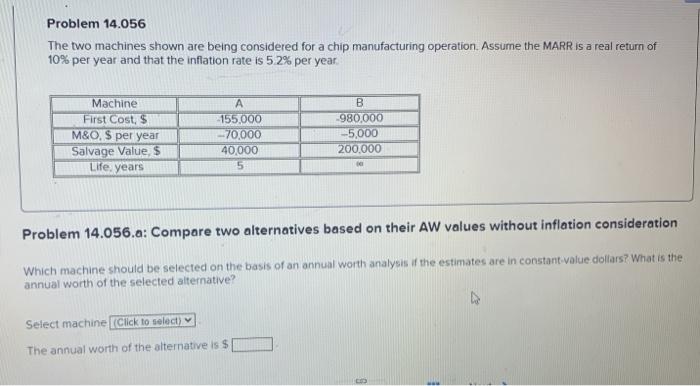

Question: Problem 14.056 The two machines shown are being considered for a chip manufacturing operation. Assume the MARR is a real return of 10% per year

Problem 14.056 The two machines shown are being considered for a chip manufacturing operation. Assume the MARR is a real return of 10% per year and that the inflation rate is 52% per year Machine First Cost, $ M&O. $ per year Salvage Value $ Life years 155.000 -70,000 40,000 5 B .980.000 --5,000 200.000 Problem 14.056.a: Compare two alternatives based on their AW values without inflation consideration Which machine should be selected on the basis of an annual worth analysis of the estimates are in constant value dollars? What is the annual worth of the selected alternative? Select machine (Click to select) The annual worth of the alternative is $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts