Question: Problem 16-02 Joel Franklin is a portfolio manager responsible for derivatives. Franklin observes an American-style option and a European-style option with the same strike price,

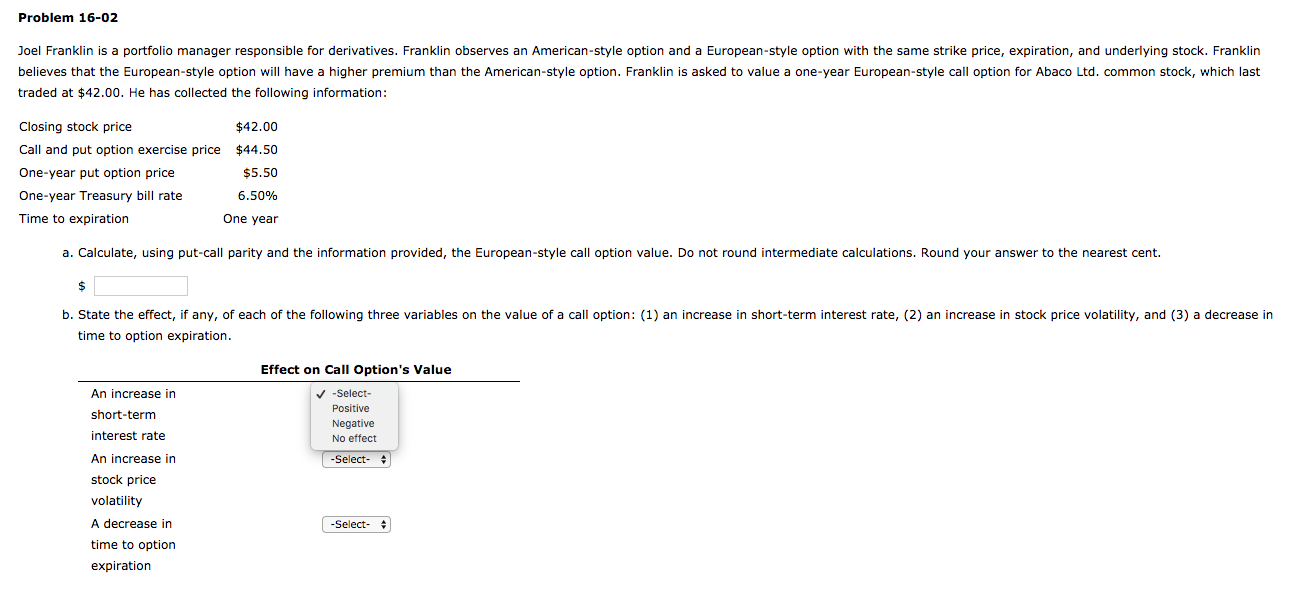

Problem 16-02 Joel Franklin is a portfolio manager responsible for derivatives. Franklin observes an American-style option and a European-style option with the same strike price, expiration, and underlying stock. Franklin believes that the European-style option will have a higher premium than the American-style option. Franklin is asked to value a one-year European-style call option for Abaco Ltd. common stock, which last traded at $42.00. He has collected the following information: Closing stock price $42.00 Call and put option exercise price $44.50 One-year put option price $5.50 One-year Treasury bill rate 6.50% Time to expiration One year a. Calculate, using put-call parity and the information provided, the European-style call option value. Do not round intermediate calculations. Round your answer to the nearest cent. b. State the effect, if any, of each of the following three variables on the value of a call option: (1) an increase in short-term interest rate, (2) an increase in stock price volatility, and (3) a decrease in time to option expiration. Effect on Call Option's Value -Select- Positive Negative No effect -Select- An increase in short-term interest rate An increase in stock price volatility A decrease in time to option expiration -Select

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts