Question: Problem 13-14 Value-at-Risk (VaR) Statistic (LO4, CFA6) a. A stock has an annual return of 11.6 percent and a standard deviation of 47 percent. What

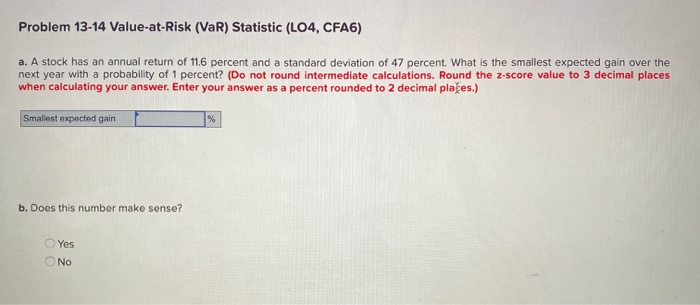

Problem 13-14 Value-at-Risk (VaR) Statistic (LO4, CFA6) a. A stock has an annual return of 11.6 percent and a standard deviation of 47 percent. What is the smallest expected gain over the next year with a probability of 1 percent? (Do not round intermediate calculations. Round the Z-score value to 3 decimal places when calculating your answer. Enter your answer as a percent rounded to 2 decimal plages.) Smallest expected gain b. Does this number make sense? Yes O No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts