Question: Problem 15-6 Spreadsheet Problem: AFN with Lumpy Assets (LG15-4) Suppose that Wall-E Corporation currently has the balance sheet shown below, and that sales for the

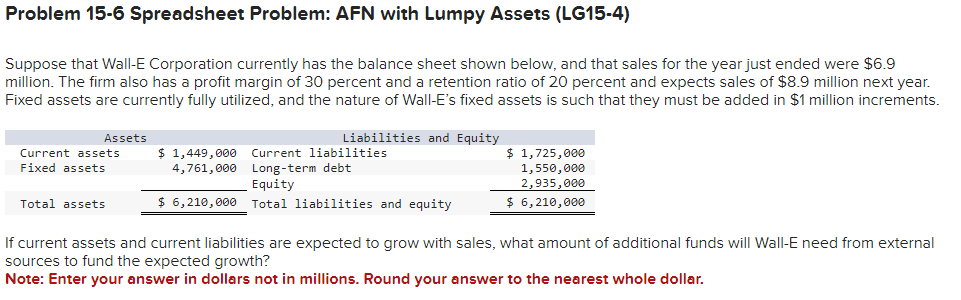

Problem 15-6 Spreadsheet Problem: AFN with Lumpy Assets (LG15-4) Suppose that Wall-E Corporation currently has the balance sheet shown below, and that sales for the year just ended were $6.9 million. The firm also has a profit margin of 30 percent and a retention ratio of 20 percent and expects sales of $8.9 million next year. Fixed assets are currently fully utilized, and the nature of Wall-E's fixed assets is such that they must be added in $1 million increments. If current assets and current liabilities are expected to grow with sales, what amount of additional funds will Wall-E need from external sources to fund the expected growth? Note: Enter your answer in dollars not in millions. Round your answer to the nearest whole dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts