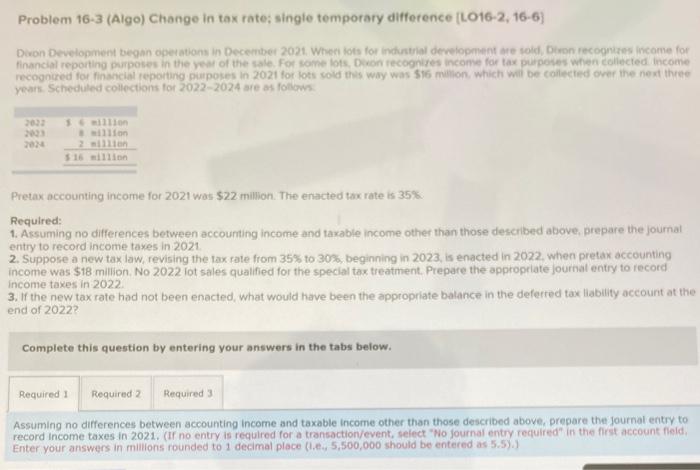

Question: Problem 16-3 (Algo) Change in tax rate; single temporary difference [LO16-2, 16-6] Divon Development began operations in Decentber 2021 . Wheri fots for industial development

Problem 16-3 (Algo) Change in tax rate; single temporary difference [LO16-2, 16-6] Divon Development began operations in Decentber 2021 . Wheri fots for industial development are soid, Diwon recognizes income for financial reporting pripotes in the year of the sale. For some lots. Dwon recognites income for tax purposes when collecied. income recognured for financial reporting piaposes in 2021 for lots sold this way was $16 million. which will be collected oref the next three years. Schectuled collections for 20222024 are as follown. Pretax accounting income for 2021 was $22 million. The enacted tax rate is 35%. Required: 1. Assuming no differences between accounting income and taxable income other than those described above, prepare the journal entry to record income taxes in 2021 2. Suppose a new tax law, revising the tax rate from 35% to 30%, beginning in 2023 , is enacted in 2022 . when pretax accounting income was $18 million. No 2022 lot sales qualified for the special tax treatment. Prepare the approprlate journal entry to record income taxes in 2022. 3. If the new tax rate had not been enacted, what would have been the appropriate balance in the deferred tax liability account at the end of 2022? Complete this question by entering your answers in the tabs below. Assuming no differences between accounting income and taxable income other than those described above, prepare the journal entry to record income taxes in 2021. (If no entry is requlred for a transaction/event, select "No fournal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (1.e.,5,500,000 should be entered as 5.5).1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts