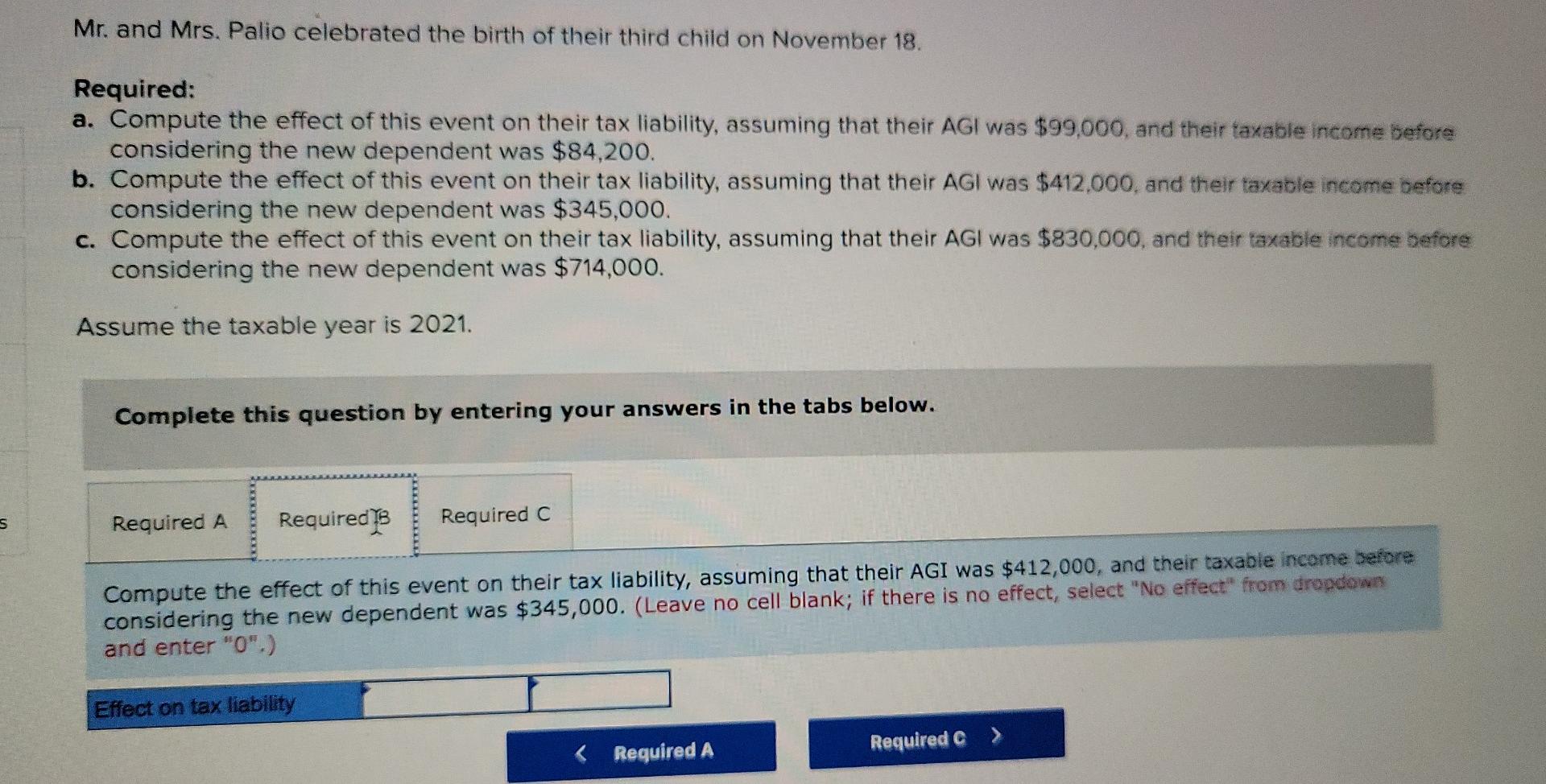

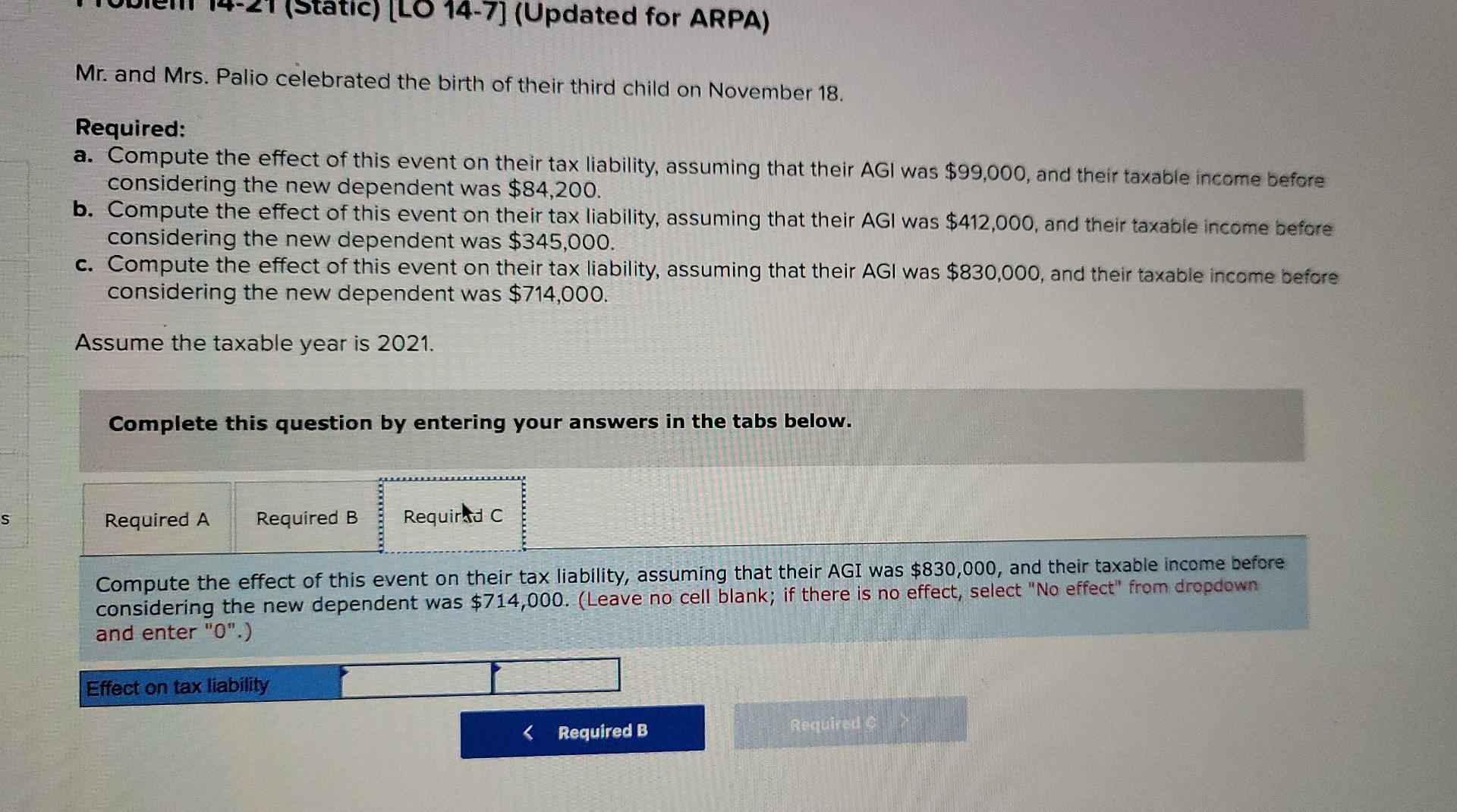

Question: Problem 14-21 (Static) (LO 14-7] (Updated for ARPA) Mr. and Mrs. Palio celebrated the birth of their third child on November 18. Required: a. Compute

![Problem 14-21 (Static) (LO 14-7] (Updated for ARPA) Mr. and Mrs.](https://s3.amazonaws.com/si.experts.images/answers/2024/09/66e0467306d97_13066e046726523d.jpg)

Problem 14-21 (Static) (LO 14-7] (Updated for ARPA) Mr. and Mrs. Palio celebrated the birth of their third child on November 18. Required: a. Compute the effect of this event on their tax liability, assuming that their AGI was $99,000, and their taxable income before considering the new dependent was $84,200. b. Compute the effect of this event on their tax liability, assuming that their AGI was $412,000, and their taxable income before considering the new dependent was $345,000. c. Compute the effect of this event on their tax liability, assuming that their AGI was $830,000, and their taxable income before considering the new dependent was $714,000. Assume the taxable year is 2021. Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute the effect of this event on their tax liability, assuming that their AGI was $99,000, and their taxable income before considering the new dependent was $84,200. (Leave no cell blank; if there is no effect, select "No effect" from dropdown and enter "O".) Effect on tax liability Mr. and Mrs. Palio celebrated the birth of their third child on November 18. Required: a. Compute the effect of this event on their tax liability, assuming that their AGI was $99,000, and their taxable income before considering the new dependent was $84,200. b. Compute the effect of this event on their tax liability, assuming that their AGI was $412,000, and their taxable income before considering the new dependent was $345,000. c. Compute the effect of this event on their tax liability, assuming that their AGI was $830,000, and their taxable income before considering the new dependent was $714,000. Assume the taxable year is 2021. Complete this question by entering your answers in the tabs below. S Required A Required Required C Compute the effect of this event on their tax liability, assuming that their AGI was $412,000, and their taxable income before considering the new dependent was $345,000. (Leave no cell blank; if there is no effect, select "No effect" from dropdown and enter "O".) Effect on tax liability (Static) [LO 14-7) (Updated for ARPA) Mr. and Mrs. Palio celebrated the birth of their third child on November 18. Required: a. Compute the effect of this event on their tax liability, assuming that their AGI was $99,000, and their taxable income before considering the new dependent was $84,200. b. Compute the effect of this event on their tax liability, assuming that their AGI was $412,000, and their taxable income before considering the new dependent was $345,000. C. Compute the effect of this event on their tax liability, assuming that their AGI was $830,000, and their taxable income before considering the new dependent was $714,000. Assume the taxable year is 2021. Complete this question by entering your answers in the tabs below. s Required A Required B Requird C Compute the effect of this event on their tax liability, assuming that their AGI was $830,000, and their taxable income before considering the new dependent was $714,000. (Leave no cell blank; if there is no effect, select "No effect" from dropdown and enter "0".) Effect on tax liability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts