Question: Problem 13-17 Value-at-Risk (VaR) Statistic (LO4, CFA6) Your portfolio allocates equal amounts to three stocks. All three stocks have the same mean annual return of

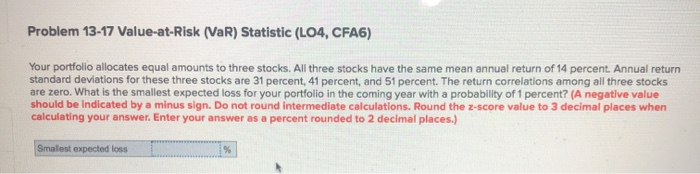

Problem 13-17 Value-at-Risk (VaR) Statistic (LO4, CFA6) Your portfolio allocates equal amounts to three stocks. All three stocks have the same mean annual return of 14 percent. Annual return standard deviations for these three stocks are 31 percent, 41 percent, and 51 percent. The return correlations among all three stocks are zero. What is the smallest expected loss for your portfolio in the coming year with a probability of 1 percent? (A negative value should be indicated by a minus sign. Do not round Intermediate calculations. Round the 2-score value to 3 decimal places when calculating your answer. Enter your answer as a percent rounded to 2 decimal places.) Smalest expected loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts