Question: Problem 13-4A (Static) Calculating financial statement ratios LO P3 Selected current year-end financial statements of Cabot Corporation follow. (All sales were on credit; selected balance

Problem 13-4A (Static) Calculating financial statement ratios LO P3

Selected current year-end financial statements of Cabot Corporation follow. (All sales were on credit; selected balance sheet amounts at December 31 of the prior year were inventory, $48,900; total assets, $189,400; common stock, $90,000; and retained earnings, $33,748.)

| CABOT CORPORATION | |||

| Balance Sheet | |||

| December 31 of current year | |||

| Assets | Liabilities and Equity | ||

| Cash | $ 10,000 | Accounts payable | $ 17,500 |

| Short-term investments | 8,400 | Accrued wages payable | 3,200 |

| Accounts receivable, net | 33,700 | Income taxes payable | 3,300 |

| Merchandise inventory | 32,150 | Long-term note payable, secured by mortgage on plant assets | 63,400 |

| Prepaid expenses | 2,650 | Common stock | 90,000 |

| Plant assets, net | 153,300 | Retained earnings | 62,800 |

| Total assets | $ 240,200 | Total liabilities and equity | $ 240,200 |

| CABOT CORPORATION | |

| Income Statement | |

| For Current Year Ended December 31 | |

| Sales | $ 448,600 |

|---|---|

| Cost of goods sold | 297,250 |

| Gross profit | 151,350 |

| Operating expenses | 98,600 |

| Interest expense | 4,100 |

| Income before taxes | 48,650 |

| Income tax expense | 19,598 |

| Net income | $ 29,052 |

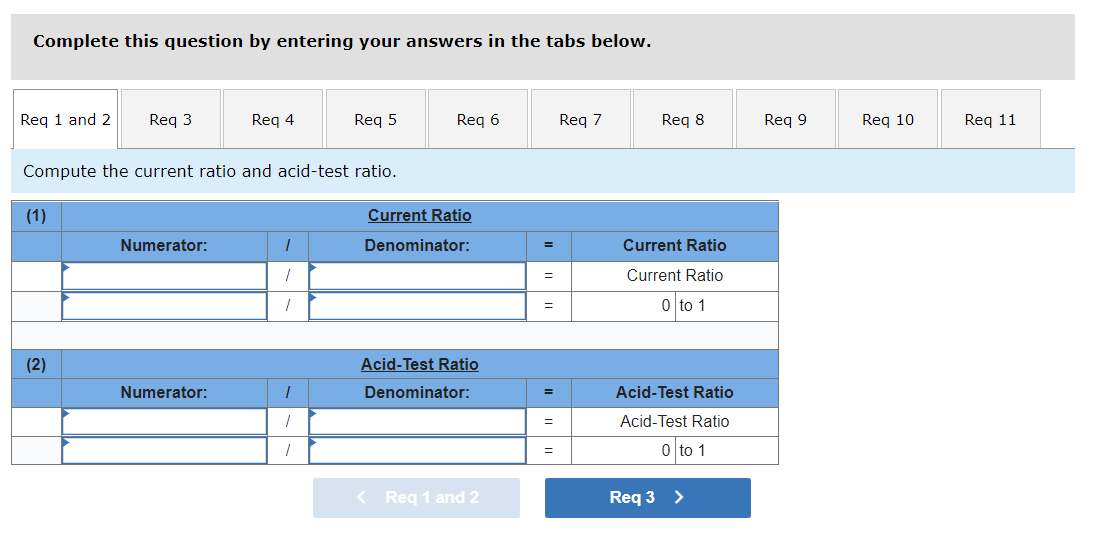

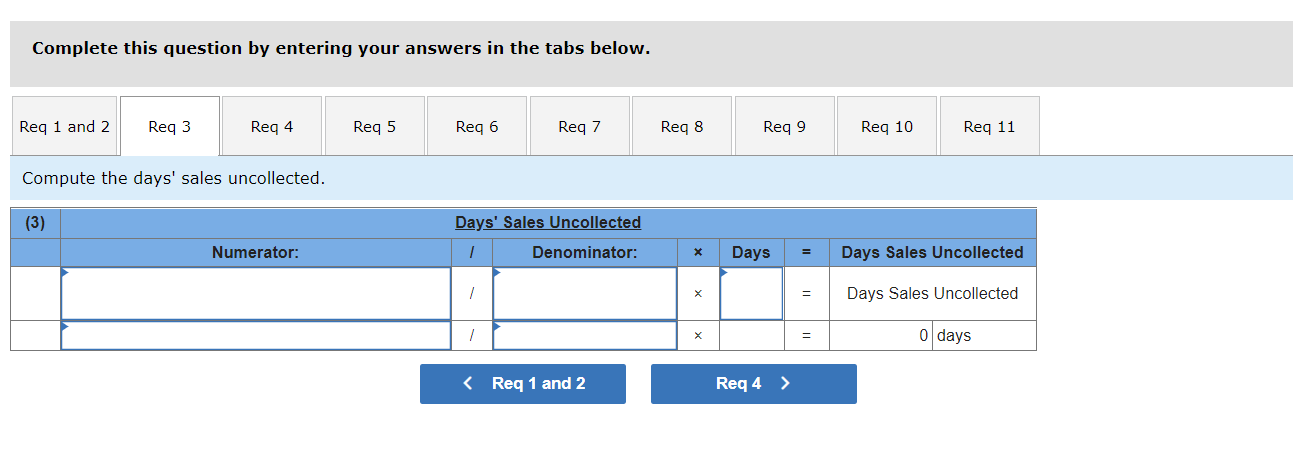

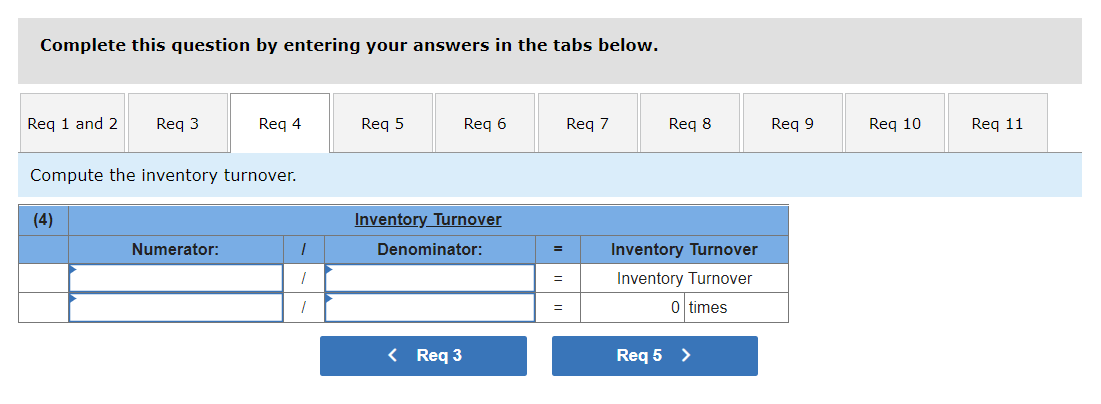

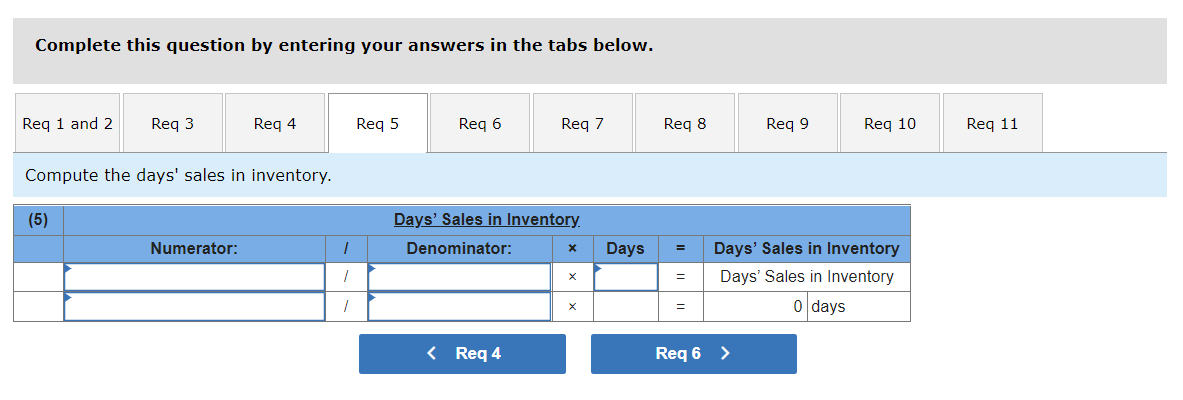

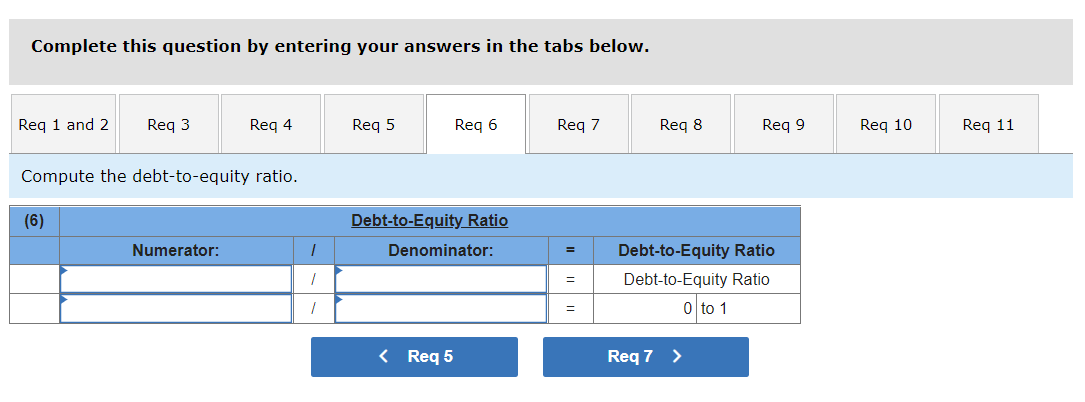

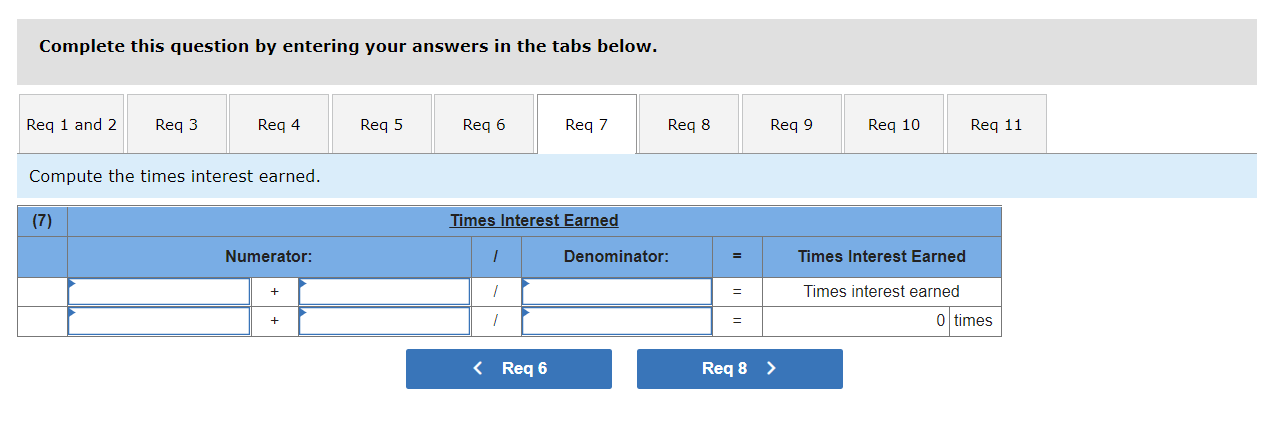

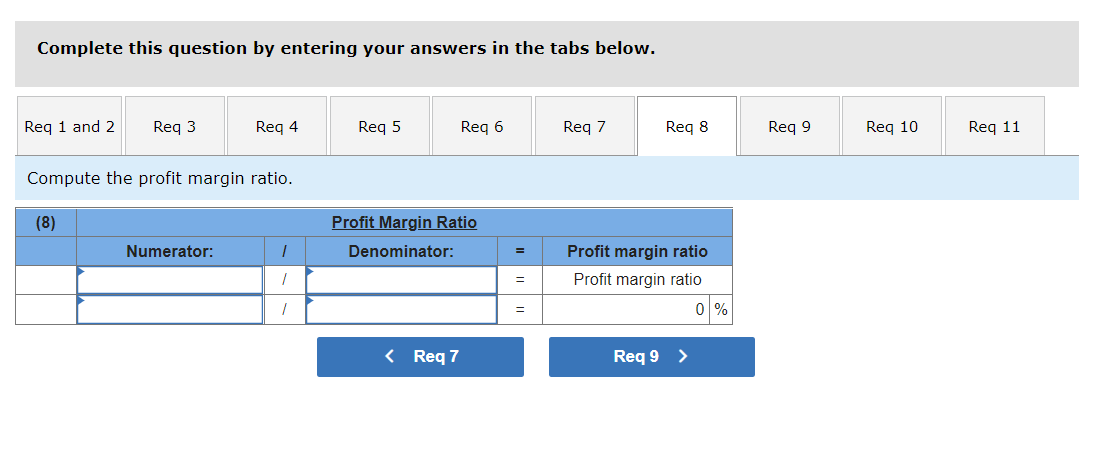

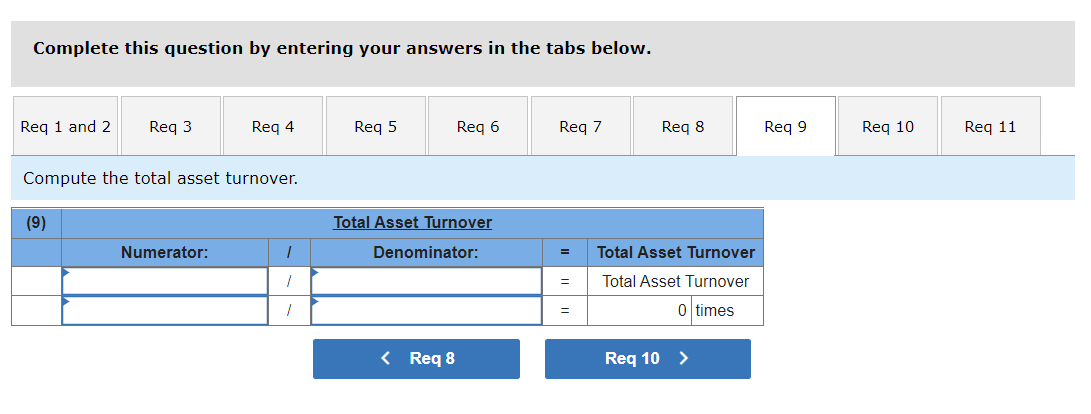

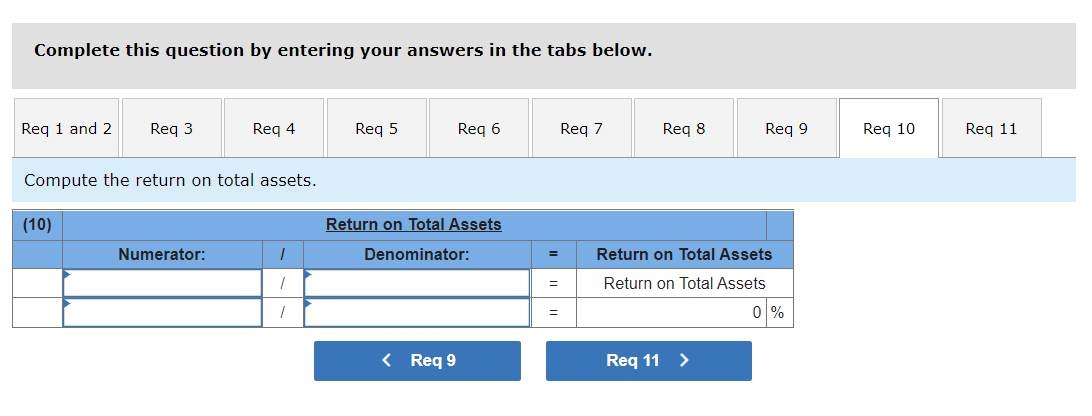

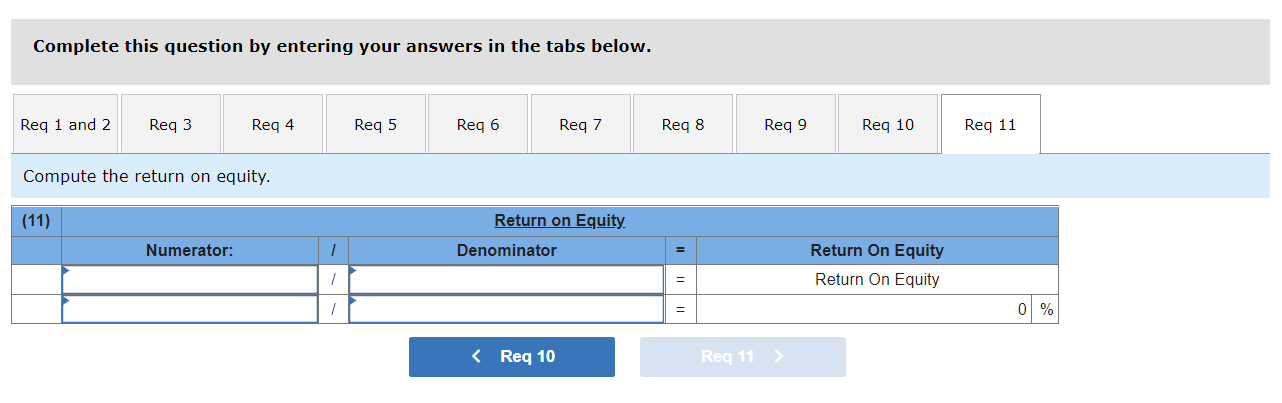

Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory, (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on equity. (Do not round intermediate calculations.)

Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3 Req 4 Req 5 Req 6 Req 7 Req 8 Compute the current ratio and acid-test ratio. (1) Numerator: 1 Current Ratio Current Ratio 1 1 0 to 1 (2) Numerator: Acid-Test Ratio Acid-Test Ratio / / 0 to 1 Req 3 > Current Ratio Denominator: Acid-Test Ratio Denominator: Req 10 Req 11 Days Sales Uncollected Days Sales Uncollected 0 days Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3 Req 4 Req 5 Req 6 Req 7 Req 8 Compute the inventory turnover. Inventory Turnover Numerator: 1 Denominator: Inventory Turnover 1 Inventory Turnover 1 0 times = = = Req 9 Req 10 Req 11 Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3 Req 4 Req 5 Req 6 Req 7 Req 8 Compute the days' sales in inventory. (5) Days' Sales in Inventory Numerator: 1 Denominator: = 1 X = / = Days Req 9 Req 10 Days' Sales in Inventory Days' Sales in Inventory 0 days Req 11 Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3 Req 4 Req 5 Req 6 Req 7 Req 8 Compute the debt-to-equity ratio. (6) Debt-to-Equity Ratio Numerator: 1 Denominator: = Debt-to-Equity Ratio 1 = Debt-to-Equity Ratio 1 = 0 to 1 Req 9 Req 10 Req 11 Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3 Req 4 Req 5 Req 6 Req 7 Req 8 Compute the times interest earned. (7) Times Interest Earned Numerator: 1 + 1 1 Req 11 0 times Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3 Req 4 Req 5 Req 6 Req 7 Req 8 Compute the profit margin ratio. (8) Profit Margin Ratio Numerator: 1 Denominator: Profit margin ratio 1 Profit margin ratio 1 = = = 0% Req 9 Req 10 Req 11 Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3 Req 4 Req 5 Req 6 Req 7 Req 8 Compute the total asset turnover. (9) Total Asset Turnover Numerator: 1 Denominator: = Total Asset Turnover 7 = Total Asset Turnover 1 = 0 times Req 9 Req 10 Req 11 Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3 Req 4 Req 5 Req 6 Req 7 Req 8 Compute the return on total assets. (10) Return on Total Assets Numerator: 7 Denominator: Return on Total Assets 1 Return on Total Assets 1 = = = Req 9 0% Req 10 Req 11 Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3 Req 4 Req 5 Req 6 Req 7 Req 8 Compute the return on equity. (11) Return on Equity Numerator: 1 1 1 Denominator Reg 10 Return On Equity Return On Equity Req 11 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts