Question: > Problem 14. (5 pts) Consider the following option replication strategy for a call option with strike 30 on an underlying asset with spot price

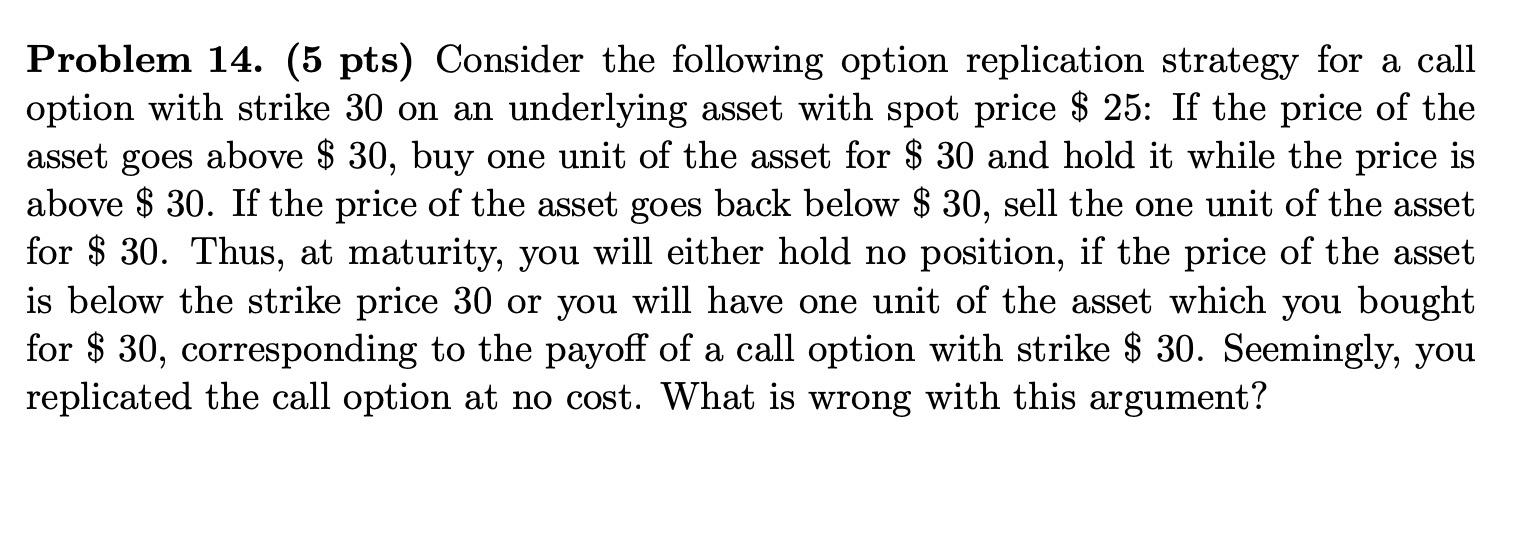

> Problem 14. (5 pts) Consider the following option replication strategy for a call option with strike 30 on an underlying asset with spot price $ 25: If the price of the asset goes above $ 30, buy one unit of the asset for $ 30 and hold it while the price is above $ 30. If the price of the asset goes back below $ 30, sell the one unit of the asset for $ 30. Thus, at maturity, you will either hold no position, if the price of the asset is below the strike price 30 or you will have one unit of the asset which you bought for $ 30, corresponding to the payoff of a call option with strike $ 30. Seemingly, you a replicated the call option at no cost. What is wrong with this argument? > > Problem 14. (5 pts) Consider the following option replication strategy for a call option with strike 30 on an underlying asset with spot price $ 25: If the price of the asset goes above $ 30, buy one unit of the asset for $ 30 and hold it while the price is above $ 30. If the price of the asset goes back below $ 30, sell the one unit of the asset for $ 30. Thus, at maturity, you will either hold no position, if the price of the asset is below the strike price 30 or you will have one unit of the asset which you bought for $ 30, corresponding to the payoff of a call option with strike $ 30. Seemingly, you a replicated the call option at no cost. What is wrong with this argument? >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts