Question: Problem 15-22 (LO. 2) Use the following data to calculate Chiara's 2017 AMT base. Chiara files as a single taxpayer and itemizes her deductions Taxable

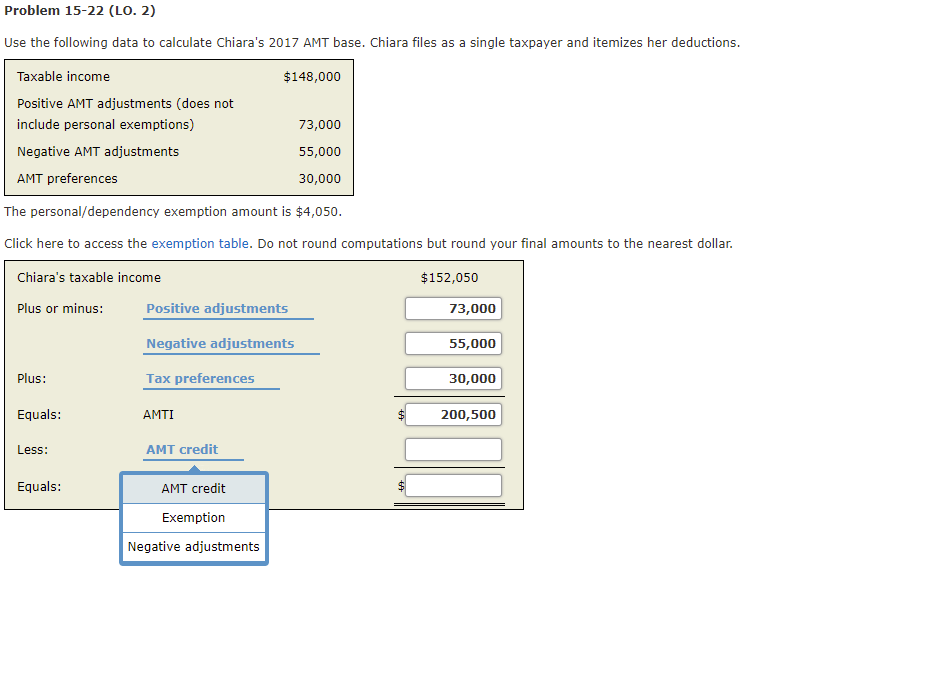

Problem 15-22 (LO. 2) Use the following data to calculate Chiara's 2017 AMT base. Chiara files as a single taxpayer and itemizes her deductions Taxable income Positive AMT adjustments (does not include personal exemptions) Negative AMT adjustments AMT preferences $148,000 73,000 55,000 30,000 The personal/dependency exemption amount is $4,050 Click here to access the exemption table. Do not round computations but round your final amounts to the nearest dollar. Chiara's taxable income $152,050 Positive adjustments Negative adjustments Tax preferences AMTI AMT credit Plus or minus: 73,000 55,000 30,000 200,500 Plus: Equals Less: Equals AMT credit Exemption Negative adjustments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts