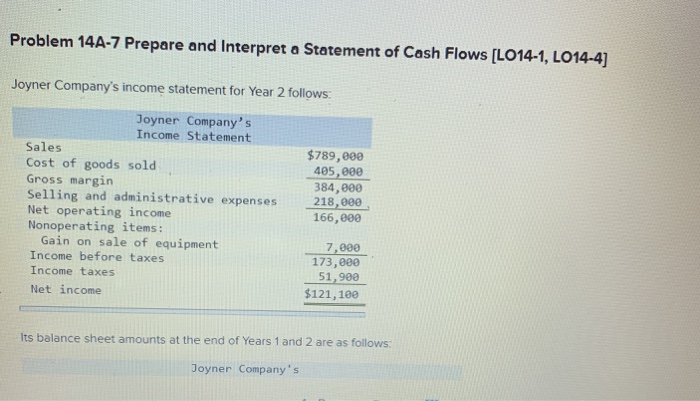

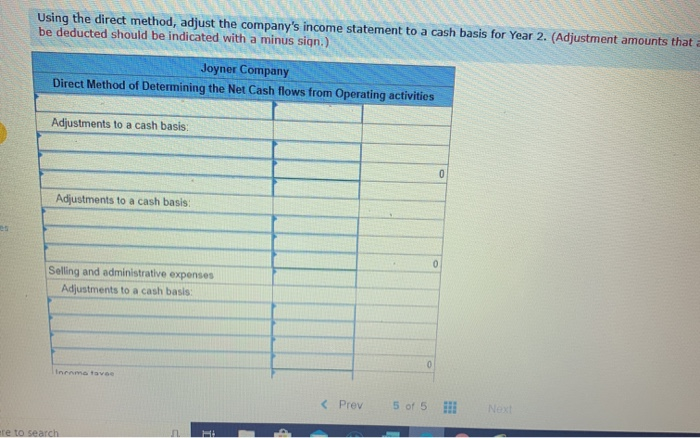

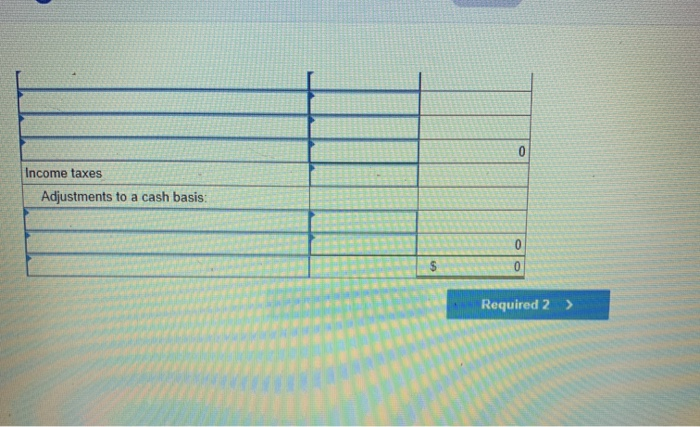

Question: Problem 14A-7 Prepare and Interpret a Statement of Cash Flows [LO14-1, LO14-4] Joyner Company's income statement for Year 2 follows: Joyner Company's Income Statement Sales

![LO14-4] Joyner Company's income statement for Year 2 follows: Joyner Company's Income](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e529b6b9dc9_45466e529b613fe3.jpg)

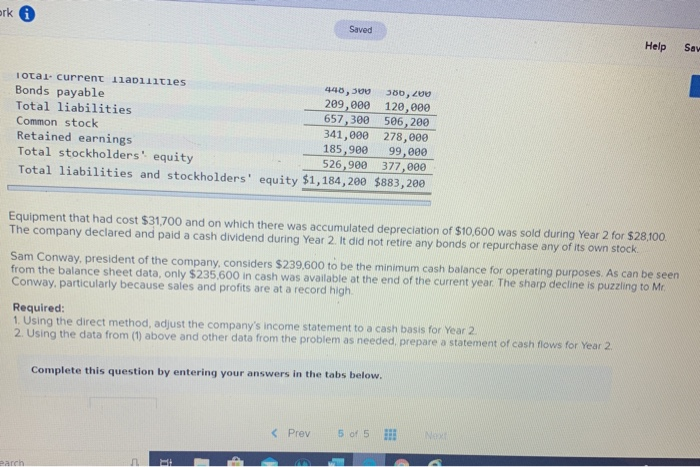

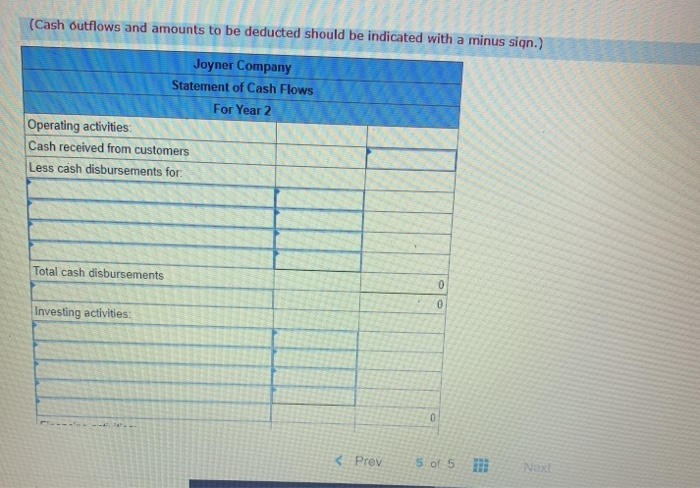

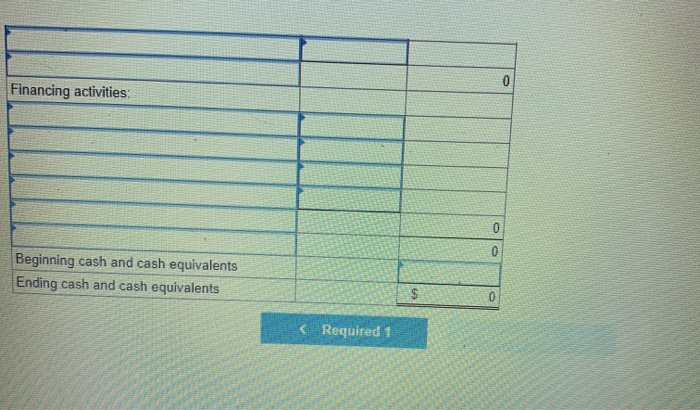

Problem 14A-7 Prepare and Interpret a Statement of Cash Flows [LO14-1, LO14-4] Joyner Company's income statement for Year 2 follows: Joyner Company's Income Statement Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income Nonoperating items: Gain on sale of equipment Income before taxes Income taxes Net income $789,000 405,000 384,000 218,000 166,000 7,000 173,000 51,900 $121,100 Its balance sheet amounts at the end of Years 1 and 2 are as follows: Joyner Company's Its balance sheet amounts at the end of Years 1 and 2 are as follows: Joyner Company's Balance Sheet Year 2 Year 1 Assets Cash Accounts receivable Inventory Prepaid expenses Total current assets Property, plant, and equipment Less accumulated depreciation Net property, plant, and equipment Loan to Hymans Company Total assets Liabilities and Stockholders' Equity Accounts payable Accrued liabilities $ 235,600 $226,800 269,000 110,000 320,000 289,000 9.000 18,000 833,600 643,800 468,000 370,000 166,400 130, 600 301,600 239,400 49,000 @ $1,184,200 $883,200 Total current liabilities Bonds payable Total liabilities 320,000 251,000 44,000 54,000 84,300 81,200 448,388 386,200 209,000 120,000 657,388 506,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts