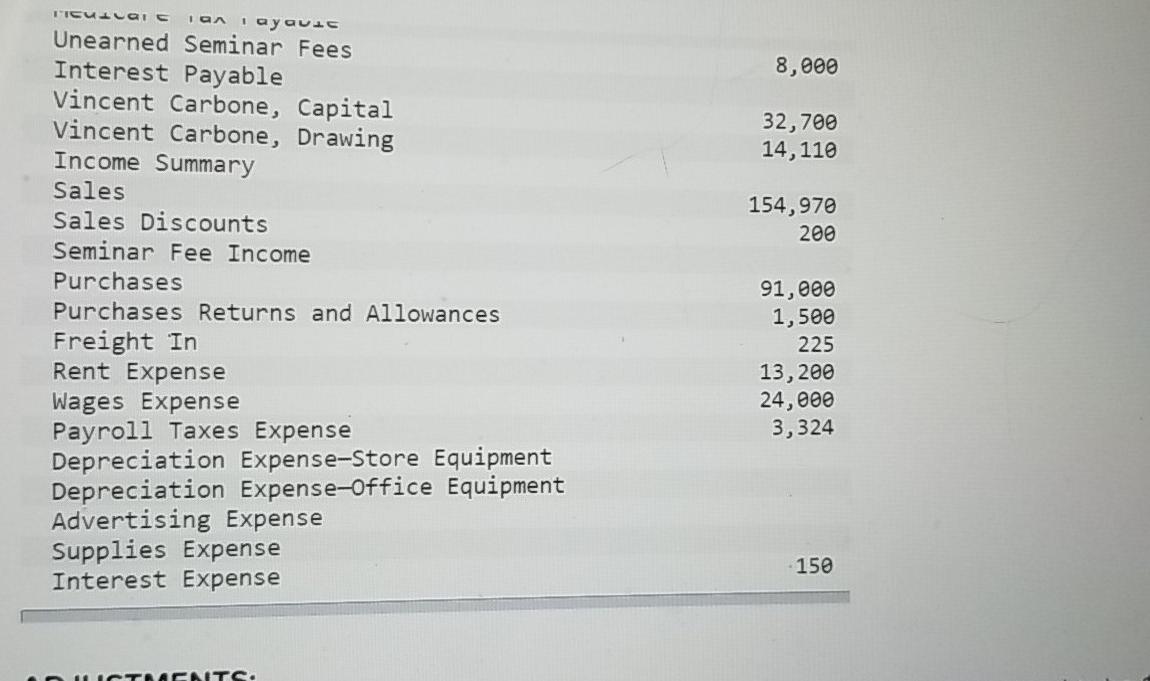

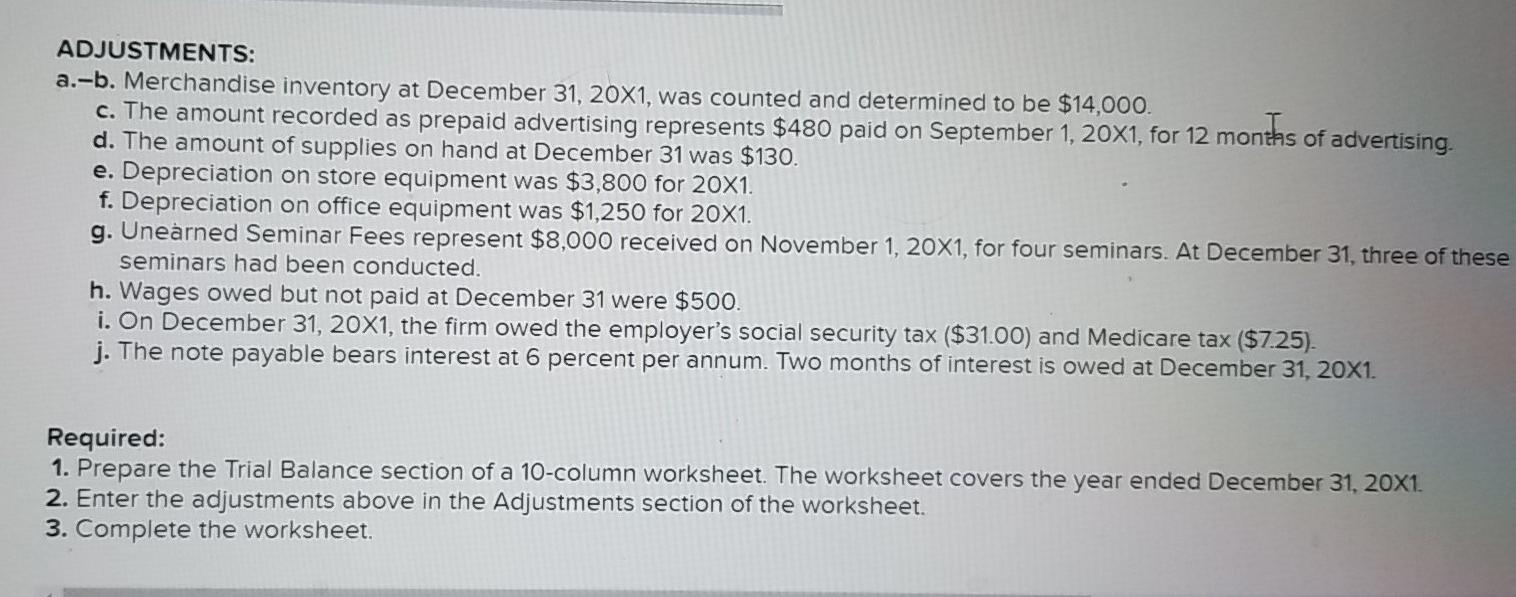

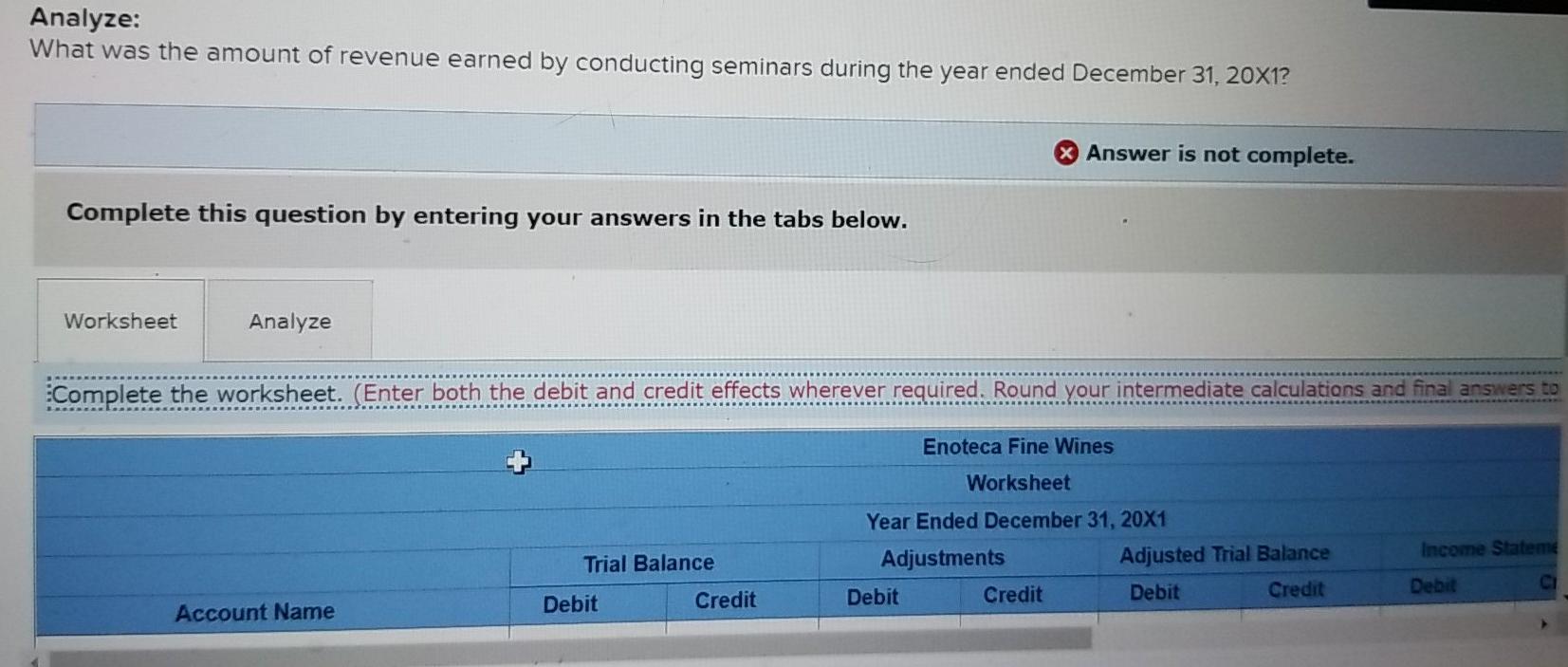

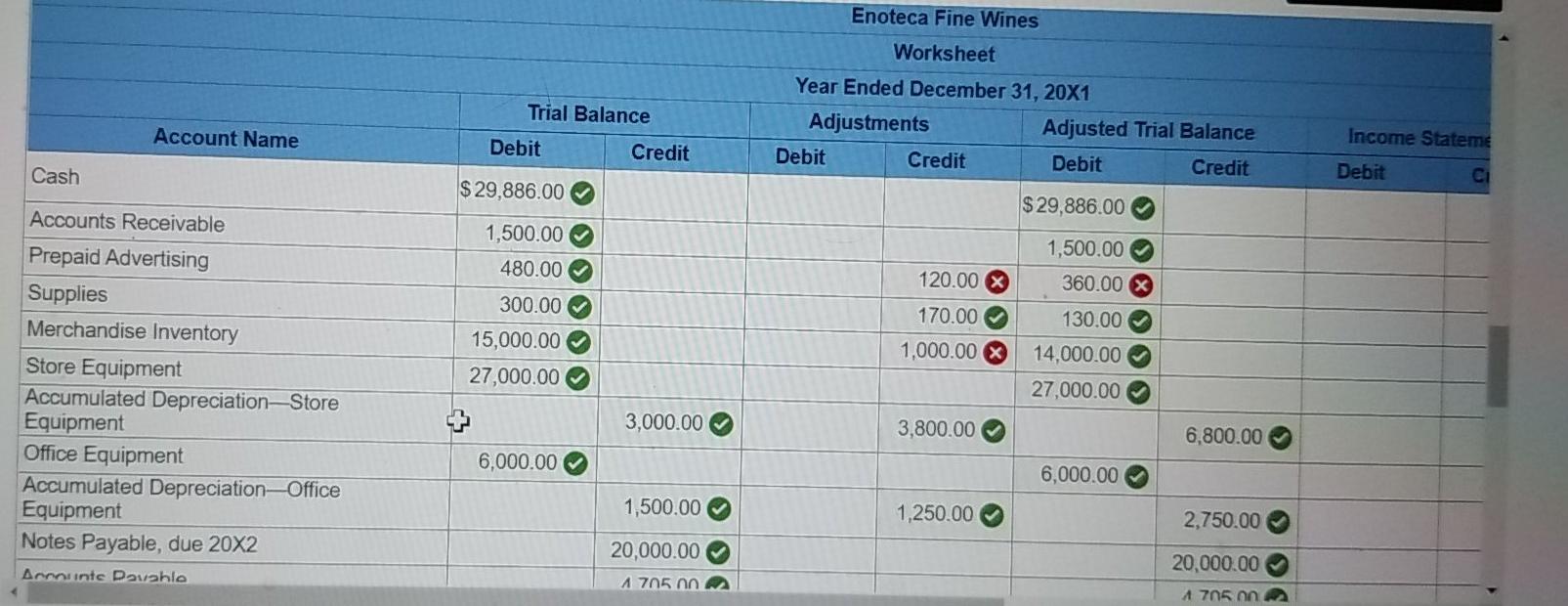

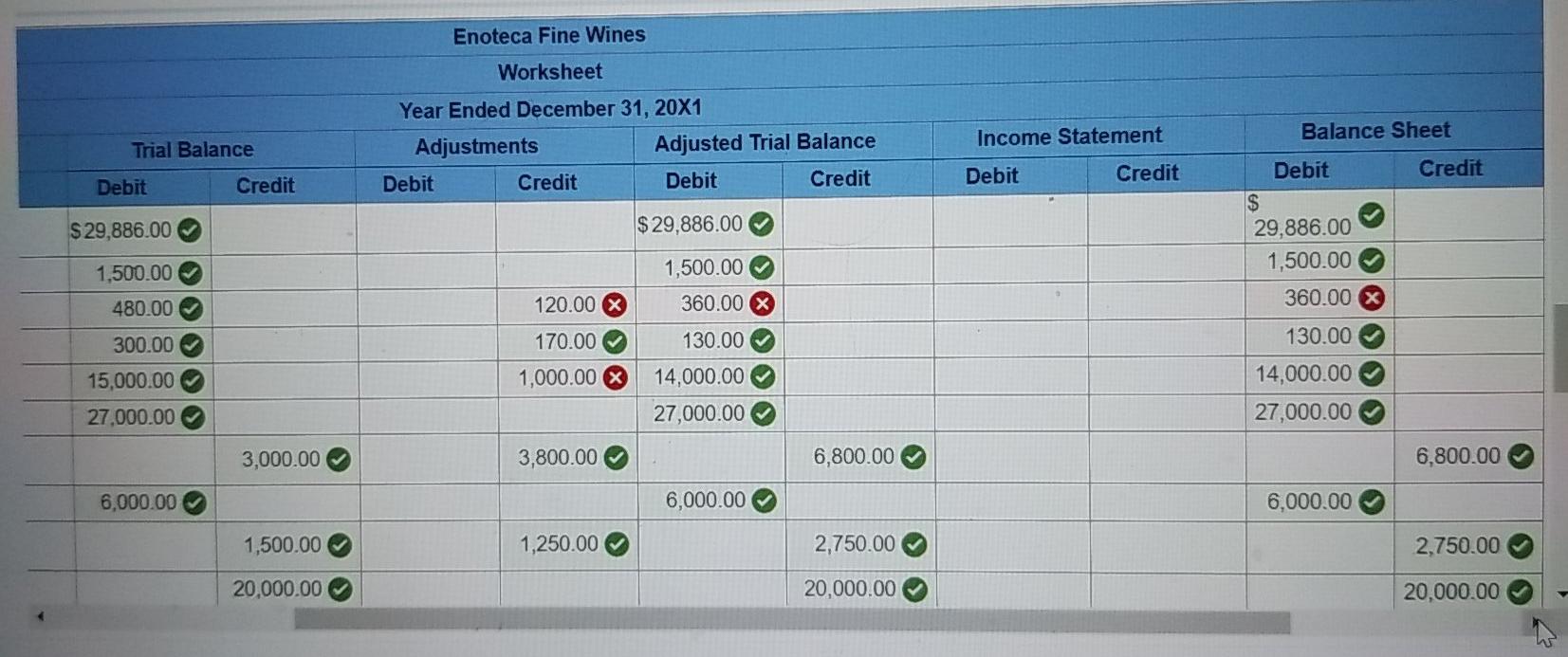

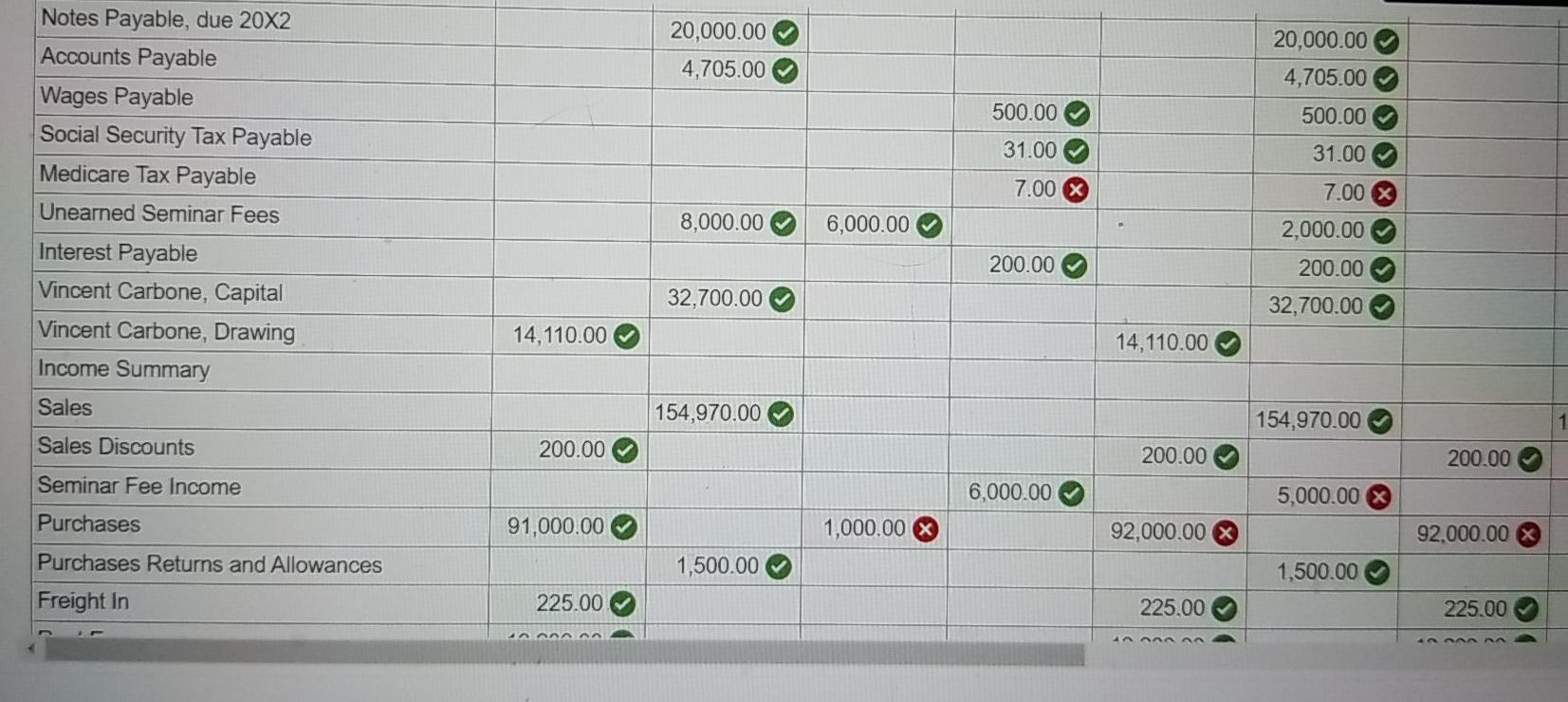

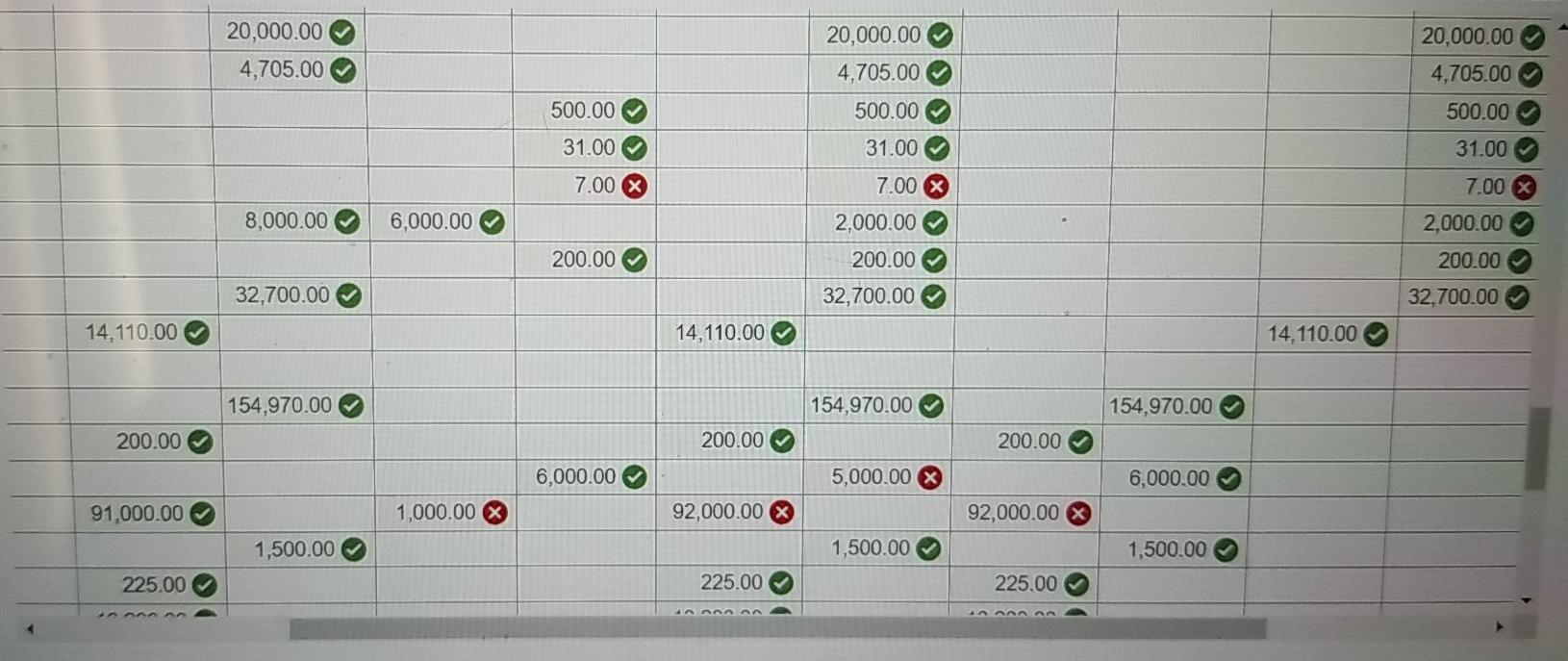

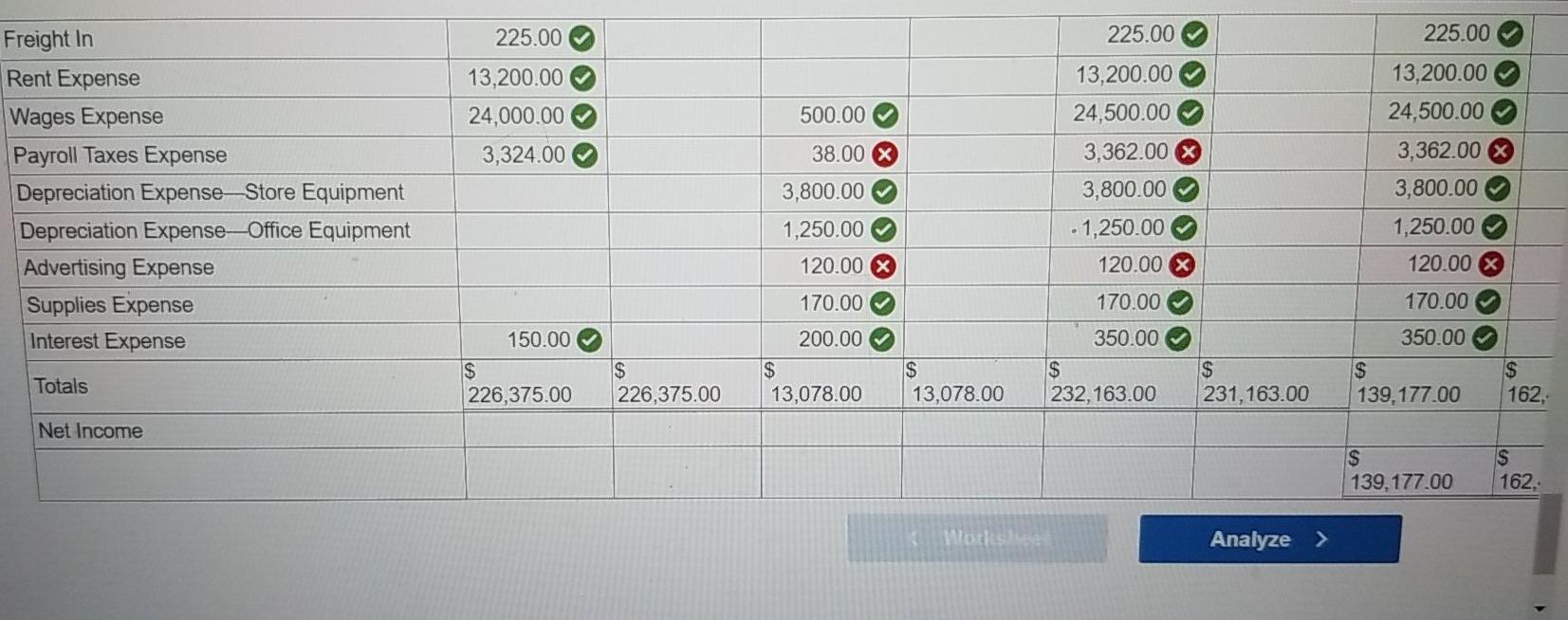

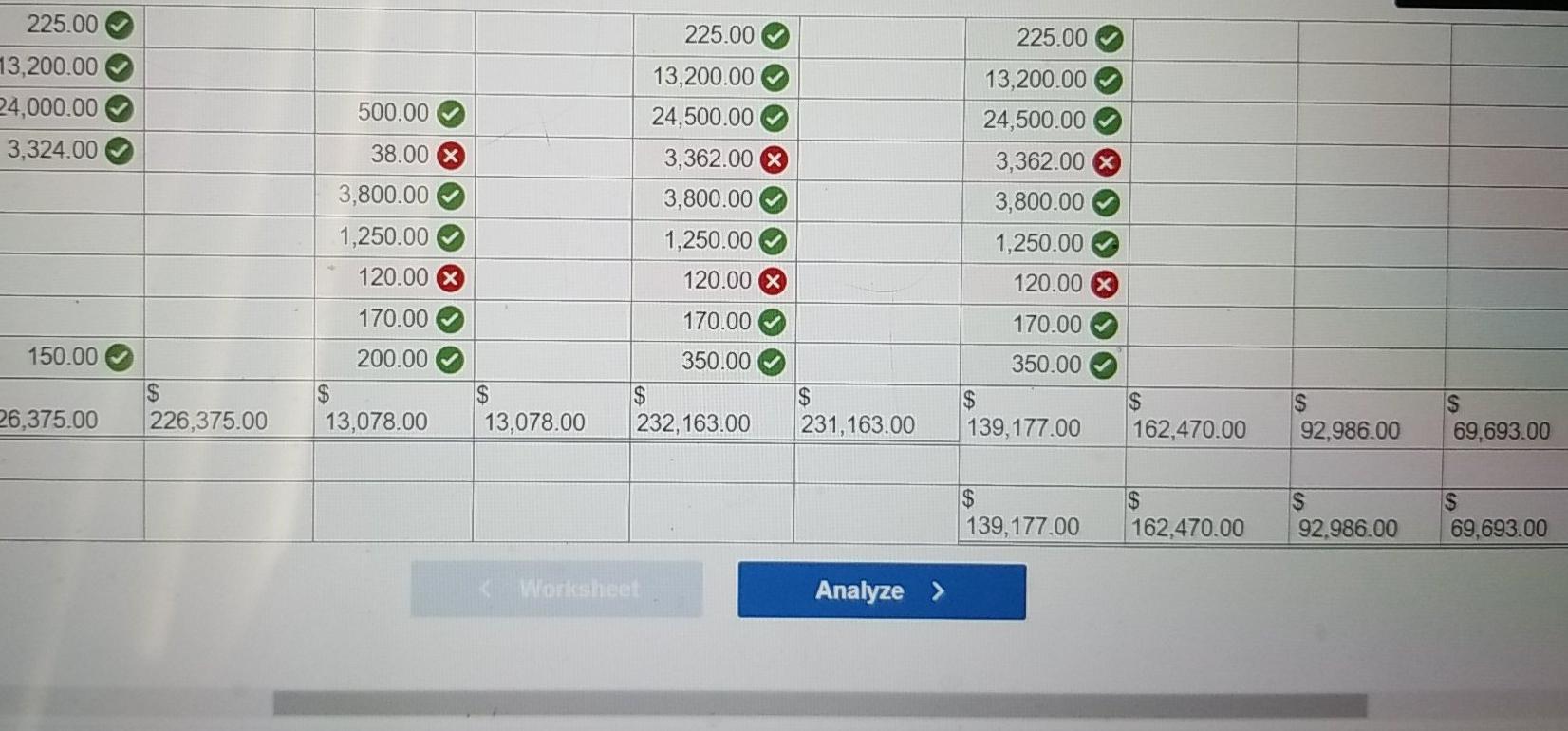

Problem 12.6A (Static) Recording adjustments and completing the worksheet. LO 12-1, 12-2, 12-3, 12-4 Enoteca Fine Wines is a retail store selling vintage wines. On December 31, 20X1, the firm's general ledger contained the accounts and balances below. All account balances are normal. Cash Accounts Receivable Prepaid Advertising Supplies Merchandise Inventory Store Equipment Accumulated Depreciation-Store Equipment Office Equipment Accumulated Depreciation-office Equipment Notes Payable, due 20x2 Accounts Payable Wages Payable Social Security Tax Payable Medicare Tax Payable Unearned Seminar Fees $ 29,886 1,500 480 300 15,000 27,000 3,000 6,000 1,500 20,000 4,705 8,000 l'icutcai 8,000 32,700 14, 110 154,970 200 vic Unearned Seminar Fees Interest Payable Vincent Carbone, Capital Vincent Carbone, Drawing Income Summary Sales Sales Discounts Seminar Fee Income Purchases Purchases Returns and Allowances Freight In Rent Expense Wages Expense Payroll Taxes Expense Depreciation Expense-Store Equipment Depreciation Expense-Office Equipment Advertising Expense Supplies Expense Interest Expense 91,000 1,500 225 13,200 24,000 3, 324 - 150 DCT AGAITS. ADJUSTMENTS: a.-b. Merchandise inventory at December 31, 20x1, was counted and determined to be $14,000. c. The amount recorded as prepaid advertising represents $480 paid on September 1, 20x1, for 12 months of advertising. d. The amount of supplies on hand at December 31 was $130. e. Depreciation on store equipment was $3,800 for 20X1. f. Depreciation on office equipment was $1,250 for 20X1. g. Unearned Seminar Fees represent $8,000 received on November 1, 20X1, for four seminars. At December 31, three of these seminars had been conducted. h. Wages owed but not paid at December 31 were $500. i. On December 31, 20X1, the firm owed the employer's social security tax ($31.00) and Medicare tax ($7.25). j. The note payable bears interest at 6 percent per annum. Two months of interest is owed at December 31, 20X1. Required: 1. Prepare the Trial Balance section of a 10-column worksheet. The worksheet covers the year ended December 31, 20X1. 2. Enter the adjustments above in the Adjustments section of the worksheet. 3. Complete the worksheet. Analyze: What was the amount of revenue earned by conducting seminars during the year ended December 31, 20X1? Answer is not complete. Complete this question by entering your answers in the tabs below. Worksheet Analyze Complete the worksheet. (Enter both the debit and credit effects wherever required. Round your intermediate calculations and final answers to Enoteca Fine Wines Worksheet Year Ended December 31, 20X1 Adjustments Adjusted Trial Balance Debit Credit Debit Credit Income Stateme Trial Balance Debit Credit Debit Account Name Enoteca Fine Wines Worksheet Trial Balance Year Ended December 31, 20X1 Adjustments Adjusted Trial Balance Debit Credit Debit Credit Account Name Income Stateme Debit Credit Cash Debit CI $ 29,886.00 $ 29,886.00 1,500.00 480.00 1,500.00 360.00 X 120.00 X 300.00 170.00 130.00 15,000.00 1,000.00 27,000.00 Accounts Receivable Prepaid Advertising Supplies Merchandise Inventory Store Equipment Accumulated Depreciation Store Equipment Office Equipment Accumulated Depreciation Office Equipment Notes Payable, due 20X2 Arnouinto Davahla 14,000.00 27,000.00 3,000.00 3,800.00 6,800.00 6,000.00 6,000.00 1,500.00 1,250.00 2,750.00 20,000.00 1 705 nn 20,000.00 4 705 on Enoteca Fine Wines Worksheet Year Ended December 31, 20X1 Adjustments Adjusted Trial Balance Debit Credit Debit Credit Income Statement Trial Balance Debit Credit Debit Credit Balance Sheet Debit Credit $ 29,886.00 1,500.00 360.00 $ 29,886.00 $ 29,886.00 1,500.00 1,500.00 480.00 120.00 X 360.00 X 300.00 15,000.00 27,000.00 170.00 130.00 1,000.00 X 14,000.00 27,000.00 130.00 14,000.00 27,000.00 3,000.00 3,800.00 6,800.00 6,800.00 6,000.00 6,000.00 6,000.00 1,500.00 1,250.00 2,750.00 2,750.00 20,000.00 20,000.00 20,000.00 20,000.00 4,705.00 20,000.00 4,705.00 500.00 500.00 31.00 31.00 Notes Payable, due 20X2 Accounts Payable Wages Payable Social Security Tax Payable Medicare Tax Payable Unearned Seminar Fees Interest Payable Vincent Carbone, Capital Vincent Carbone, Drawing Income Summary 7.00 X 7.00 X 8,000.00 6,000.00 2,000.00 200.00 200.00 32,700.00 32,700.00 14,110.00 14,110.00 Sales 154,970.00 154,970.00 1 Sales Discounts 200.00 200.00 200.00 Seminar Fee Income 6,000.00 5,000.00 Purchases 91,000.00 1,000.00 X 92,000.00 92,000.00 Purchases Returns and Allowances 1,500.00 1,500.00 Freight In 225.00 225.00 225.00 ANA Annan 20,000.00 4,705.00 20,000.00 4,705.00 20,000.00 4,705.00 500.00 500.00 500.00 31.00 31.00 31.00 7.00 X 7.00 X 7.00 x 8,000.00 6,000.00 2,000.00 2,000.00 200.00 200.00 200.00 32,700.00 32,700.00 32,700.00 14.110.00 14,110.00 14,110.00 154,970.00 154,970.00 154,970.00 200.00 200.00 200.00 6,000.00 5,000.00 X 6,000.00 91,000.00 1,000.00 92,000.00 92,000.00 X 1,500.00 1,500.00 1,500.00 225.00 225.00 225.00 225.00 225.00 225.00 13,200.00 13,200.00 24,000.00 3,324.00 500.00 38.00 X Freight In Rent Expense Wages Expense Payroll Taxes Expense Depreciation Expense-Store Equipment Depreciation Expense-Office Equipment Advertising Expense Supplies Expense Interest Expense 13,200.00 24,500.00 3,362.00 X 3,800.00 1,250.00 24,500.00 3,362.00 3,800.00 1,250.00 120.00 3,800.00 1,250.00 120.00 X 120.00 170.00 170.00 200.00 150.00 $ 226,375.00 170.00 350.00 $ 139.177.00 $ 350.00 $ 232,163.00 $ 226,375.00 Totals $ 13,078.00 $ 13,078.00 $ 231,163.00 162, Net Income $ 139,177.00 $ 162, Work Analyze > 225.00 225.00 225.00 13,200.00 24,000.00 3,324.00 500.00 38.00 3,800.00 1,250.00 120.00 X 13,200.00 24,500.00 3,362.00 3,800.00 1,250.00 13,200.00 24,500.00 3,362.00 X 3,800.00 1,250.00 120.00 X 120.00 170.00 170.00 170.00 150.00 350.00 200.00 $ 13,078.00 $ 226,375.00 26,375.00 $ 13,078.00 $ 232,163.00 350.00 $ 139,177.00 $ 231,163.00 $ 162,470.00 s 92,986.00 69,693.00 $ 139,177.00 $ 162,470.00 S 92.986.00 S 69,693.00 Worksheet Analyze >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts