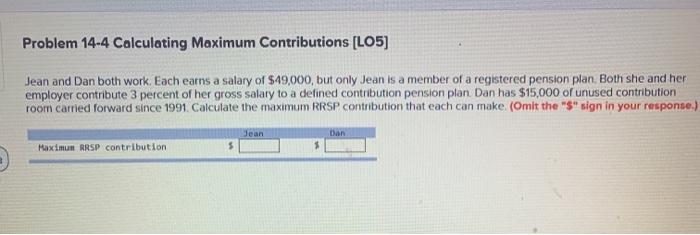

Question: Problem 14-4 Calculating Maximum Contributions [LO5) Jean and Dan both work. Each earns a salary of $49,000, but only Jean is a member of a

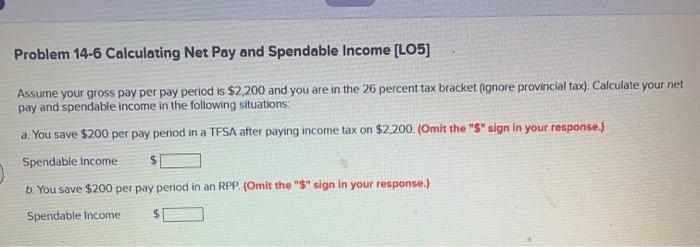

Problem 14-4 Calculating Maximum Contributions [LO5) Jean and Dan both work. Each earns a salary of $49,000, but only Jean is a member of a registered pension plan. Both she and her employer contribute 3 percent of her gross salary to a defined contribution pension plan Dan has $15,000 of unused contribution room carried forward since 1991. Calculate the maximum RRSP contribution that each can make (Omit the "S" sign in your response.) Jean Dan Maximun RRSP contribution $ Problem 14-6 Calculating Net Pay and Spendable Income (LO5) Assume your gross pay per pay period is $2,200 and you are in the 26 percent tax bracket (ignore provincial tax). Calculate your net pay and spendable income in the following situations a. You save $200 per pay perod in a TESA after paying income tax on $2,200. (Omit the "S" sign in your response.) Spendable Income b. You save $200 per pay period in an RPP (Omit the "$" sign in your response.) Spendable Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts