Question: Problem 14-39 (LO. 1, 3, 4) Kantner, Inc., is a domestic corporation with the following temporary timing differences for the current year: The building

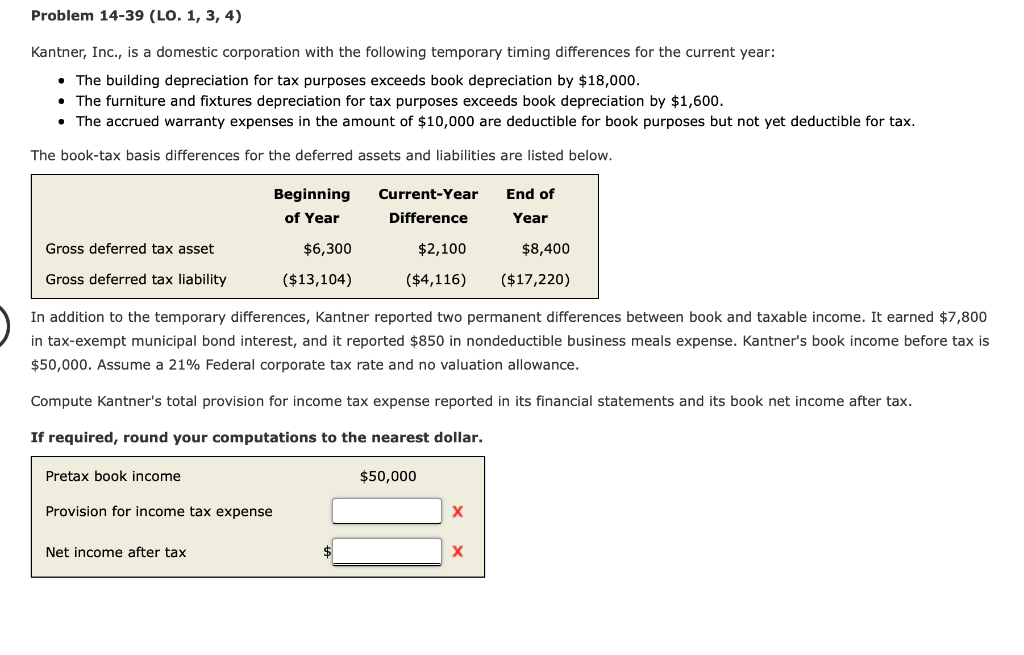

Problem 14-39 (LO. 1, 3, 4) Kantner, Inc., is a domestic corporation with the following temporary timing differences for the current year: The building depreciation for tax purposes exceeds book depreciation by $18,000. The furniture and fixtures depreciation for tax purposes exceeds book depreciation by $1,600. The accrued warranty expenses in the amount of $10,000 are deductible for book purposes but not yet deductible for tax. The book-tax basis differences for the deferred assets and liabilities are listed below. Beginning of Year Current-Year Difference End of Year Gross deferred tax asset Gross deferred tax liability $6,300 ($13,104) $2,100 ($4,116) $8,400 ($17,220) In addition to the temporary differences, Kantner reported two permanent differences between book and taxable income. It earned $7,800 in tax-exempt municipal bond interest, and it reported $850 in nondeductible business meals expense. Kantner's book income before tax is $50,000. Assume a 21% Federal corporate tax rate and no valuation allowance. Compute Kantner's total provision for income tax expense reported in its financial statements and its book net income after tax. If required, round your computations to the nearest dollar. Pretax book income Provision for income tax expense Net income after tax $50,000 x x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts