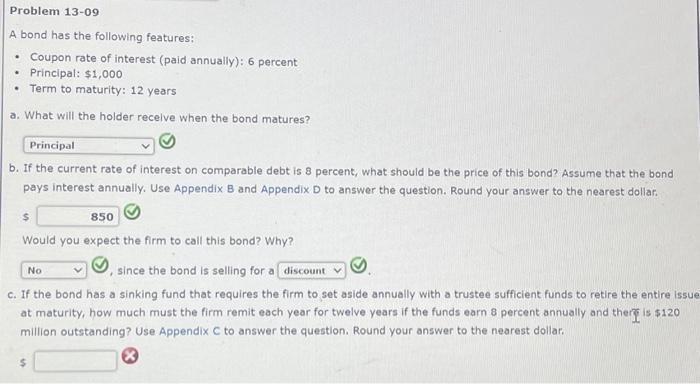

Question: Problem 13-09 A bond has the following features: - Coupon rate of interest (paid annually): 6 percent - Principal: $1,000 - Term to maturity: 12

Problem 13-09 A bond has the following features: - Coupon rate of interest (paid annually): 6 percent - Principal: $1,000 - Term to maturity: 12 years a. What will the holder recelve when the bond matures? b. If the current rate of interest on comparable debt is 8 percent, what should be the price of this bond? Assume that the bond pays interest annually. Use Appendix B and Appendix D to answer the question. Round your answer to the nearest dollar. \$ Would you expect the firm to call this bond? Why? since the bond is selling for a c. If the bond has a sinking fund that requires the firm to set aside annually with a trustee sufficient funds to retire the entire issu at maturity, how much must the firm remit each year for twelve years if the funds earn 8 percent annually and ther $ is $120 million outstanding? Use Appendix C to answer the question. Round your answer to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts