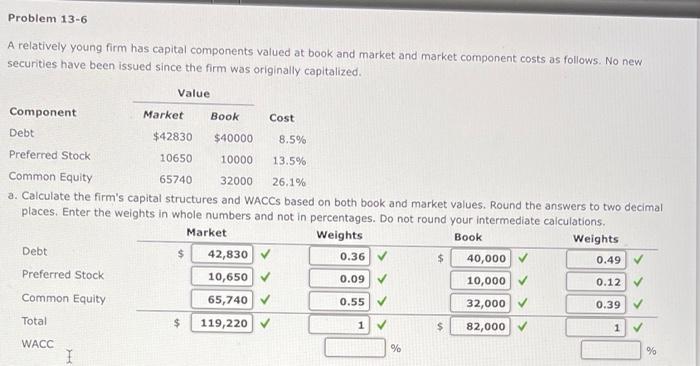

Question: Problem 13-6 A relatively young firm has capital components valued at book and market and market component costs as follows. No new securities have been

Problem 13-6 A relatively young firm has capital components valued at book and market and market component costs as follows. No new securities have been issued since the firm was originally capitalized Value Component Market Book Cost Debt $42830 $40000 8.5% Preferred Stock 10650 10000 13.5% Common Equity 65740 32000 26.1% a. Calculate the firm's capital structures and WACCs based on both book and market values. Round the answers to two decimal places. Enter the weights in whole numbers and not in percentages. Do not round your intermediate calculations. Market Weights Book Weights Debt 42,830 0.36 $ 40,000 0.49 Preferred Stock 10,650 0.09 10,000 V 0.12 Common Equity 65,740 0.55 32,000 0.39 Total $ 119,220 1 82,000 1 WACC % % I $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts