Question: Problem 13-55 (Algorithmic) (LO. 1, 2, 3) Roberto has received various gifts over the years and has decided to dispose of the following assets he

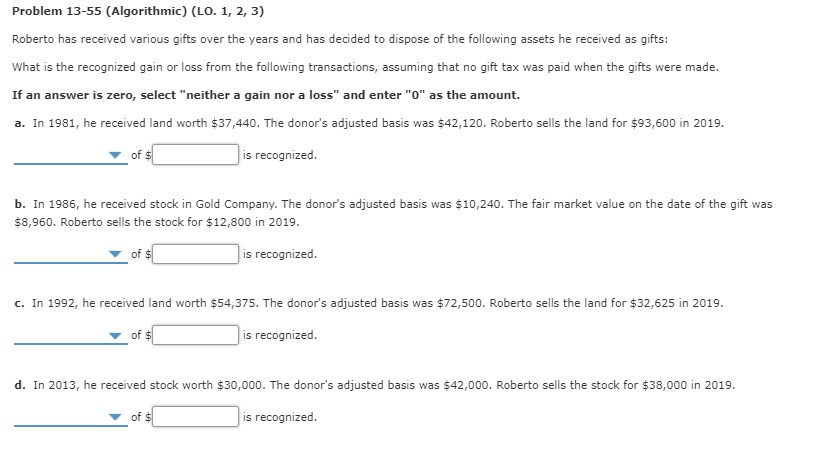

Problem 13-55 (Algorithmic) (LO. 1, 2, 3) Roberto has received various gifts over the years and has decided to dispose of the following assets he received as gifts: What is the recognized gain or loss from the following transactions, assuming that no gift tax was paid when the gifts were made. If an answer is zero, select "neither a gain nor a loss" and enter"" as the amount. a. In 1981, he received land worth $37,440. The donor's adjusted basis was $42,120. Roberto sells the land for $93,600 in 2019. of $ is recognized. b. In 1986, he received stock in Gold Company. The donor's adjusted basis was $10,240. The fair market value on the date of the gift was $8,960. Roberto sells the stock for $12,800 in 2019. of $ is recognized. C. In 1992, he received land worth $54,375. The donor's adjusted basis was $72,500. Roberto sells the land for $32,625 in 2019. of $ is recognized. d. In 2013, he received stock worth $30,000. The donor's adjusted basis was $42,000. Roberto sells the stock for $38,000 in 2019. of $ is recognized

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts