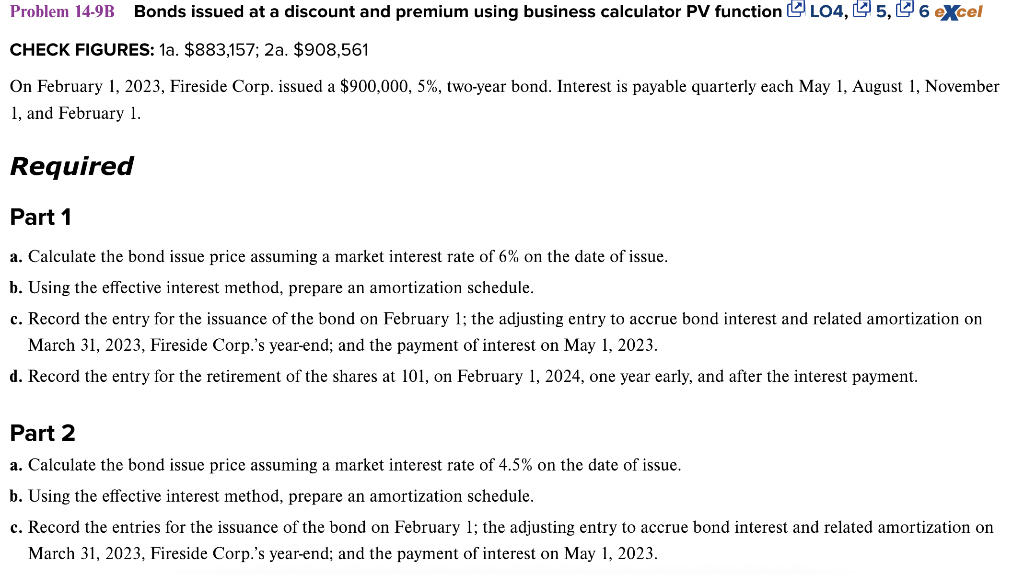

Question: Problem 14-9B Bonds issued at a discount and premium using business calculator PV function BO4, B. CHECK FIGURES: 1a.$883,157;2a.$908,561 On February 1, 2023, Fireside Corp.

Problem 14-9B Bonds issued at a discount and premium using business calculator PV function BO4, B. CHECK FIGURES: 1a.$883,157;2a.$908,561 On February 1, 2023, Fireside Corp. issued a $900,000,5%, two-year bond. Interest is payable quarterly each May 1, August 1, November 1, and February 1. Required Part 1 a. Calculate the bond issue price assuming a market interest rate of 6% on the date of issue. b. Using the effective interest method, prepare an amortization schedule. c. Record the entry for the issuance of the bond on February 1; the adjusting entry to accrue bond interest and related amortization on March 31, 2023, Fireside Corp.'s year-end; and the payment of interest on May 1, 2023. d. Record the entry for the retirement of the shares at 101, on February 1, 2024, one year early, and after the interest payment. Part 2 a. Calculate the bond issue price assuming a market interest rate of 4.5% on the date of issue. b. Using the effective interest method, prepare an amortization schedule. c. Record the entries for the issuance of the bond on February 1; the adjusting entry to accrue bond interest and related amortization on March 31, 2023, Fireside Corp.'s year-end; and the payment of interest on May 1, 2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts