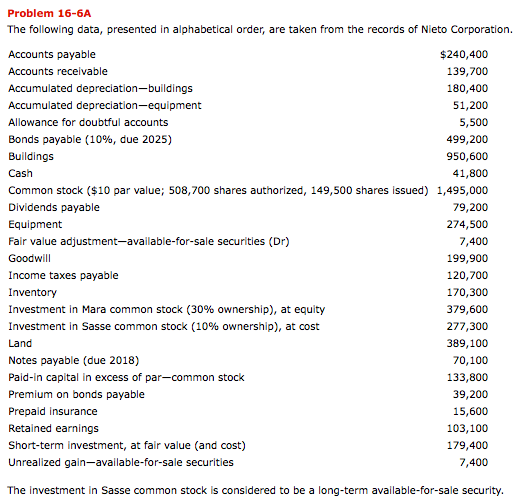

Question: Problem 16-6A The following data, presented in alphabetical order, are taken from the records of Nieto Corporation. $240,400 139,700 180,400 51,200 5,500 499,200 950,600 41,800

Problem 16-6A The following data, presented in alphabetical order, are taken from the records of Nieto Corporation. $240,400 139,700 180,400 51,200 5,500 499,200 950,600 41,800 Accounts payable Accounts recelvable Accumulated depreciation-buildings Accumulated depreciation-equipment Allowance for doubtful accounts Bonds payable (10%, due 2025) Buildings Cash Common stock ($10 par value; 508,700 shares authorized, 149,500 shares issued) 1,495,000 Dividends payable Equipment Fair value adjustment-available-for-sale securities (Dr) Goodwill Income taxes payable Inventory Investment in Mara common stock (30% ownership), at equity Investment in Sasse common stock (10% ownership), at cost Land Notes payable (due 2018) Paid-n capital in excess of par-common stock Premium on bonds payable Prepaid insurance Retained earnings Short-term investment, at fair value (and cost) Unrealized gain-available-for-sale securitles 79,200 274,500 7,400 199,900 120,700 170,300 379,600 277,300 389,100 70,100 133,800 39,200 15,600 103,100 179,400 7,400 The investment in Sasse common stock is considered to be a long-term available-for-sale security

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts