Question: Problem 1(6 Points) Using the Market-Derived Model discussed in class, please estimate the cost of equity capital for Allstate (Ticker: ALL) as of December 3,

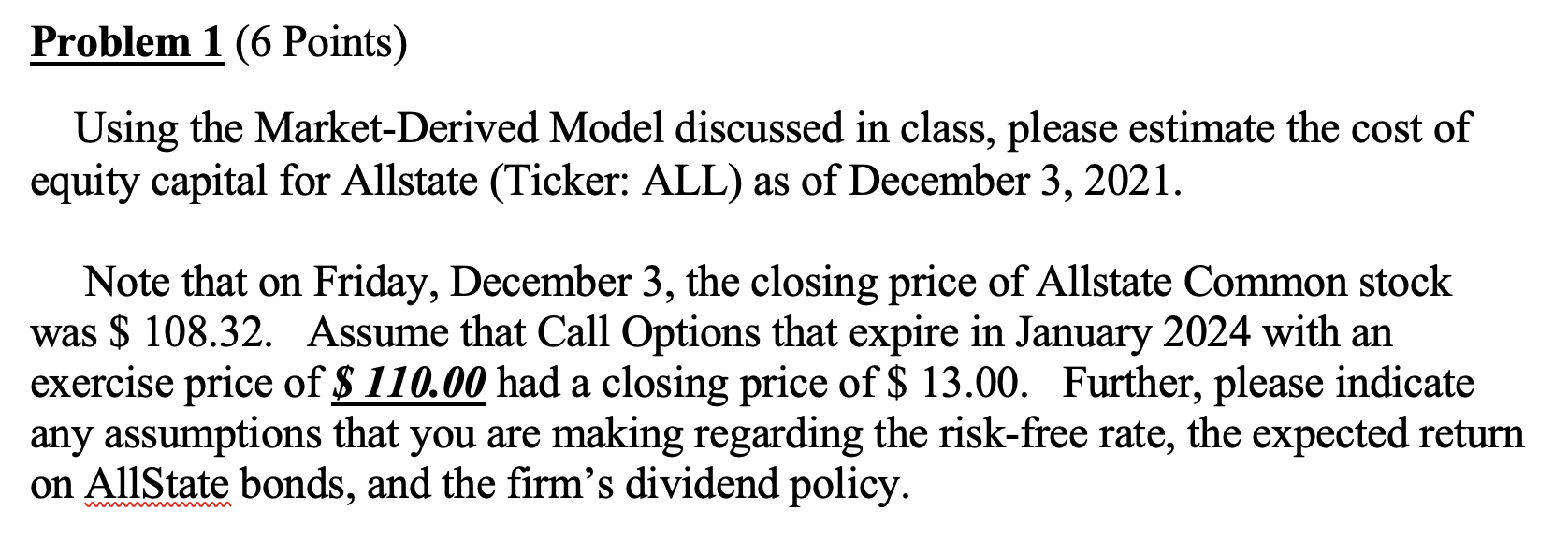

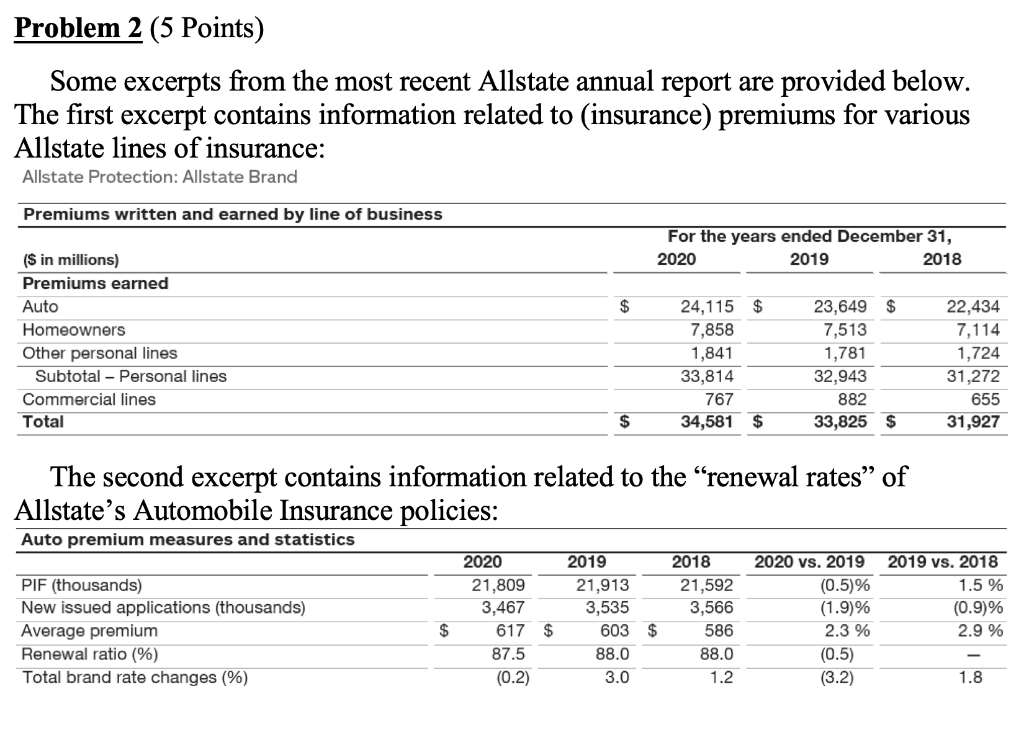

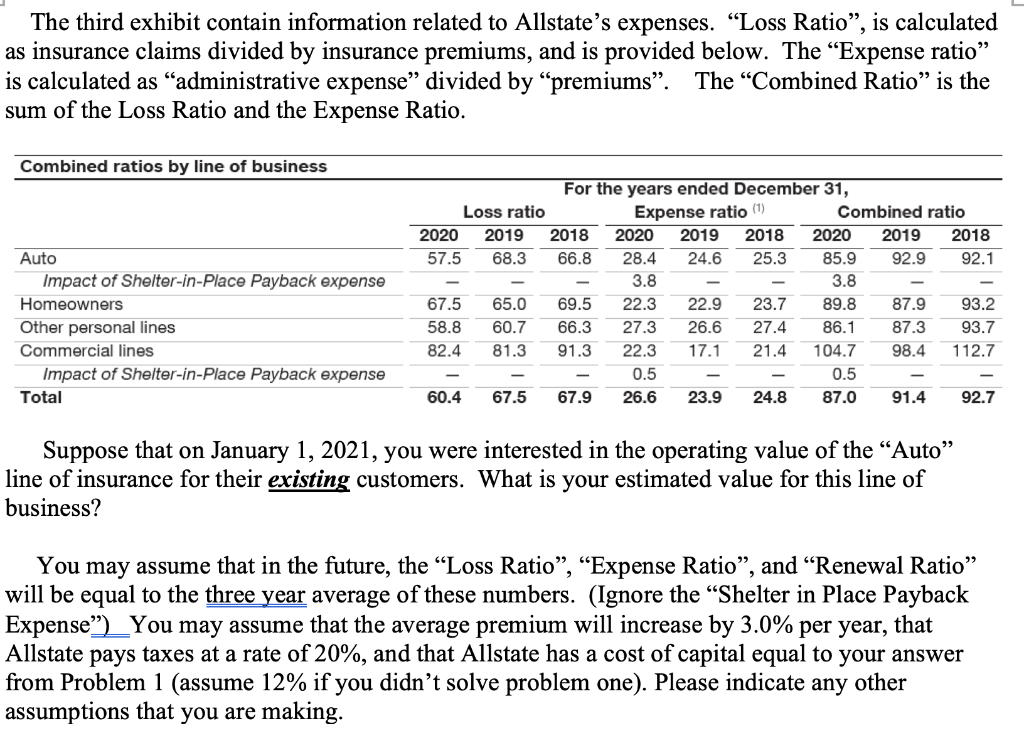

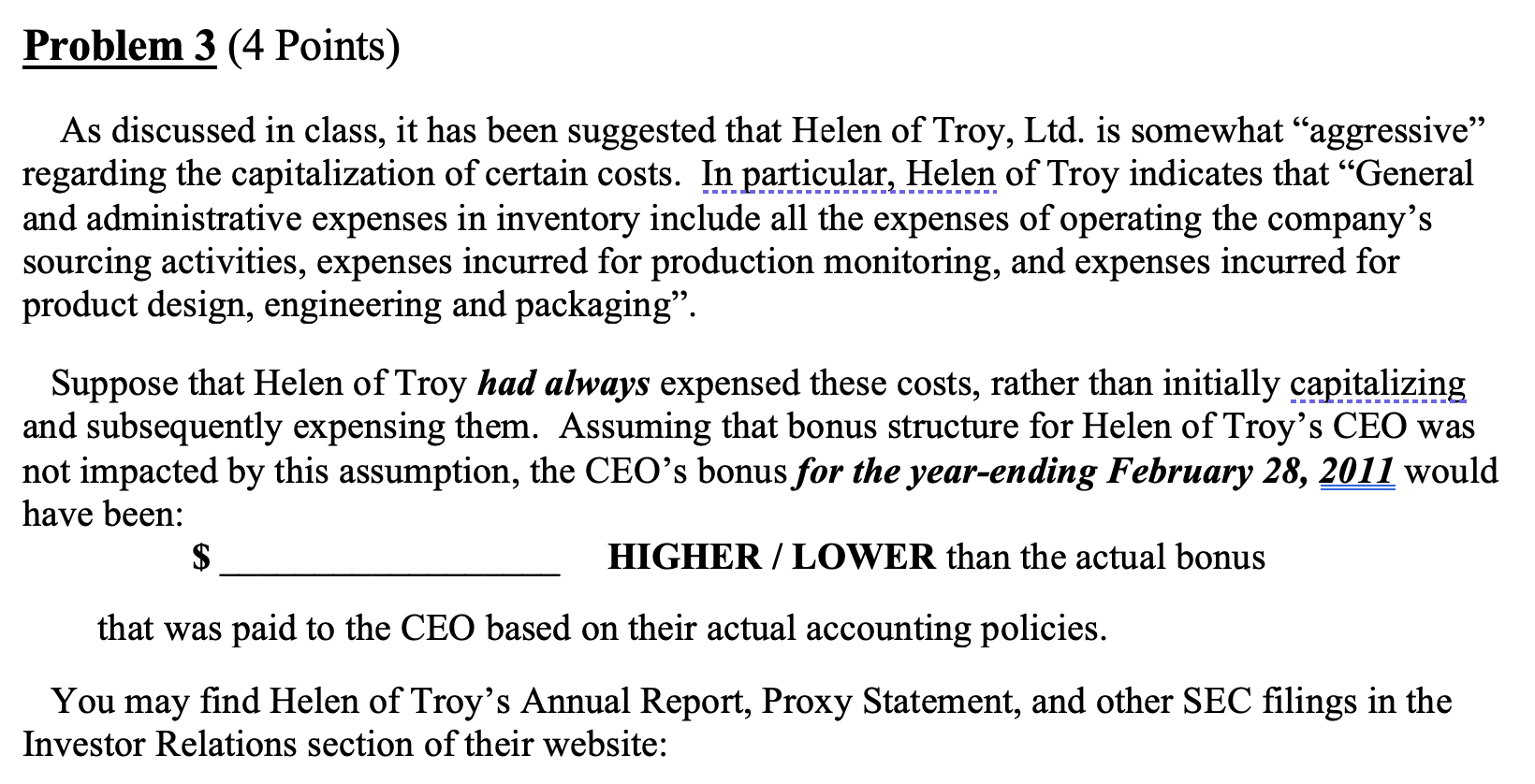

Problem 1(6 Points) Using the Market-Derived Model discussed in class, please estimate the cost of equity capital for Allstate (Ticker: ALL) as of December 3, 2021. Note that on Friday, December 3, the closing price of Allstate Common stock was $ 108.32. Assume that Call Options that expire in January 2024 with an exercise price of $ 110.00 had a closing price of $ 13.00. Further, please indicate any assumptions that you are making regarding the risk-free rate, the expected return on AllState bonds, and the firm's dividend policy. Problem 2 (5 Points) Some excerpts from the most recent Allstate annual report are provided below. The first excerpt contains information related to insurance) premiums for various Allstate lines of insurance: Allstate Protection: Allstate Brand Premiums written and earned by line of business For the years ended December 31, 2020 2019 2018 $ ($ in millions) Premiums earned Auto Homeowners Other personal lines Subtotal - Personal lines Commercial lines Total 24,115 $ 7,858 1,841 33,814 767 34,581 $ 23,649 $ 7,513 1,781 32,943 882 33,825 $ 22,434 7,114 1,724 31,272 655 31,927 $ The second excerpt contains information related to the renewal rates of Allstate's Automobile Insurance policies: Auto premium measures and statistics PIF (thousands) New issued applications (thousands) Average premium Renewal ratio (%) Total brand rate changes (%) 2020 21,809 3,467 617 87.5 (0.2) 2019 21,913 3,535 603 $ 88.0 2018 21,592 3,566 586 88.0 1.2 2020 vs. 2019 (0.5)% (1.9)% 2.3 % (0.5) (3.2) 2019 vs. 2018 1.5 % (0.9)% 2.9 % $ $ 3.0 1.8 The third exhibit contain information related to Allstate's expenses. Loss Ratio", is calculated as insurance claims divided by insurance premiums, and is provided below. The Expense ratio is calculated as administrative expense divided by premiums. The Combined Ratio" is the sum of the Loss Ratio and the Expense Ratio. Combined ratios by line of business For the years ended December 31, Loss ratio Expense ratio (1) Combined ratio 2020 2019 2018 2020 2019 2018 2020 2019 2018 57.5 68.3 66.8 28.4 24.6 25.3 85.9 92.9 92.1 3.8 3.8 67.5 65.0 69.5 22.9 23.7 89.8 87.9 93.2 58.8 60.7 66.3 27.3 26.6 27.4 86.1 87.3 93.7 82.4 81.3 91.3 22.3 17.1 21.4 104.7 98.4 112.7 0.5 0.5 60.4 67.5 67.9 26.6 23.9 24.8 87.0 91.4 92.7 Auto Impact of Shelter-in-Place Payback expense Homeowners Other personal lines Commercial lines Impact of Shelter-in-Place Payback expense Total 22.3 Suppose that on January 1, 2021, you were interested in the operating value of the Auto line of insurance for their existing customers. What is your estimated value for this line of business? You may assume that in the future, the Loss Ratio, Expense Ratio, and Renewal Ratio" will be equal to the three year average of these numbers. (Ignore the Shelter in Place Payback Expense)_You may assume that the average premium will increase by 3.0% per year, that Allstate pays taxes at a rate of 20%, and that Allstate has a cost of capital equal to your answer from Problem 1 (assume 12% if you didn't solve problem one). Please indicate any other assumptions that you are making. Problem 3 (4 Points) As discussed in class, it has been suggested that Helen of Troy, Ltd. is somewhat aggressive regarding the capitalization of certain costs. In particular, Helen of Troy indicates that General and administrative expenses in inventory include all the expenses of operating the company's sourcing activities, expenses incurred for production monitoring, and expenses incurred for product design, engineering and packaging". Suppose that Helen of Troy had always expensed these costs, rather than initially capitalizing and subsequently expensing them. Assuming that bonus structure for Helen of Troy's CEO was not impacted by this assumption, the CEO's bonus for the year-ending February 28, 2011 would have been: $ HIGHER / LOWER than the actual bonus that was paid to the CEO based on their actual accounting policies. You may find Helen of Troy's Annual Report, Proxy Statement, and other SEC filings in the Investor Relations section of their website: Problem 1(6 Points) Using the Market-Derived Model discussed in class, please estimate the cost of equity capital for Allstate (Ticker: ALL) as of December 3, 2021. Note that on Friday, December 3, the closing price of Allstate Common stock was $ 108.32. Assume that Call Options that expire in January 2024 with an exercise price of $ 110.00 had a closing price of $ 13.00. Further, please indicate any assumptions that you are making regarding the risk-free rate, the expected return on AllState bonds, and the firm's dividend policy. Problem 2 (5 Points) Some excerpts from the most recent Allstate annual report are provided below. The first excerpt contains information related to insurance) premiums for various Allstate lines of insurance: Allstate Protection: Allstate Brand Premiums written and earned by line of business For the years ended December 31, 2020 2019 2018 $ ($ in millions) Premiums earned Auto Homeowners Other personal lines Subtotal - Personal lines Commercial lines Total 24,115 $ 7,858 1,841 33,814 767 34,581 $ 23,649 $ 7,513 1,781 32,943 882 33,825 $ 22,434 7,114 1,724 31,272 655 31,927 $ The second excerpt contains information related to the renewal rates of Allstate's Automobile Insurance policies: Auto premium measures and statistics PIF (thousands) New issued applications (thousands) Average premium Renewal ratio (%) Total brand rate changes (%) 2020 21,809 3,467 617 87.5 (0.2) 2019 21,913 3,535 603 $ 88.0 2018 21,592 3,566 586 88.0 1.2 2020 vs. 2019 (0.5)% (1.9)% 2.3 % (0.5) (3.2) 2019 vs. 2018 1.5 % (0.9)% 2.9 % $ $ 3.0 1.8 The third exhibit contain information related to Allstate's expenses. Loss Ratio", is calculated as insurance claims divided by insurance premiums, and is provided below. The Expense ratio is calculated as administrative expense divided by premiums. The Combined Ratio" is the sum of the Loss Ratio and the Expense Ratio. Combined ratios by line of business For the years ended December 31, Loss ratio Expense ratio (1) Combined ratio 2020 2019 2018 2020 2019 2018 2020 2019 2018 57.5 68.3 66.8 28.4 24.6 25.3 85.9 92.9 92.1 3.8 3.8 67.5 65.0 69.5 22.9 23.7 89.8 87.9 93.2 58.8 60.7 66.3 27.3 26.6 27.4 86.1 87.3 93.7 82.4 81.3 91.3 22.3 17.1 21.4 104.7 98.4 112.7 0.5 0.5 60.4 67.5 67.9 26.6 23.9 24.8 87.0 91.4 92.7 Auto Impact of Shelter-in-Place Payback expense Homeowners Other personal lines Commercial lines Impact of Shelter-in-Place Payback expense Total 22.3 Suppose that on January 1, 2021, you were interested in the operating value of the Auto line of insurance for their existing customers. What is your estimated value for this line of business? You may assume that in the future, the Loss Ratio, Expense Ratio, and Renewal Ratio" will be equal to the three year average of these numbers. (Ignore the Shelter in Place Payback Expense)_You may assume that the average premium will increase by 3.0% per year, that Allstate pays taxes at a rate of 20%, and that Allstate has a cost of capital equal to your answer from Problem 1 (assume 12% if you didn't solve problem one). Please indicate any other assumptions that you are making. Problem 3 (4 Points) As discussed in class, it has been suggested that Helen of Troy, Ltd. is somewhat aggressive regarding the capitalization of certain costs. In particular, Helen of Troy indicates that General and administrative expenses in inventory include all the expenses of operating the company's sourcing activities, expenses incurred for production monitoring, and expenses incurred for product design, engineering and packaging". Suppose that Helen of Troy had always expensed these costs, rather than initially capitalizing and subsequently expensing them. Assuming that bonus structure for Helen of Troy's CEO was not impacted by this assumption, the CEO's bonus for the year-ending February 28, 2011 would have been: $ HIGHER / LOWER than the actual bonus that was paid to the CEO based on their actual accounting policies. You may find Helen of Troy's Annual Report, Proxy Statement, and other SEC filings in the Investor Relations section of their website

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts