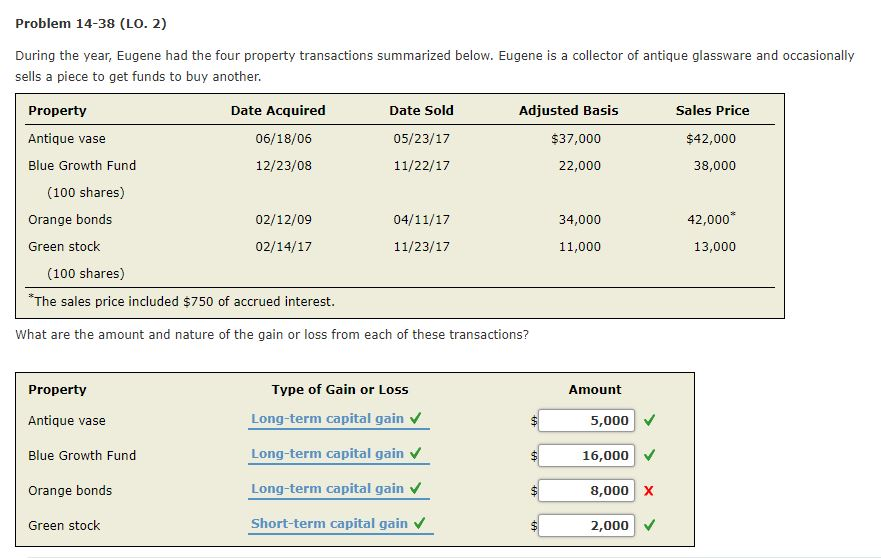

Question: Problem 14-38 (LO. 2) During the year, Eugene had the four property transactions summarized below. Eugene is a collector of antique glassware and occasionally sells

Problem 14-38 (LO. 2) During the year, Eugene had the four property transactions summarized below. Eugene is a collector of antique glassware and occasionally sells a piece to get funds to buy another. Date Acquired Date Sold 05/23/17 11/22/17 Adjusted Basis Property Antique vase Blue Growth Fund Sales Price $42,000 38,000 06/18/06 $37,000 12/23/08 22,000 (100 shares) Orange bonds Green stock 02/12/09 34,000 42,000 02/14/17 11/23/17 11,000 13,000 (100 shares) The sales price included $750 of accrued interest What are the amount and nature of the gain or loss from each of these transactions? Property Antique vase Blue Growth Fund Type of Gain or Loss Long-term capital gain V Long-term capital gain v Long-term capital gain v Short-term capital gain Amount 5,000 V 16,000 Orange bonds 8,000 X Green stock 2,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts