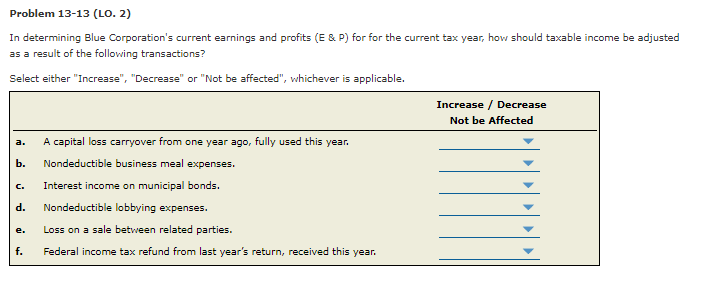

Question: Problem 13-13 (LO. 2) In determining Blue Corporation's current earnings and profits (E & P) for for the current tax year, how should taxable income

Problem 13-13 (LO. 2) In determining Blue Corporation's current earnings and profits (E & P) for for the current tax year, how should taxable income be adjusted as a result of the following transactions? Select either "Increase", "Decrease" or "Not be affected", whichever is applicable. Increase / Decrease Not be Affected A capital loss carryover from one year ago, fully used this year. b. Nondeductible business meal expenses. Interest income on municipal bonds. d. Nondeductible lobbying expenses. Loss on a sale between related parties. Federal income tax refund from last year's return, received this year. C. e. f

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock