Question: Problem 14-03 MN, Inc., $5 preferred ( $120 par) $ CH,Inc.,$5 preferred ( $120 par) with mandatory retirement after 15 years $ What should be

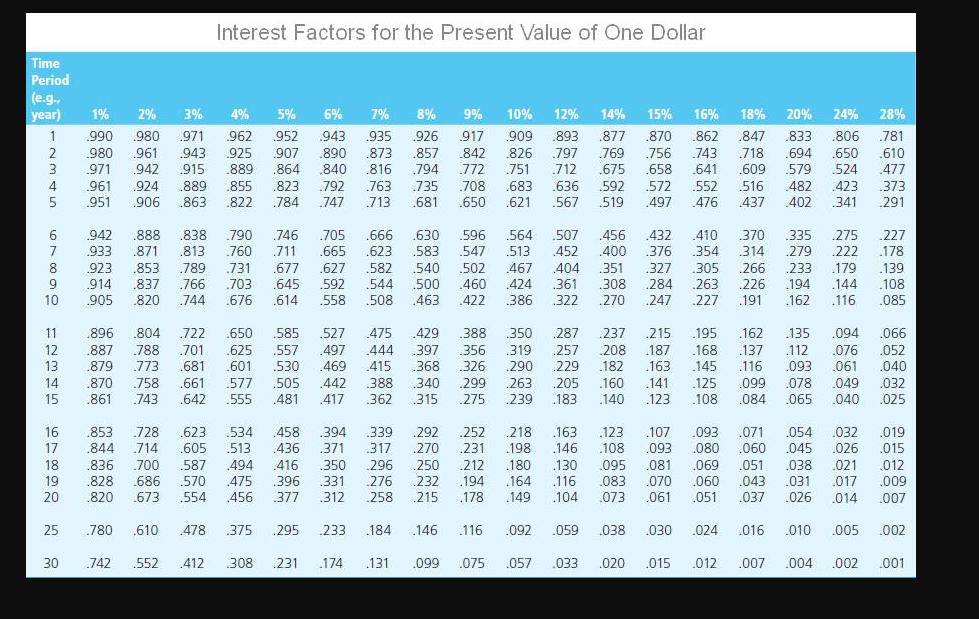

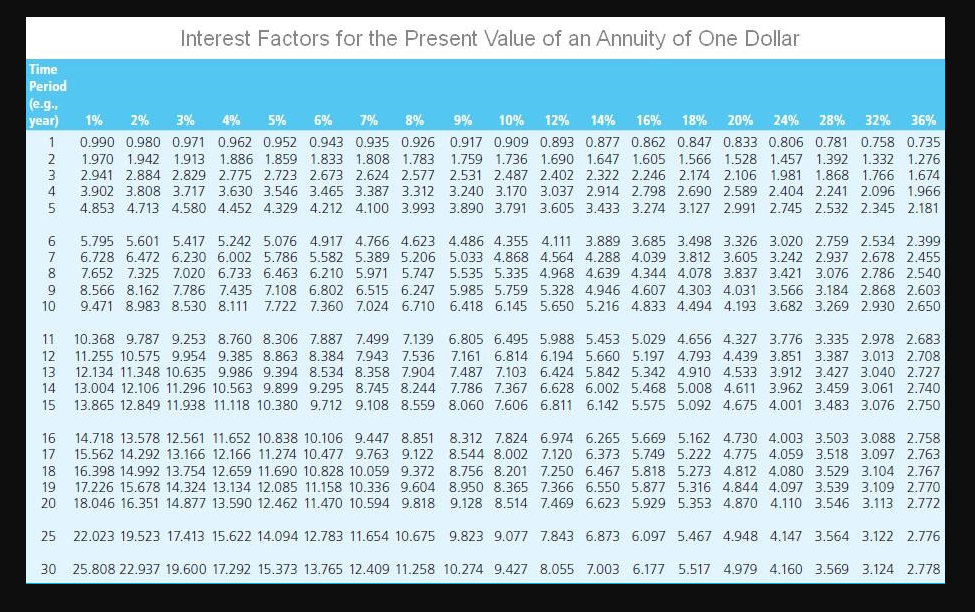

Problem 14-03 MN, Inc., $5 preferred ( $120 par) $ CH,Inc.,$5 preferred ( $120 par) with mandatory retirement after 15 years $ What should be the prices of the following preferred stocks if comparable securities yield 10 percent? Round your answers to the nearest cent. MN, Inc., $5 preferred ( $120 par) $ CH,Inc., $5 preferred ( $120 par) with mandatory retirement after 15 years In which case did the price of the stock change? As with the valuation of bonds, an increase in interest rates causes the value of preferred stock to In which case was the price more volatile? While the prices of both preferred stocks , the price of the was more volatile. Interest Factors for the Present Value of One Dollar Time Period (e.g. 6789101112131415.942.933.923.914.905.896.887.879.870.861.888.871.853.837.820.804.788.773.758.743.838.813.789.766.744.722.701.681.661.642.790.760.731.703.676.650.625.601.577.555.746.711.677.645.614.585.557.530.505.481.705.665.627.592.558.527.497.469.442.417.666.623.582.544.508.475.444.415.388.362.630.583.540.500.463.429.397.368.340.315.596.547.502.460.422.388.356.326.299.275.564.513.467.424.386.350.319.290.263.239.507.452.404.361.322.287.257.229.205.183.456.400.351.308.270.237.208.182.160.140.432.376.327.284.247.215.187.163.141.123.410.354.305.263.227.195.168.145.125.108.370.314.266.226.191.162.137.116.099.084.335.279.233.194.162.135.112.093.078.065.275.222.179.144.116.094.076.061.049.040.227.178.139.108.085.066.052.040.032.025 16171819202530.853.844.836.828.820.780.742.728.714.700.686.673.610.552.623.605.587.570.554.478.412.534.513.494.475.456.375.308.458.436.416.396.377.295.231.394.371.350.331.312.233.174.339.317.296.276.258.184.131.292.270.250.232.215.146.099.252.231.212.194.178.116.075.218.198.180.164.149.092.057.163.146.130.116.104.059.033.123.108.095.083.073.038.020.107.093.081.070.061.030.015.093.080.069.060.051.024.012.071.060.051.043.037.016.007.054.045.038.031.026.010.004.032.026.021.017.014.005.002.019.015.012.009.007.002.001 Interest Factors for the Present Value of an Annuity of One Dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts