Question: Problem 13-17 Capital Structure (LO3) Binomial Tree Farm's financing includes $6.80 million of bank loans and $780 million book (face) value of 10 year bonds,

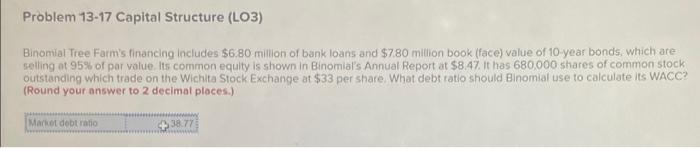

Problem 13-17 Capital Structure (LO3) Binomial Tree Farm's financing includes $6.80 million of bank loans and $780 million book (face) value of 10 year bonds, which are selling at 95% of par value. Its common equity is shown in Binomial's Annual Report at $8.47 It has 680,000 shares of common stock Outstanding which trade on the Wichita Stock Exchange at $33 per share What debt tatlo should Binomial use to calculate ts WACC? (Round your answer to 2 decimal places.) Mariot debt ratio 38.77

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts