Question: Problem 14-14 Question Help You are negotiating with your underwriters in a firm commitment offering of 11 million primary shares. You have two options: set

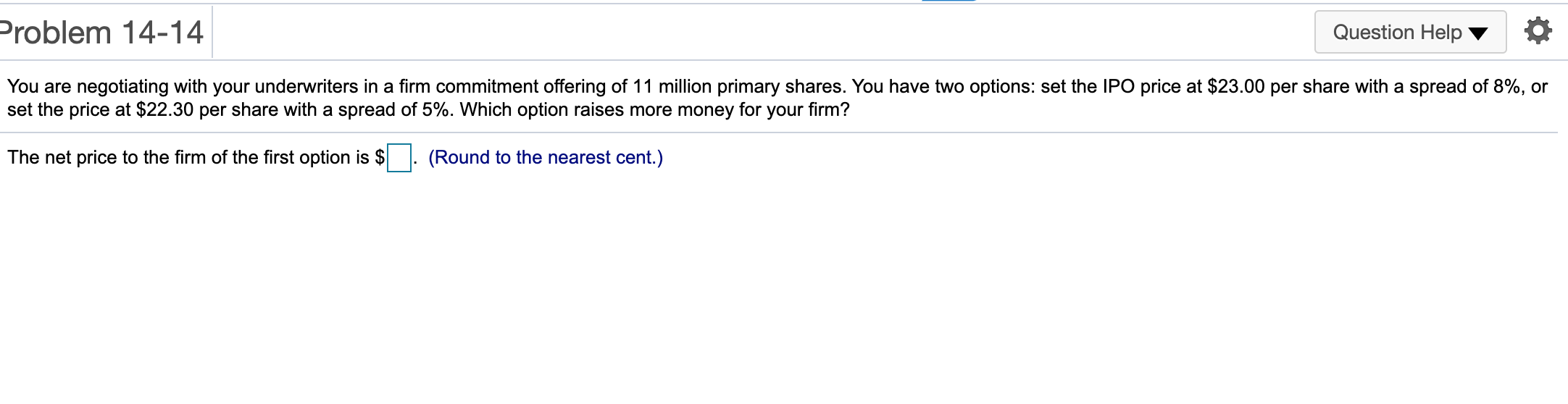

Problem 14-14 Question Help You are negotiating with your underwriters in a firm commitment offering of 11 million primary shares. You have two options: set the IPO price at $23.00 per share with a spread of 8%, or set the price at $22.30 per share with a spread of 5%. Which option raises more money for your firm? The net price to the firm of the first option is $. (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts