Question: Problem 16-45 (LO 16-2) In year 1 (the current year), LAA Inc. made a charitable donation of $100,000 to the American Red Cross (a qualifying

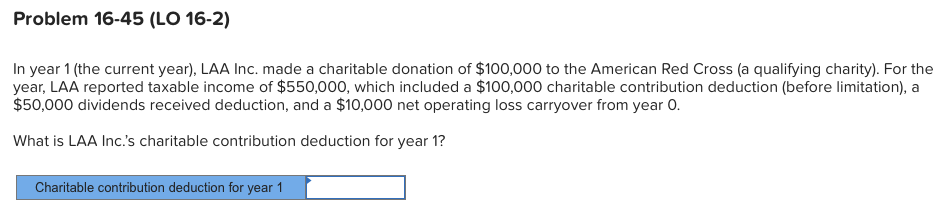

Problem 16-45 (LO 16-2) In year 1 (the current year), LAA Inc. made a charitable donation of $100,000 to the American Red Cross (a qualifying charity). For the year, LAA reported taxable income of $550,000, which included a $100,000 charitable contribution deduction (before limitation), a $50,000 dividends received deduction, and a $10,000 net operating loss carryover from year 0. What is LAA Inc.'s charitable contribution deduction for year 1? Charitable contribution deduction for year 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts