Question: Problem 16-52 Net Present Value Internal Rate of Return: Payback Sensitivity Analysis, Taxes Sections 2,3) (LO 16-3, 16-4, 16-6, 16-B) Total after-tax cash flow, 204

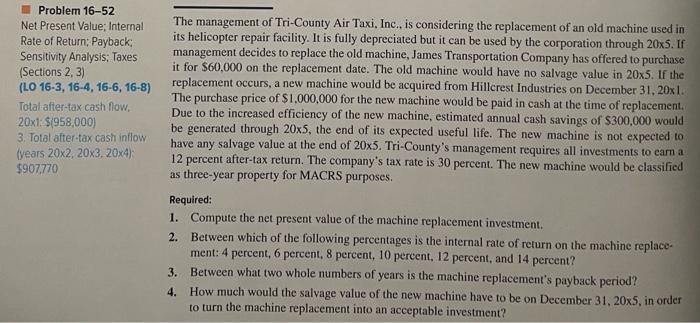

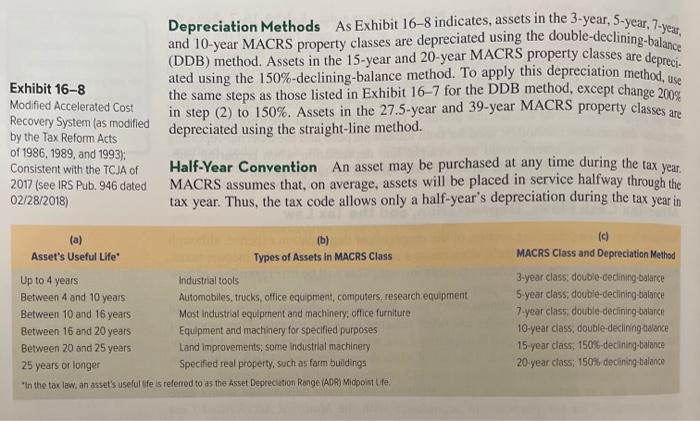

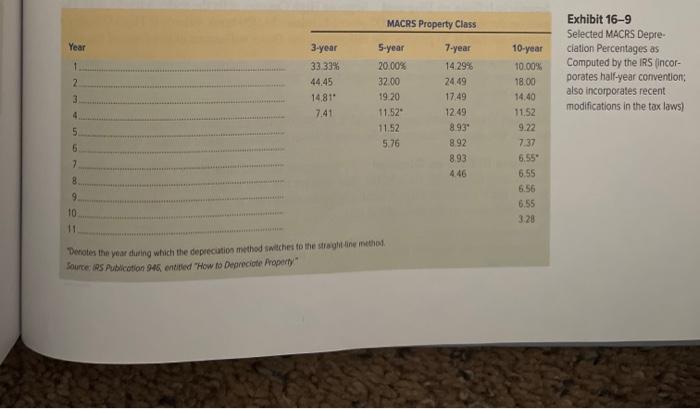

Problem 16-52 Net Present Value Internal Rate of Return: Payback Sensitivity Analysis, Taxes Sections 2,3) (LO 16-3, 16-4, 16-6, 16-B) Total after-tax cash flow, 204 51958.000) 3. Total after-tax cash intlow years 20x2.200.2024 $907770 The management of Tri-County Air Taxi, Inc., is considering the replacement of an old machine used in its helicopter repair facility. It is fully depreciated but it can be used by the corporation through 20x5. If management decides to replace the old machine, James Transportation Company has offered to purchase it for $60,000 on the replacement date. The old machine would have no salvage value in 20xS. If the replacement occurs, a new machine would be acquired from Hillcrest Industries on December 31, 20x1. The purchase price of $1,000,000 for the new machine would be paid in cash at the time of replacement Due to the increased efficiency of the new machine, estimated annual cash savings of $300,000 would be generated through 20x5, the end of its expected useful life. The new machine is not expected to have any salvage value at the end of 205. Tri-County's management requires all investments to earn a 12 percent after-tax return. The company's tax rate is 30 percent. The new machine would be classified as three-year property for MACRS purposes. Required: 1. Compute the net present value of the machine replacement investment. 2. Between which of the following percentages is the internal rate of return on the machine replace ment: 4 percent, 6 percent, 8 percent, 10 percent, 12 percent, and 14 percent? 3. Between what two whole numbers of years is the machine replacement's payback period? 4. How much would the salvage value of the new machine have to be on December 31, 20x5, in order to turn the machine replacement into an acceptable investment? ICMA adapted) Problem 16-52 Net Present Value: Internal Rate of Return: Payback Sensitivity Analysis: Taxes (Sections 2.3) (LO 16-3, 16-4, 16-6, 16-8) Total after-tax cash flow, 20x1: $(958,000) 3. Total after-tax cash inflow (years 20x2,20x3,20x4) $907.770 The management of Tri-County Air Taxi, Inc., is considering the replacement of an old machine used in its helicopter repair facility. It is fully depreciated but it can be used by the corporation through 20x5. If management decides to replace the old machine, James Transportation Company has offered to purchase it for $60,000 on the replacement date. The old machine would have no salvage value in 20x5. If the replacement occurs, a new machine would be acquired from Hillcrest Industries on December 31, 20x1. The purchase price of $1,000,000 for the new machine would be paid in cash at the time of replacement. Due to the increased efficiency of the new machine, estimated annual cash savings of $300,000 would be generated through 20x5, the end of its expected useful life. The new machine is not expected to have any salvage value at the end of 205. Tri-County's management requires all investments to earn a 12 percent after-tax return. The company's tax rate is 30 percent. The new machine would be classified as three-year property for MACRS purposes. Required: 1. Compute the net present value of the machine replacement investment. 2. Between which of the following percentages is the internal rate of return on the machine replace- ment: 4 percent, 6 percent, 8 percent, 10 percent. 12 percent, and 14 percent? 3. Between what two whole numbers of years is the machine replacement's payback period? 4. How much would the salvage value of the new machine have to be on December 31, 20x5, in order to turn the machine replacement into an acceptable investment? Depreciation Methods As Exhibit 16-8 indicates, assets in the 3-year, 5-year, 7-year, and 10-year MACRS property classes are depreciated using the double-declining-balance (DDB) method. Assets in the 15-year and 20-year MACRS property classes are deprecia ated using the 150%-declining-balance method. To apply this depreciation method, use Exhibit 16-8 the same steps as those listed in Exhibit 167 for the DDB method, except change 2009 Modified Accelerated Cost Recovery System (as modified depreciated using the straight-line method. in step (2) to 150%. Assets in the 27.5-year and 39-year MACRS property classes are by the Tax Reform Acts of 1986, 1989, and 1993): Consistent with the TCJA of Half-Year Convention An asset may be purchased at any time during the tax year. 2017 (see IRS Pub. 946 dated MACRS assumes that, on average, assets will be placed in service halfway through the 02/28/2018) tax year. Thus, the tax code allows only a half-year's depreciation during the tax year in (a) (b) Asset's Useful Life Types of Assets in MACRS Class Up to 4 years Industrial tools Between 4 and 10 years Automobiles, trucks, office equipment, computers, research equipment Between 10 and 16 years Most industrial equipment and machinery, office furniture Between 16 and 20 years Equipment and machinery for specified purposes Between 20 and 25 years Land improvements; some industrial machinery 25 years or longer Specified real property, such as farm buildings in the tax law, an asset's useful life is referred to as the Asset Depreciation Range (ADR) Midopiste (0) MACRS Class and Depreciation Method 3-year class, double-dedining-batarce 5 year class, double-declining balance 7-year class, double-decning balance 10-year dass, double-declining Cance 15-year class: 150%-declining-balance 20 year class:150%-declining balance MACRS Property Class Year 5-year 1 2 3 3-year 33.33% 44,45 14.810 7.41 20.00% 32.00 19.20 11.52 11.52 5.76 7-year 14.29% 24.49 17.49 12.49 8.93 892 8.93 4.46 Exhibit 16-9 Selected MACRS Depre ciation Percentages as Computed by the IRS (incor- porates half-year convention also incorporates recent modifications in the tax laws) 4 5 10-year 10.00% 18.00 14.40 11.52 9.22 737 6.55 6.55 6.56 6.55 3.28 6 7 8 9 10 11 Domotes the year during which the depreciation method switches to the stage method SourceIRS Publication 946 unted How to Depreciate Property

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts