Question: Problem 13-02 a. A $1,000 bond has a 6.5 percent coupon and matures after eleven years. If current interest rates are 9 percent, what should

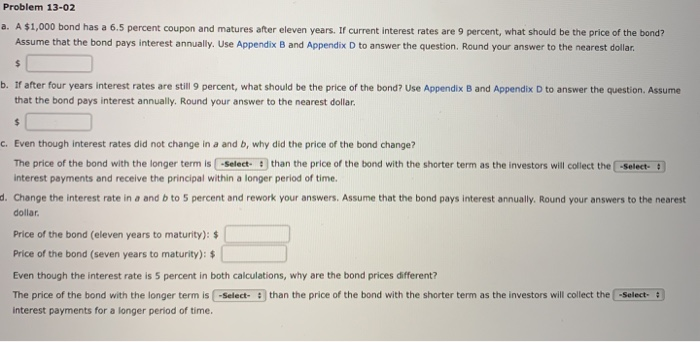

Problem 13-02 a. A $1,000 bond has a 6.5 percent coupon and matures after eleven years. If current interest rates are 9 percent, what should be the price of the bond? Assume that the bond pays Interest annually. Use Appendix B and Appendix D to answer the question. Round your answer to the nearest dollar. b. If after four years interest rates are still 9 percent, what should be the price of the bond? Use Appendix B and Appendix D to answer the question. Assume that the bond pays interest annually. Round your answer to the nearest dollar. c. Even though interest rates did not change in a and b, why did the price of the bond change? The price of the bond with the longer term is Select than the price of the bond with the shorter term as the investors will collect the select Interest payments and receive the principal within a longer period of time. 1. Change the interest rate in a and b to 5 percent and rework your answers. Assume that the bond pays interest annually. Round your answers to the nearest dollar. Price of the bond (eleven years to maturity): $ Price of the bond (seven years to maturity): $ Even though the interest rate is 5 percent in both calculations, why are the bond prices different? The price of the bond with the longer term is Select than the price of the bond with the shorter term as the investors will collect the interest payments for a longer period of time. Select

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts