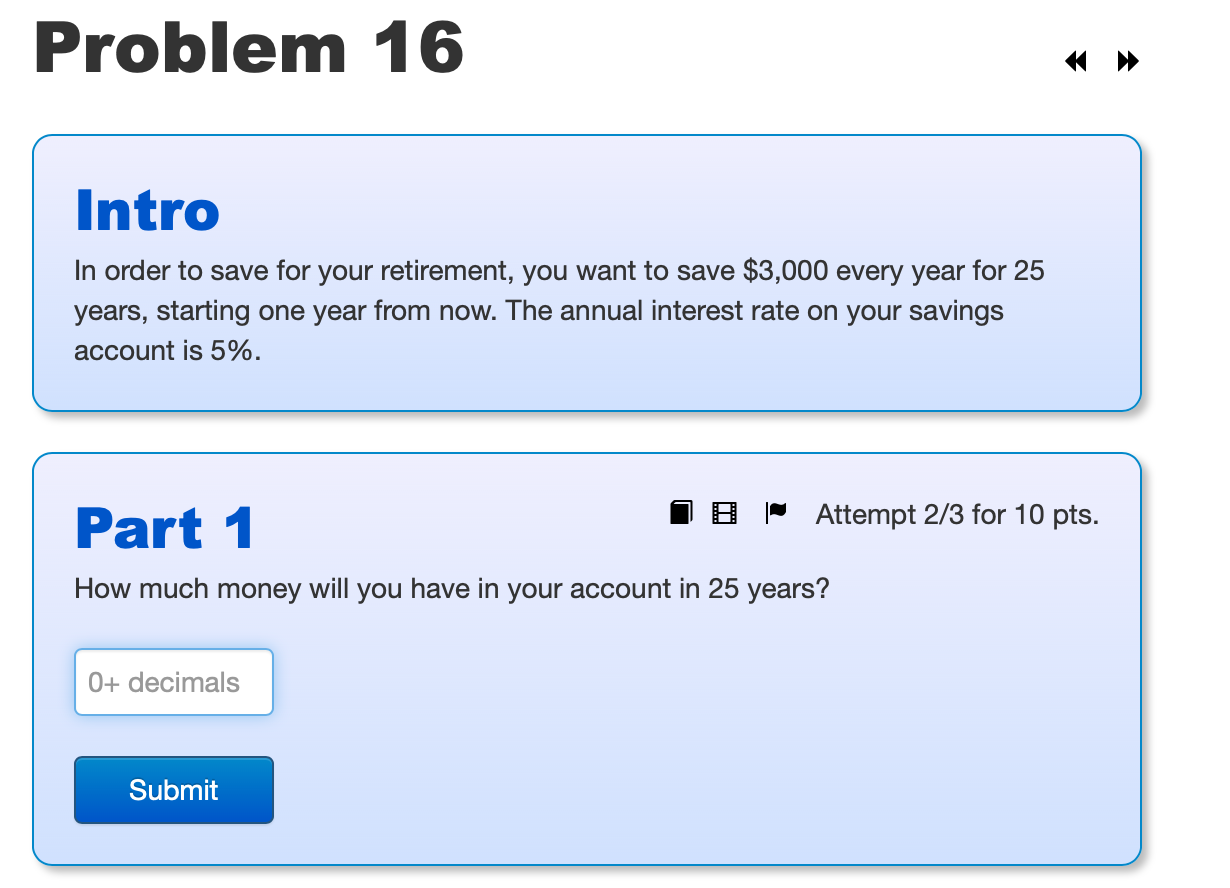

Question: Problem 16 Intro In order to save for your retirement, you want to save $3,000 every year for 25 years, starting one year from now.

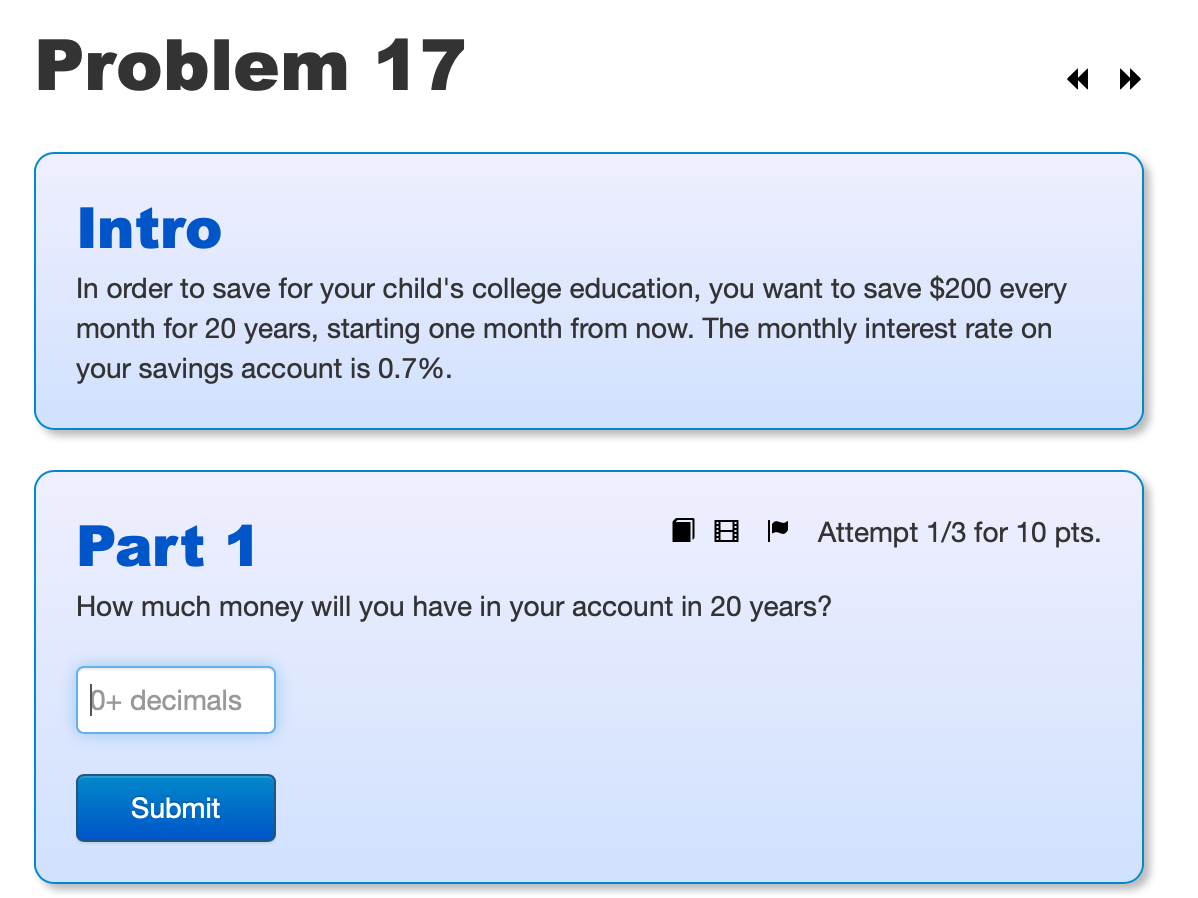

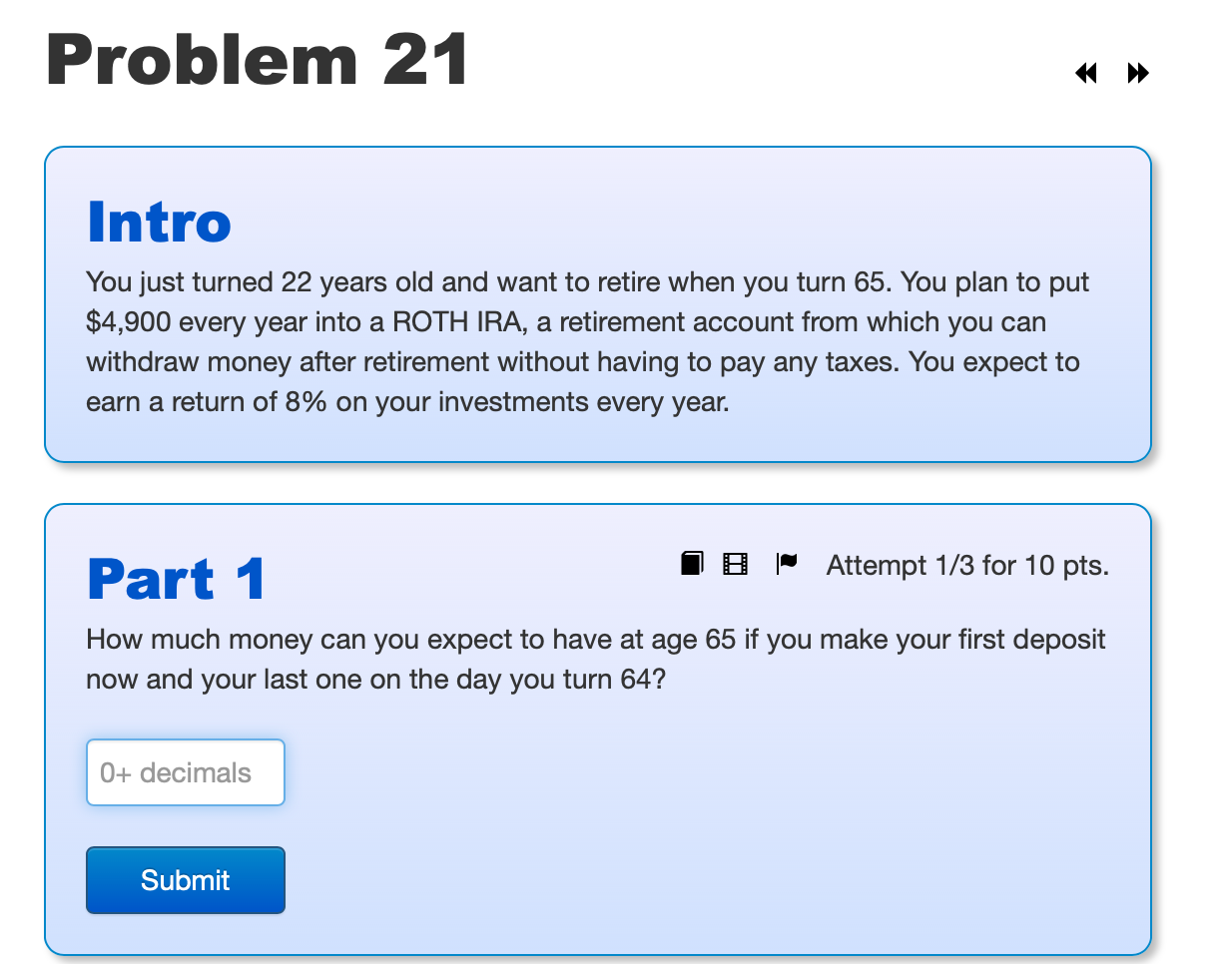

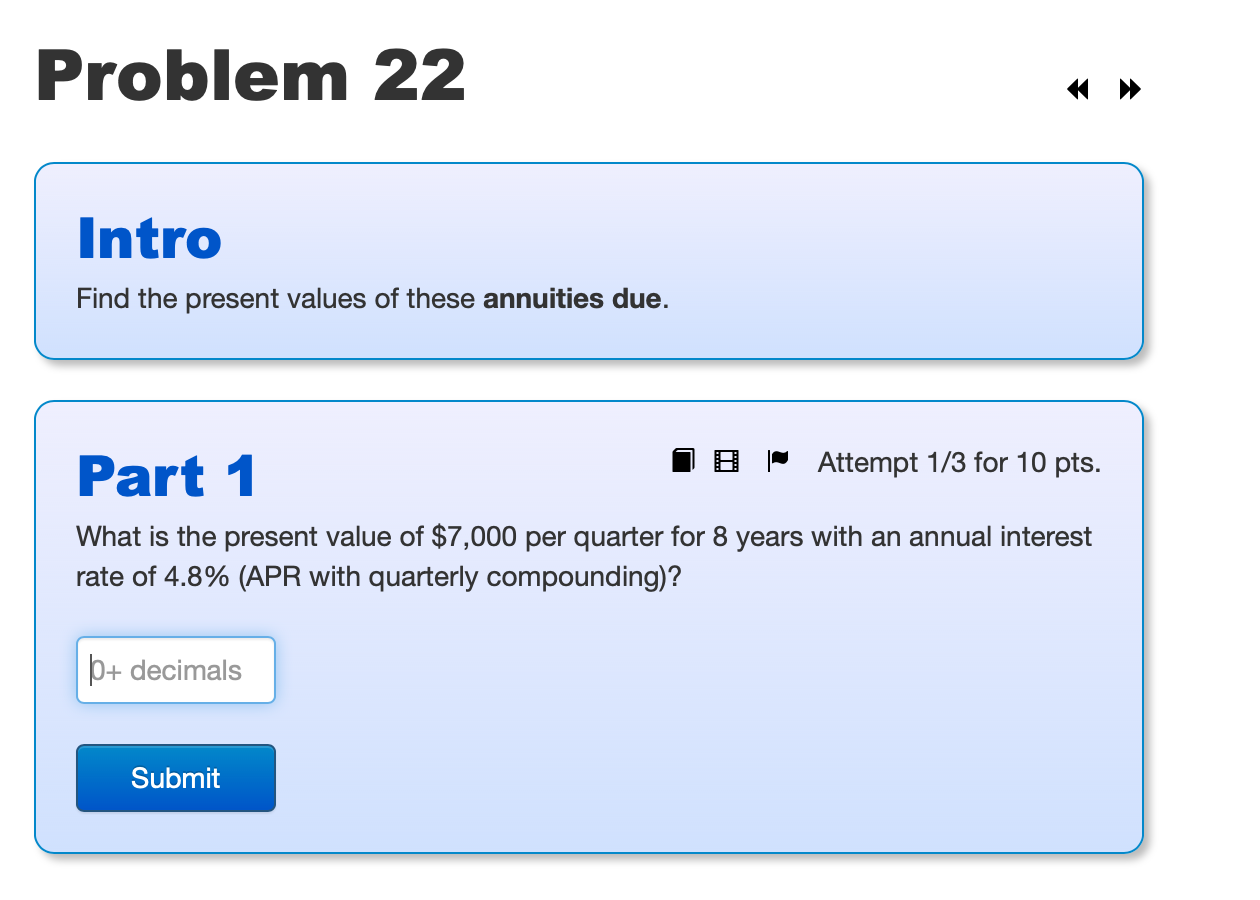

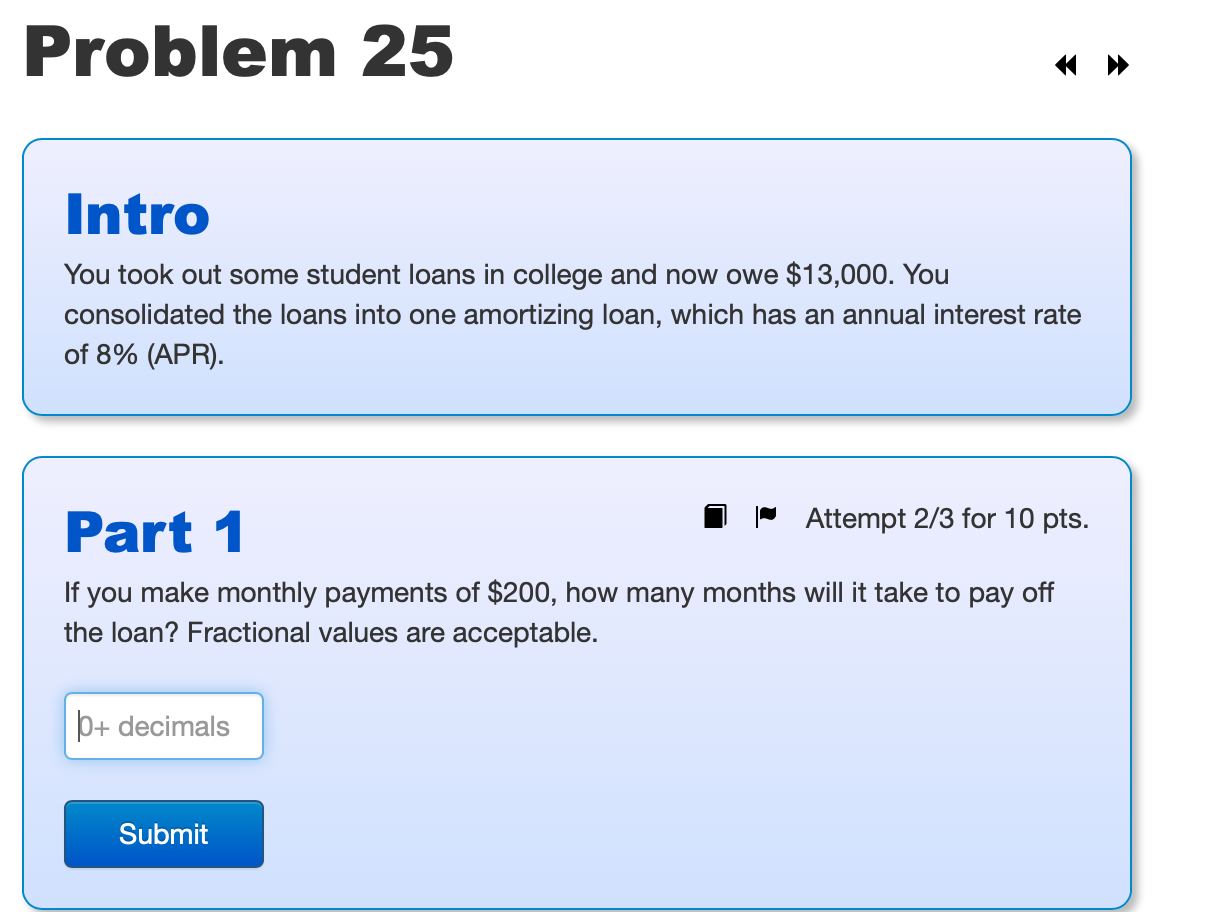

Problem 16 Intro In order to save for your retirement, you want to save $3,000 every year for 25 years, starting one year from now. The annual interest rate on your savings account is 5%. Part 1 | Attempt 2/3 for 10 pts. How much money will you have in your account in 25 years? 0+ decimals Submit Problem 17 Intro In order to save for your child's college education, you want to save $200 every month for 20 years, starting one month from now. The monthly interest rate on your savings account is 0.7%. Part 1 Attempt 1/3 for 10 pts. How much money will you have in your account in 20 years? b+ decimals Submit Problem 21 Intro You just turned 22 years old and want to retire when you turn 65. You plan to put $4,900 every year into a ROTH IRA, a retirement account from which you can withdraw money after retirement without having to pay any taxes. You expect to earn a return of 8% on your investments every year. Part 1 | Attempt 1/3 for 10 pts. How much money can you expect to have at age 65 if you make your first deposit now and your last one on the day you turn 64? 0+ decimals Submit Problem 22 Intro Find the present values of these annuities due. Part 1 | Attempt 1/3 for pts. What is the present value of $7,000 per quarter for 8 years with an annual interest rate of 4.8% (APR with quarterly compounding)? b+ decimals Submit Problem 25 Intro You took out some student loans in college and now owe $13,000. You consolidated the loans into one amortizing loan, which has an annual interest rate of 8% (APR). Part 1 Attempt 2/3 for 10 pts. If you make monthly payments of $200, how many months will it take to pay off the loan? Fractional values are acceptable. + decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts