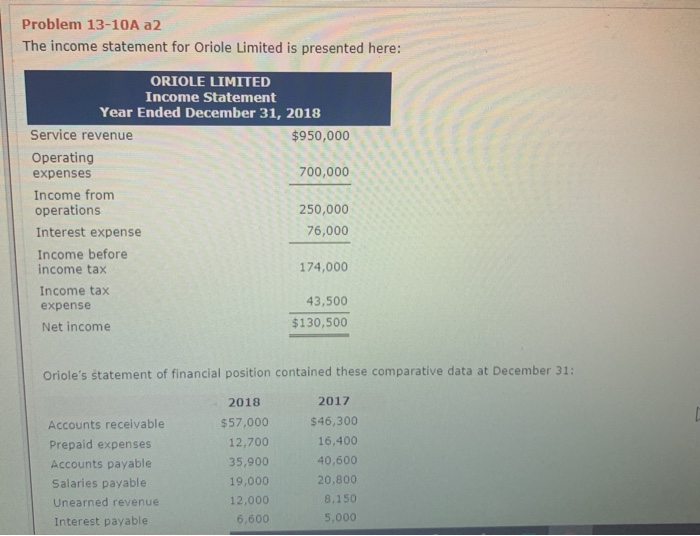

Question: Problem 13-10A a2 The income statement for Oriole Limited is presented here: ORIOLE LIMITED Income Statement Year Ended December 31, 2018 Service revenue $950,000 Operating

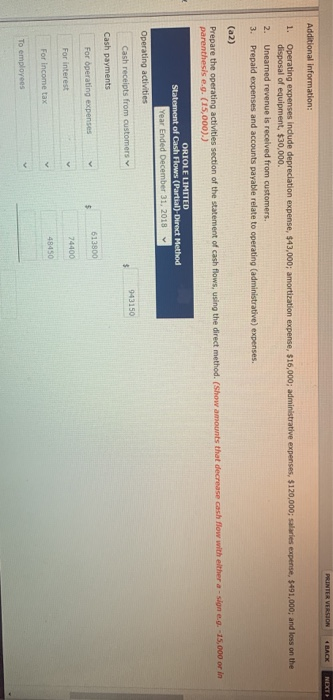

Problem 13-10A a2 The income statement for Oriole Limited is presented here: ORIOLE LIMITED Income Statement Year Ended December 31, 2018 Service revenue $950,000 Operating expenses 700,000 Income from operations 250,000 Interest expense 76,000 Income before income tax 174,000 Income tax expense 43,500 Net income $130,500 Oriole's statement of financial position contained these comparative data at December 31: Accounts receivable Prepaid expenses Accounts payable Salaries payable Unearned revenue Interest payable 2018 $57,000 12,700 35,900 19,000 12,000 6.600 2017 $46,300 16,400 40,600 20,800 8,150 5.000 PRINTER VERSION 4 BACK NEXT Additional Information: 1. Operating expenses include depreciation expense, $43,000; amortization expense, $16,000; administrative expenses, $120,000; salaries expense, $491,000, and loss on the disposal of equipment, $30,000 2. Unearned revenue is received from customers. 3. Prepaid expenses and accounts payable relate to operating (administrative) expenses. (a2) Prepare the operating activities section of the statement of cash flows, using the direct method. (Show amounts that decrease cash flow with either a sign ..-15.000 or in parenthesis e.g. (15,000).) ORIOLE LIMITED Statement of Cash Flows (Partial)-Direct Method Year Ended December 31, 2018 Operating activities Cash receipts from customers 943150 Cash payments 613800 For operating expenses $ 74400 For interest 48450 For income tax To employees

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts