Question: Problem 14.10 (LO1, 3) Comprehensive Financial Statement Analysis Marty Monk Fisher owns the largest motorcycle dealership in southern Ohio. Recently, he was approached by Bob

Problem 14.10 (LO1, 3) Comprehensive Financial Statement Analysis Marty "Monk" Fisher owns the largest motorcycle dealership in southern Ohio. Recently, he was approached by Bob Sherman, founder of Mandrake Motorcycles, and offered the opportunity to be the sole distributor of Mandrake bikes in the state. Acceptance of the offer will require Monk to open a dedicated Mandrake showroom and repair facility and, obviously, stock Mandrake cycles and parts. Monk is quite impressed by the Mandrake product, but before making a major investment, he wants to be confident that the company will be around for the long haul. Accordingly, he has asked you to analyze the audited financial statements of Mandrake for the previous two years.

Required

a. Prepare a horizontal and a vertical analysis of the 2021 and 2020 financial statements.

b. Calculate the following ratios for 2021 and 2020: return on assets, gross margin percentage, receivables turnover, days' sales in receivables, inventory turnover, days' sales in inventory, debt to equity, and times interest earned.

c. Based on your analysis in parts a and b, comment on any matters that Monk should probe in an upcoming meeting with Bob Sherman from Mandrake.

d. Based on the limited information available, do you think Monk should open a Mandrake showroom?

Problem 14.11 (LO1, 3) Additional Information Related to Problem 14.10 In 2022, Mandrake Motorcycles declared bankruptcy. Subsequently, it was determined that in fiscal 2021, the company produced more units than needed to fill pending orders. The result was a substantial decrease in production cost per unit. The company uses the LIFO inventory method.

Required

Discuss how (or if) this information is consistent with the results of the analysis conducted in Problem 14.10, parts a and b.

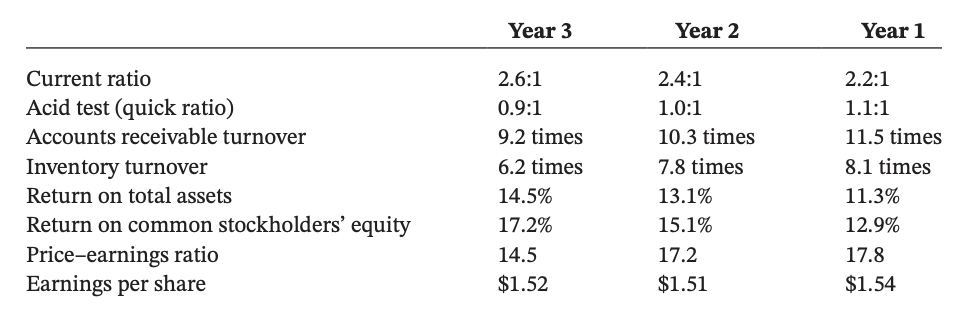

Problem 14.12 (LO3) Interpretation of Financial Ratios Jordan Li is interested in purchasing the stock of Mendella, a company that sells concrete mixtures to the construction industry. Before purchasing the stock, Jordan would like to learn as much as possible about the company. However, all she has to go on is the current year's (year 3) annual report, which contains no comparative data other than the summary of the ratios given below.

Current ratio Acid test (quick ratio) Accounts receivable turnover Inventory turnover Return on total assets Return on common stockholders' equity Priceearnings ratio Earnings per share Year 3 2.61 0.9:1 9.2 times 6.2 times 14.5% 17.2% 14.5 $1.52 Year 2 2.4:1 1.0:1 10.3 times 7.8 times 13.1% 15.1% 17.2 $1.51 Year 1 2.2:1 1.1:1 11.5 times 8.1 times 11.3% 12.9% 17.8 $1.54

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts