Question: | Problem 1-3 CATHY CO. requires advance payments for its products. The records of Cathy show the following: Unearned revenue, January 1, 2021 R600,000 Cash

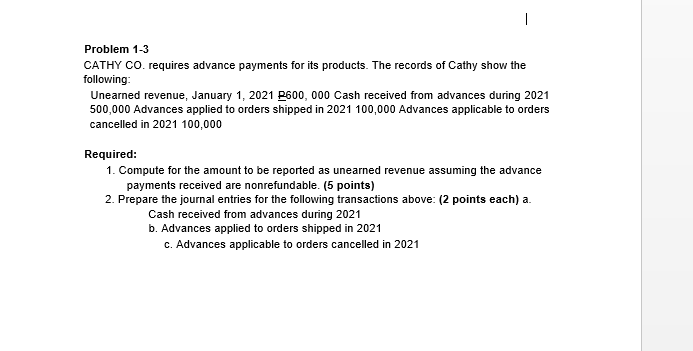

| Problem 1-3 CATHY CO. requires advance payments for its products. The records of Cathy show the following: Unearned revenue, January 1, 2021 R600,000 Cash received from advances during 2021 500,000 Advances applied to orders shipped in 2021 100,000 Advances applicable to orders cancelled in 2021 100,000 Required: 1. Compute for the amount to be reported as unearned revenue assuming the advance payments received are nonrefundable. (5 points) 2. Prepare the journal entries for the following transactions above: (2 points each) a. Cash received from advances during 2021 b. Advances applied to orders shipped in 2021 c. Advances applicable to orders cancelled in 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts