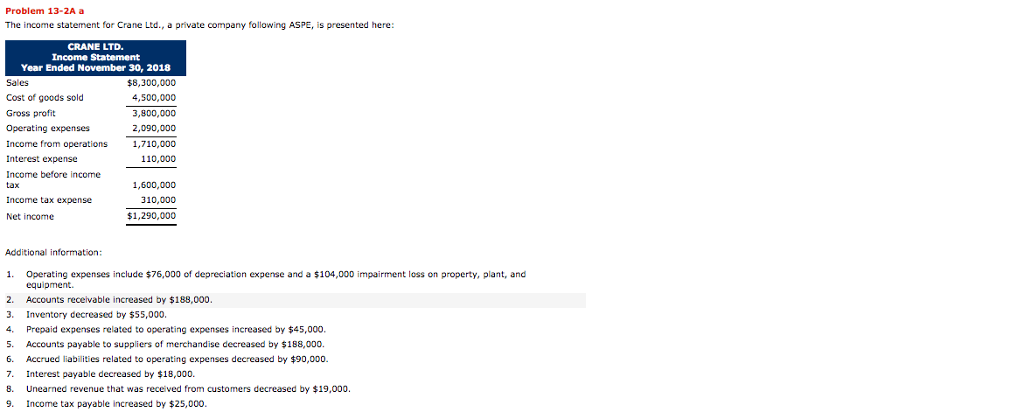

Question: Problem 13-2A a The income statement for Crane Ltd., a private company following ASPE, is presented here CRANE LTD. Income Statement Year Ended November 30,

Problem 13-2A a The income statement for Crane Ltd., a private company following ASPE, is presented here CRANE LTD. Income Statement Year Ended November 30, 2018 Cost of goods sold Gross profit Operating expenses Income from operations Interest expense Incorme before incorne $8,300,000 4,500,000 3,800,000 2,090,000 1,710,000 110,000 1,600,000 310,000 $1,290,000 Income tax expense Net income Additional information: Operating expenses include $76,000 of depreciation expense and a $104,000 impairment loss on property, plant, and equipment 1. 2. Accounts receivable increased by $188,000 3. Inventory decreased by $55,000. 4. Prepaid expenses related to operating expenses increased by $45,000 S. Accounts payable to suppliers of merchandise decreased by $188,000. 6. Accrued liabilities related to operating expenses decreased by 90,000. 7. Interest payable decreased by $18,000. 8. Unearned revenue that was received from customers decreased by $19,000 9. Income tax payable increased by $25,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts