Question: Problem 13-28 (LO. 3, 8) In the current year, Paul Chaing acquires a qualifying historic structure for $350,000 (excluding the cost of the land) and

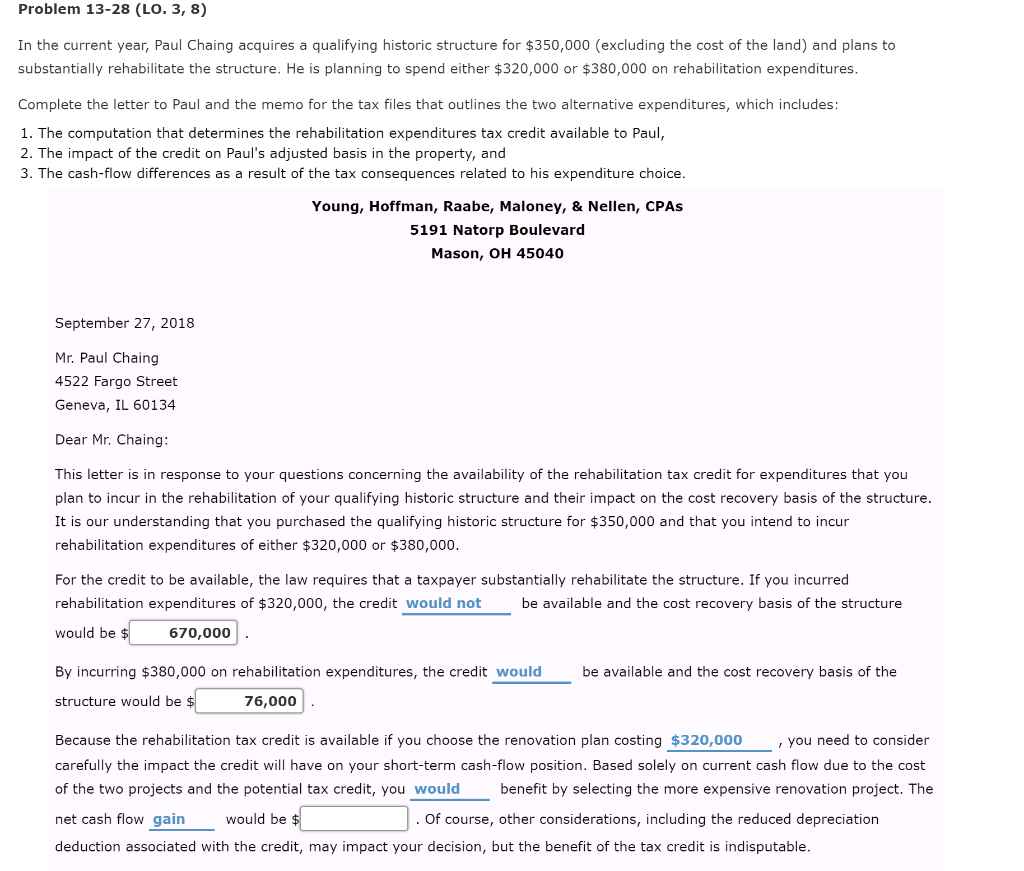

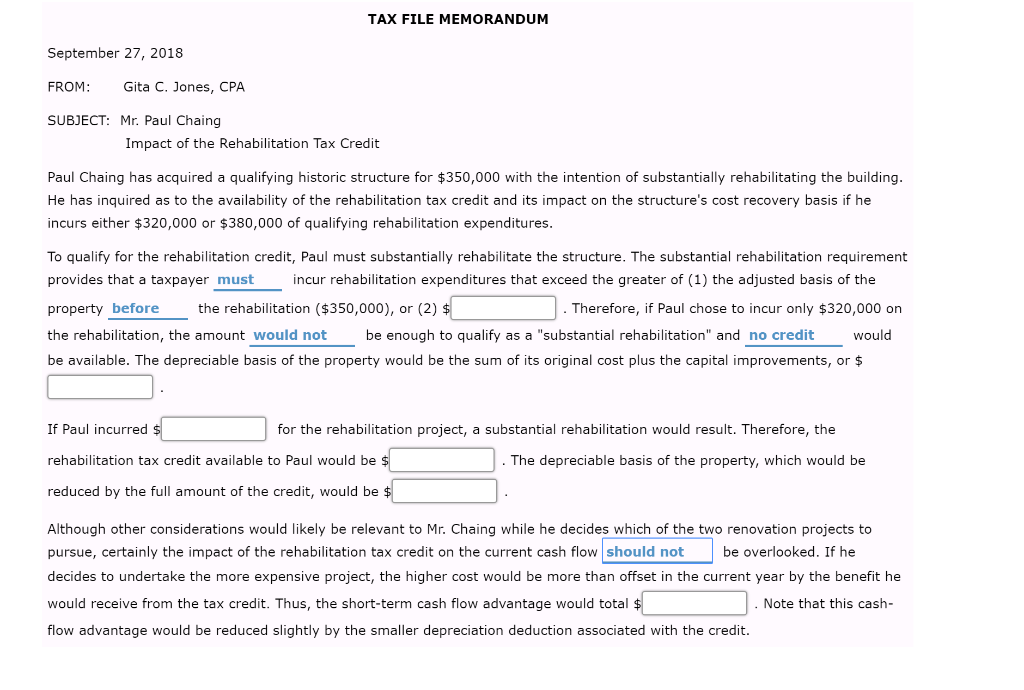

Problem 13-28 (LO. 3, 8) In the current year, Paul Chaing acquires a qualifying historic structure for $350,000 (excluding the cost of the land) and plans to substantially rehabilitate the structure. He is planning to spend either $320,000 or $380,000 on rehabilitation expenditures Complete the letter to Paul and the memo for the tax files that outlines the two alternative expenditures, which includes 1. The computation that determines the rehabilitation expenditures tax credit available to Paul 2. The impact of the credit on Paul's adjusted basis in the property, and 3. The cash-flow differences as a result of the tax consequences related to his expenditure choice Young, Hoffman, Raabe, Maloney, & Nellen, CPAs 5191 Natorp Boulevard Mason, OH 45040 September 27, 2018 Mr. Paul Chaing 4522 Fargo Street Geneva, IL 60134 Dear Mr. Chaing This letter is in response to your questions concerning the availability of the rehabilitation tax credit for expenditures that you plan to incur in the rehabilitation of your qualifying historic structure and their impact on the cost recovery basis of the structure It is our understanding that you purchased the qualifying historic structure for $350,000 and that you intend to incur rehabilitation expenditures of either $320,000 or $380,000 For the credit to be available, the law requires that a taxpayer substantially rehabilitate the structure. If you incurred rehabilitation expenditures of $320,000, the credit would not would be be available and the cost recovery basis of the structure 670,000 By incurring $380,000 on rehabilitation expenditures, the credit would be available and the cost recovery basis of the structure would be 76,000 Because the rehabilitation tax credit is available if you choose the renovation plan costing $320,000 carefully the impact the credit will have on your short-term cash-flow position. Based solely on current cash flow due to the cost of the two projects and the potential tax credit, you would net cash flow gairn deduction associated with the credit, may impact your decision, but the benefit of the tax credit is indisputable , you need to consider benefit by selecting the more expensive renovation project. The would be . Of course, other considerations, including the reduced depreciation TAX FILE MEMORANDUM September 27, 2018 FROM SUBJECT: Mr. Paul Chaing Gita C. Jones, CPA Impact of the Rehabilitation Tax Credit Paul Chaing has acquired a qualifying historic structure for $350,000 with the intention of substantially rehabilitating the building He has inquired as to the availability of the rehabilitation tax credit and its impact on the structure's cost recovery basis if he incurs either $320,000 or $380,000 of qualifying rehabilitation expenditures To qualify for the rehabilitation credit, Paul must substantially rehabilitate the structure. The substantial rehabilitation requirement provides that a taxpayer must incur rehabilitation expenditures that exceed the greater of (1) the adjusted basis of the property before the rehabilitation ($350,000), or (2) the rehabilitation, the amount would not be enough to qualify as a "substantial rehabilitation" and no credit would be available. The depreciable basis of the property would be the sum of its original cost plus the capital improvements, or . Therefore, if Paul chose to incur only $320,000 on If Paul incurred rehabilitation tax credit available to Paul would be reduced by the full amount of the credit, would be for the rehabilitation project, a substantial rehabilitation would result. Therefore, the he depreciable basis of the property, which would be Although other considerations would likely be relevant to Mr. Chaing while he decides which of the two renovation projects to pursue, certainly the impact of the rehabilitation tax credit on the current cash flow should not decides to undertake the more expensive project, the higher cost would be more than offset in the current year by the benefit he would receive from the tax credit. Thus, the short-term cash flow advantage would total flow advantage would be reduced slightly by the smaller depreciation deduction associated with the credit. be overlooked. If he . Note that this cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts