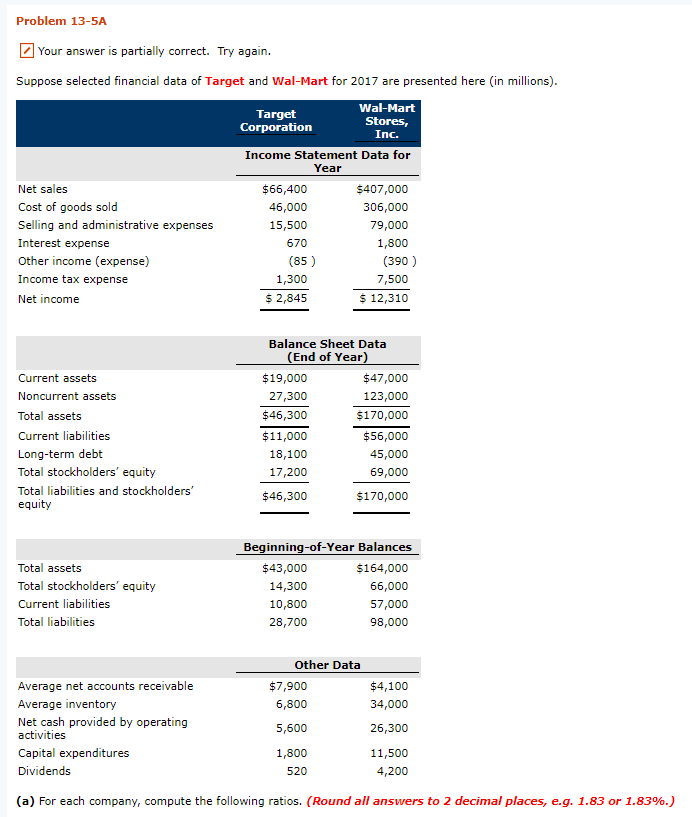

Question: Problem 13-5A Your answer is partially correct. Try again. Suppose selected financial data of Target and Wal-Mart for 2017 are presented here (in millions). Target

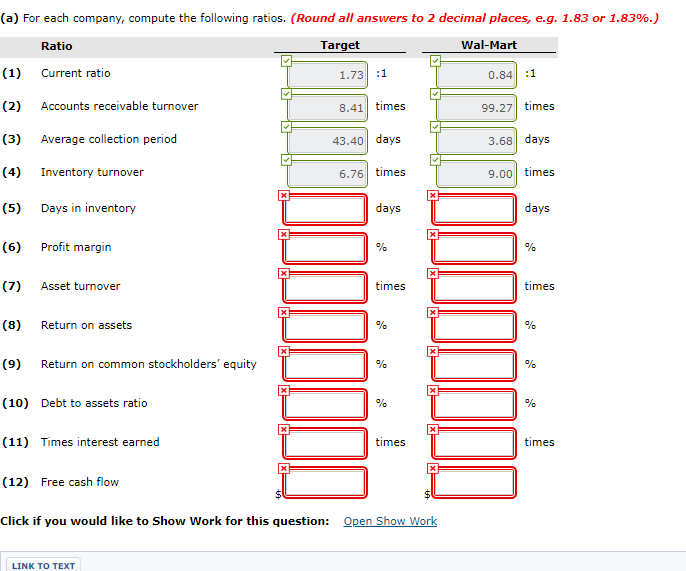

Problem 13-5A Your answer is partially correct. Try again. Suppose selected financial data of Target and Wal-Mart for 2017 are presented here (in millions). Target Wal-Mart Corporation Stores, Inc. Income Statement Data for Year Net sales $66,400 $407,000 Cost of goods sold 46,000 306,000 Selling and administrative expenses 15,500 79,000 Interest expense 670 1,800 Other income (expense) (85) (390) Income tax expense 1,300 7,500 Net income $ 2,845 $ 12,310 Current assets Noncurrent assets Total assets Current liabilities Long-term debt Total stockholders' equity Total liabilities and stockholders' equity Balance Sheet Data (End of Year) $19,000 $47,000 27,300 123,000 $46,300 $170,000 $11,000 $56,000 18,100 45,000 17,200 69,000 $46,300 $170,000 Total assets Total stockholders' equity Current liabilities Total liabilities Beginning-of-Year Balances $43,000 $164,000 14,300 66,000 10,800 57,000 28,700 98,000 Other Data $7,900 6,800 Average net accounts receivable Average inventory Net cash provided by operating activities Capital expenditures Dividends 5,600 1,800 520 $4,100 34,000 26,300 11,500 4,200 (a) For each company, compute the following ratios. (Round all answers to 2 decimal places, e.g. 1.83 or 1.83%.) (a) For each company, compute the following ratios. (Round all answers to 2 decimal places, e.g. 1.83 or 1.83%.) Ratio Target Wal-Mart (1) Current ratio 1.73 :1 0.84 :1 (2) Accounts receivable turnover 8.41 times 99.27 times (3) Average collection period 43.40 days 3.68 days (4) Inventory turnover 6.76 times 9.00 times (5) Days in inventory days days (6) Profit margin % % (7) Asset turnover times times (8) Return on assets % biriitit litli (9) Return on common stockholders' equity % (10) Debt to assets ratio % X (11) Times interest earned times times (12) Free cash flow Click if you would like to Show Work for this question: Open Show Work LINK TO TEXT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts