Question: Problem 13-29A Magna Inc. is considering modernizing its production facility by investing in new equipment and selling the old equipment. The following information has been

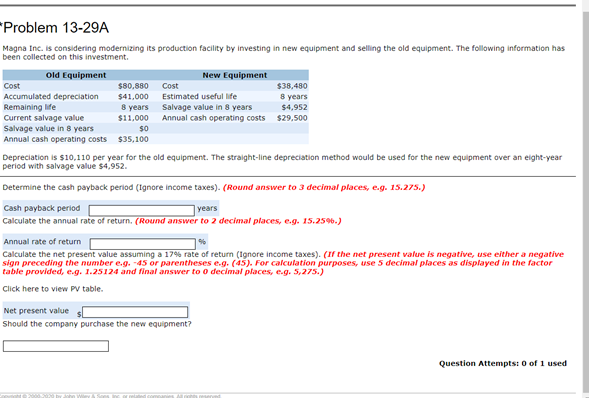

Problem 13-29A Magna Inc. is considering modernizing its production facility by investing in new equipment and selling the old equipment. The following information has been collected on this investment. Old Equipment New Equipment Cost $80,880 Cost $38,480 Accumulated depreciation $41,000 Estimated useful life 8 years Remaining life 8 years Salvage value in 8 years $4.952 Current salvage value $11,000 Annual cash operating costs $29.500 Salvage value in 8 years $0 Annual cash operating costs $35,100 Depreciation is $10,110 per year for the old equipment. The straight-line depreciation method would be used for the new equipment over an eight-year period with salvage value $4,952 Determine the cash payback period (Ignore income taxes). (Round answer to 3 decimal places, e.g. 15.275.) Cash payback period years Calculate the annual rate of return. (Round answer to 2 decimal places, e.g. 15.25%.) Annual rate of return Calculate the net present value assuming a 17% rate of return (ignore income taxes). (If the net present value is negative, use either a negative sign preceding the number e.g. -45 or parentheses e.g. (45). For calculation purposes, use 5 decimal places as displayed in the factor table provided, e.g. 1.25124 and final answer to o decimal places, e.g. 5,275.) Click here to view pv table. Net present value Should the company purchase the new equipment? Question Attempts: 0 of 1 used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts