Question: Problem 1.(70 points) Suppose you would like to put $1 either in a US bank or in a bank in Russia, to collect your return

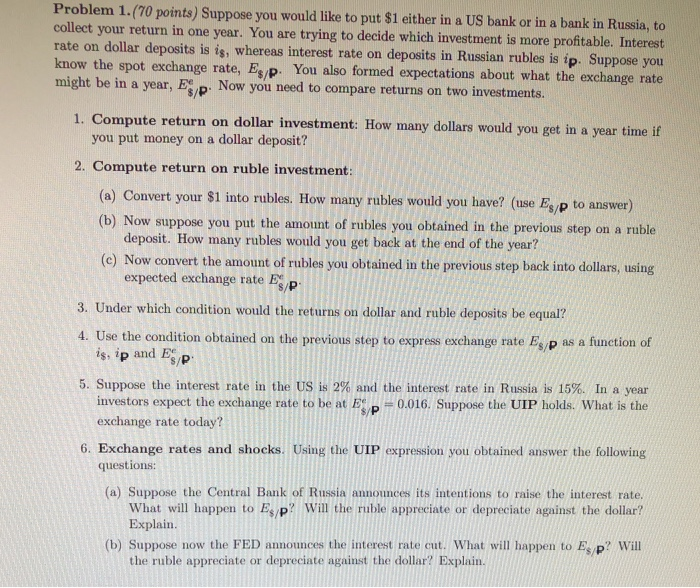

Problem 1.(70 points) Suppose you would like to put $1 either in a US bank or in a bank in Russia, to collect your return in one year. You are trying to decide which investment is more profitable. Interest rate on dollar deposits is is, whereas interest rate on deposits in Russian rubles is ip. Suppose you know the spot exchange rate, Ex P. You also formed expectations about what the exchange rate might be in a year, ES p. Now you need to compare returns on two investments. 1. Compute return on dollar investment: How many dollars would you get in a year time if you put money on a dollar deposit? 2. Compute return on ruble investment: (a) Convert your $1 into rubles. How many rubles would you have? (use Es p to answer) (5) Now suppose you put the amount of rubles you obtained in the previous step on a ruble deposit. How many rubles would you get back at the end of the year? (c) Now convert the amount of rubles you obtained in the previous step back into dollars, using expected exchange rate E P 3. Under which condition would the returns on dollar and ruble deposits be equal? 4. Use the condition obtained on the previous step to express exchange rate Es p as a function of is, ip and ESP 5. Suppose the interest rate in the US is 2% and the interest rate in Russia is 15%. In a year investors expect the exchange rate to be at E 0.016. Suppose the UIP holds. What is the exchange rate today? 6. Exchange rates and shocks. Using the UIP expression you obtained answer the following questions: (a) Suppose the Central Bank of Russia announces its intentions to raise the interest rate. What will happen to Esp? Will the ruble appreciate or depreciate against the dollar? Explain. (b) Suppose now the FED announces the interest rate cut. What will happen to Exp? Will the ruble appreciate or depreciate against the dollar? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts