Question: Problem 16-5 (Algo) Secured vs. unsecured debt [LO 16-1] Select the correct yield to maturity for each security provision. Higher returns tend to go with

![Problem 16-5 (Algo) Secured vs. unsecured debt [LO 16-1] Select the](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f8149571a92_22966f814950f504.jpg)

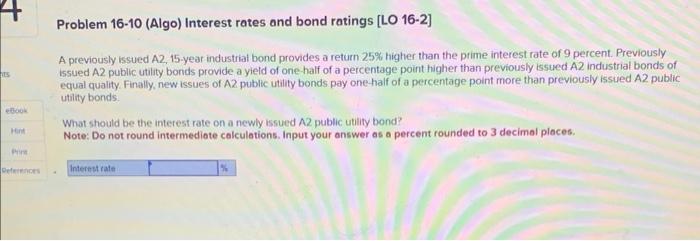

Problem 16-5 (Algo) Secured vs. unsecured debt [LO 16-1] Select the correct yield to maturity for each security provision. Higher returns tend to go with greater risk. Problem 1610 (Algo) Interest rates and bond ratings [LO 16-2] A previously issued A2, 15-year industrial bond provides a return 25\% higher than the prime interest rate of 9 percent. Previously issued A2 public utility bonds provide a yieid of one half of a percentage point higher than previously issued A2 industrial bonds of equal quality. Finally, new issues of A2 public utility bonds pay one half of a percentage point more than previously issued A2 public utility bonds. What should be the interest rate on a newly issued A2 public utility bond? Note: Do not round intermediote calculations. Input your answer as a percent rounded to 3 decimal places. Problem 16-5 (Algo) Secured vs. unsecured debt [LO 16-1] Select the correct yield to maturity for each security provision. Higher returns tend to go with greater risk. Problem 1610 (Algo) Interest rates and bond ratings [LO 16-2] A previously issued A2, 15-year industrial bond provides a return 25\% higher than the prime interest rate of 9 percent. Previously issued A2 public utility bonds provide a yieid of one half of a percentage point higher than previously issued A2 industrial bonds of equal quality. Finally, new issues of A2 public utility bonds pay one half of a percentage point more than previously issued A2 public utility bonds. What should be the interest rate on a newly issued A2 public utility bond? Note: Do not round intermediote calculations. Input your answer as a percent rounded to 3 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts