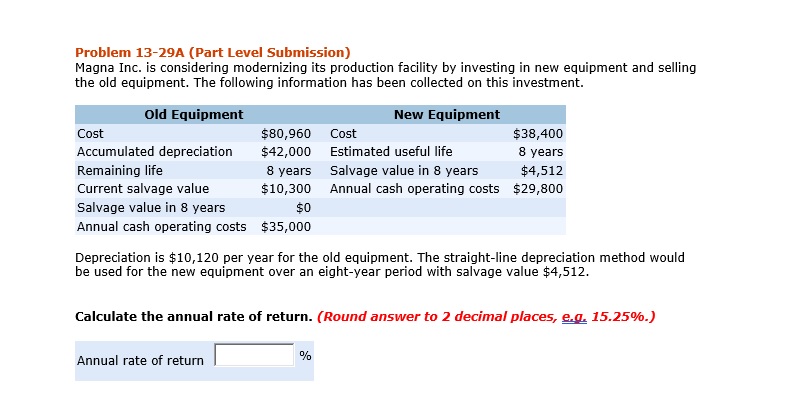

Question: Problem 13-29A. {Part Level Submission} Hagna Inc. is considering modernizing its production facilityr by investing in new equipment and selling re old equipment. The following

Problem 13-29A. {Part Level Submission} Hagna Inc. is considering modernizing its production facilityr by investing in new equipment and selling re old equipment. The following information has been collected on this investment. Cost $30,960 Cost $38,400 Accumulated depreciation $42,000 Estimated useful life 0 vears Remaining life 0 years Salvage value in 0 years $4,512 Current salvage value $10,300 Annual cash operating costs $20,300 Salvage value in 0 years $0 Annual cash operating costs $35,000 Depreciaon is $10,120 per year for the old equipment. The straightline depreciation method would he used for the new equipment over an eightyear period with salvage value $4,512. Calculate the annual rate of return. (Round answer to 2 dedmafplaces, Egg 15.25%.) Annual rate of return I ll"

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts