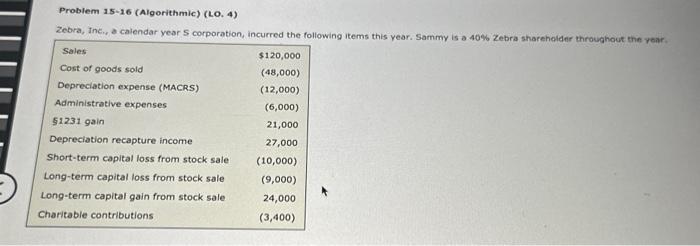

Question: Problem 15-16 (Algorithmic) (LO. 4) Zebra, Inc., a calendar year S corporation, incurred the following items this year. Sammy is a 40% Zebra shareholder

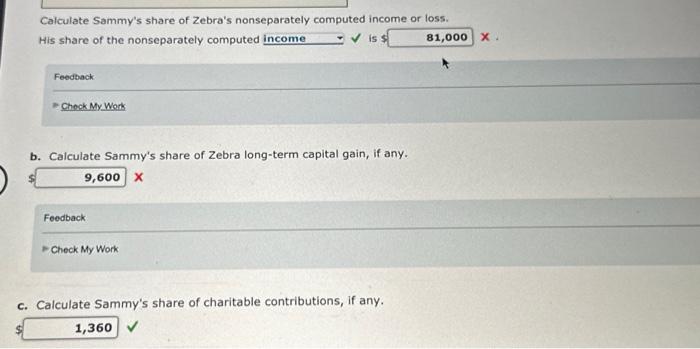

Problem 15-16 (Algorithmic) (LO. 4) Zebra, Inc., a calendar year S corporation, incurred the following items this year. Sammy is a 40% Zebra shareholder throughout the year. Sales Cost of goods sold $120,000 (48,000) Depreciation expense (MACRS) (12,000) Administrative expenses (6,000) 51231 gain 21,000 Depreciation recapture income 27,000 Short-term capital loss from stock sale (10,000) Long-term capital loss from stock sale (9,000) Long-term capital gain from stock sale 24,000 Charitable contributions (3,400) Calculate Sammy's share of Zebra's nonseparately computed income or loss. His share of the nonseparately computed income is $ 81,000 X. Feedback Check My Work b. Calculate Sammy's share of Zebra long-term capital gain, if any. 9,600 X Feedback Check My Work c. Calculate Sammy's share of charitable contributions, if any. 1,360

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts