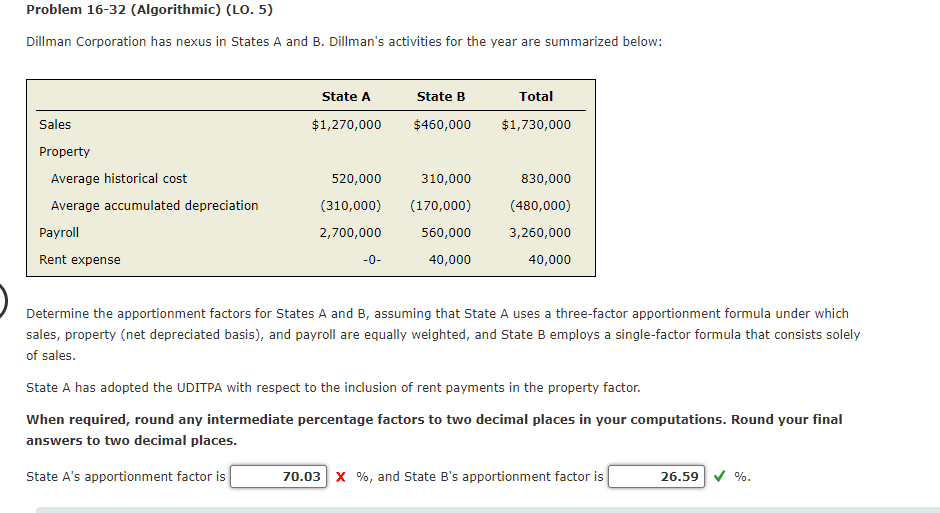

Question: Problem 16-32 (Algorithmic) (LO. 5) Dillman Corporation has nexus in States A and B. Dillman's activities for the year are summarized below: State B State

Problem 16-32 (Algorithmic) (LO. 5) Dillman Corporation has nexus in States A and B. Dillman's activities for the year are summarized below: State B State A $1,270,000 Total $1,730,000 $460,000 Sales Property Average historical cost Average accumulated depreciation 520,000 310,000 830,000 (170,000) (310,000) 2,700,000 (480,000) 3,260,000 Payroll 560,000 40,000 Rent expense -0- 40,000 Determine the apportionment factors for States A and B, assuming that State A uses a three-factor apportionment formula under which sales, property (net depreciated basis), and payroll are equally weighted, and State B employs a single-factor formula that consists solely of sales. State A has adopted the UDITPA with respect to the inclusion of rent payments in the property factor. When required, round any intermediate percentage factors to two decimal places in your computations. Round your final answers to two decimal places. State A's apportionment factor is 70.03 x %, and State B's apportionment factor is 26.59 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts