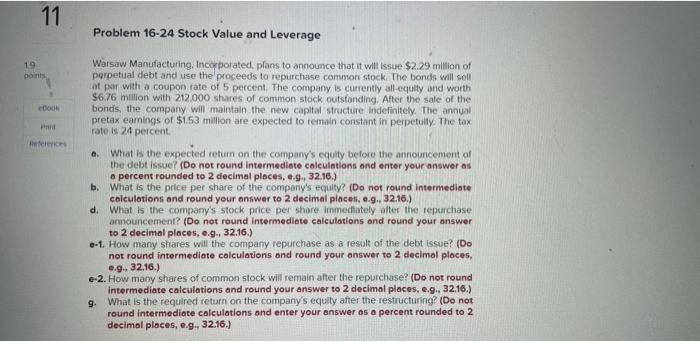

Question: Problem 16-24 Stock Value and Leverage Warsaw Manufacturing. Incorporated, plans to announce that it will issue $2.29 million of perpetual debt and use the proceeds

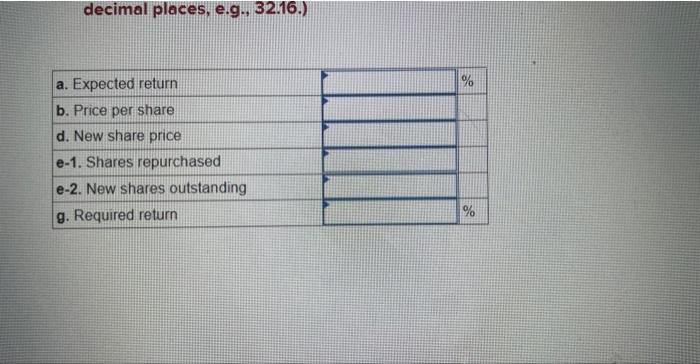

Problem 16-24 Stock Value and Leverage Warsaw Manufacturing. Incorporated, plans to announce that it will issue $2.29 million of perpetual debt and use the proceeds to repurchase common stock. The bonds will soll at par with a coupon rate of 5 percent. The company is currently all-equily and worth $6.76 million with 212.000 shares of common stock outstanding. After the sale of the bonds, the company will maintain the new caplal structure indefinitely. The annyal pretax earnings of $1.53 millon are expected to remain constant in perpetully. The tax rate is 24 percent. a. What is the expected retum on the company's equity before the announcement of the debt issue? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, 6.9,32.16. b. What is the price per share of the company's equity? (Do not round intermediate colculotions and round your onswer to 2 decimal placesi, e.9., 32.16.) d. What is the compary's stock price per share immedhately after the repurchase announcement? (Do not round intermediate calculations and round your answer to 2 decimal ploces, e.9., 32.16.) e-1. How many shares will the company repurchase as a resilt of the debt issue? (Do not round intermediate calculations and round your answer to 2 decimal ploces, e.9. 32.16.) e-2. How many shares of common stock will remain after the repurchase? (Do not round intermediate calculations and round your answer to 2 decimal places, e.9., 32.16.) 9. What is the requared return on the company's equily after the restructuring? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) decimal places, e.g., 32.16.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts