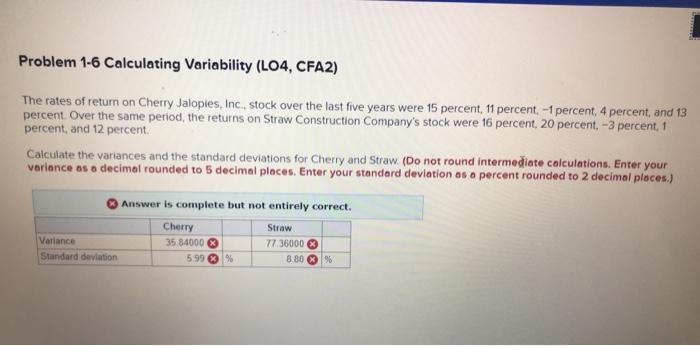

Question: Problem 1-6 Calculating Variability (L04, CFA2) The rates of return on Cherry Jalopies, Inc, stock over the last five years were 15 percent, 11 percent.

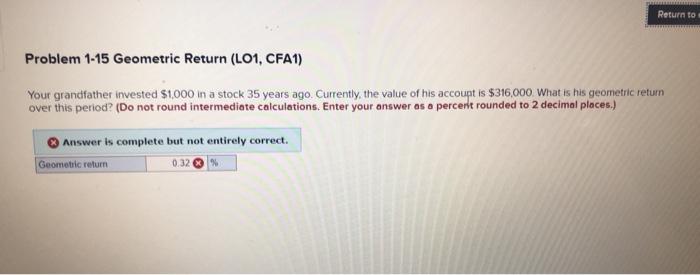

Problem 1-6 Calculating Variability (L04, CFA2) The rates of return on Cherry Jalopies, Inc, stock over the last five years were 15 percent, 11 percent. -1 percent, 4 percent, and 13 percent. Over the same period, the returns on Straw Construction Company's stock were 16 percent, 20 percent. -3 percent. 1 percent, and 12 percent Calculate the variances and the standard deviations for Cherry and Straw. (Do not round intermediate calculations. Enter your verlonce as a decimal rounded to 5 decimal places, Enter your standard deviation as a percent rounded to 2 decimal places.) Answer is complete but not entirely correct. Cherry Straw Variance 35 84000 77 36000 3 Standard deviation 5.99 % 8.80 % Return to Problem 1-15 Geometric Return (LO1, CFA1) Your grandfather invested $1,000 in a stock 35 years ago. Currently, the value of his accoupt is $316,000. What is his geometric return over this period? (Do not round intermediate calculations. Enter your answer as a percerit rounded to 2 decimal places.) Answer is complete but not entirely correct. Geometric return 0.32%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts