Question: Problem 13-3A (Direct Method) Your answer is partially correct. Try again. The income statement for Tremblant Limited is presented here: Year Ended December 31, 2015

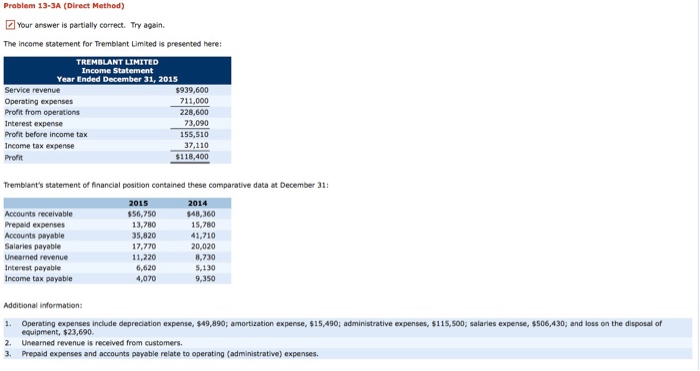

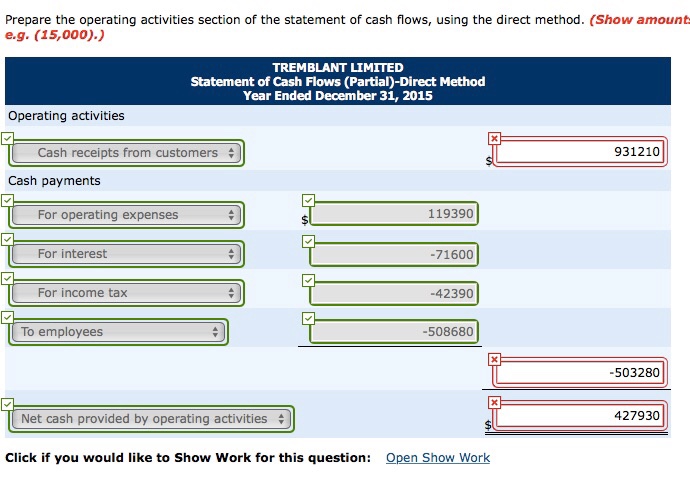

Problem 13-3A (Direct Method) Your answer is partially correct. Try again. The income statement for Tremblant Limited is presented here: Year Ended December 31, 2015 Service revenue Operating expenses Profit from operations Interest expense Profit before income tax Income tax expense Profit $939,600 711,000 228,600 73,090 155,510 37,110 118,400 Tremblant's statement of financial position contained these comparative data at December 31 2015 2014 Accounts receivable Prepaid expenses Accounts payable Salaries payable Unearned revenue Interest payable Income tax payable 56,750 13,780 35,820 17,770 11,220 6,620 4,070 48,360 15,780 1,710 20,020 8,730 5,130 9,350 Additional information: . Operating expenses include depreciation expense, $49,890; amortization expense, $15,490; administrative expenses, $115,500 salaries expense, $506,430; and loss on the disposal of 2. Unearned revenue is received from customers. equipment, $23,690 3. Prepaid expenses and accounts payable relate to operating (administrative) expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts