Question: Problem 14 - 76 ( LO . 8 , 10 ) On June 1 , 2013 , Skylark Enterprises ( not a corporation ) acquired

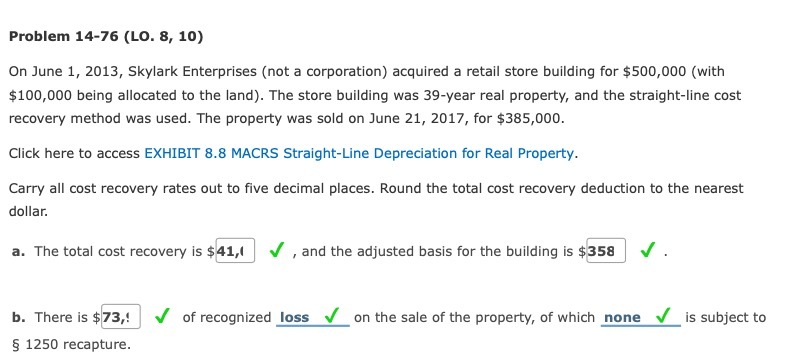

Problem 14 - 76 ( LO . 8 , 10 ) On June 1 , 2013 , Skylark Enterprises ( not a corporation ) acquired a retail store building for $500 090 ( with $100 ,000 being allocated to the land ) . The store building was 39 - year real property , and the straight - line cos recovery method was used . The property was sold on June 21 , 2017 , for $385 , 000 Click here to access EXHIBIT 8 8 MACRS Straight- Line Depreciation for Real Property Carry all cost recovery rates out to five decimal places . Round the total cost recovery deduction to the nearest dolla a . The total cost recovery is $41 , 1 , and the adjusted basis for the building is $ 358 b . There is $ 73 , ! $ 73 : V of recognized loss on the sale of the property , of which none V is subject to 5 1250 recapture

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts