Question: Problem 17-07 Your answer is partially correct. Try again. The following information relates to the debt securities investments of Tamarisk Company. 1. On February 1,

Problem 17-07

| Your answer is partially correct. Try again. | |

The following information relates to the debt securities investments of Tamarisk Company.

| 1. | On February 1, the company purchased 10% bonds of Gibbons Co. having a par value of $321,600 at 100 plus accrued interest. Interest is payable April 1 and October 1. | |

| 2. | On April 1, semiannual interest is received. | |

| 3. | On July 1, 9% bonds of Sampson, Inc. were purchased. These bonds with a par value of $184,800 were purchased at 100 plus accrued interest. Interest dates are June 1 and December 1. | |

| 4. | On September 1, bonds with a par value of $56,400, purchased on February 1, are sold at 97 plus accrued interest. | |

| 5. | On October 1, semiannual interest is received. | |

| 6. | On December 1, semiannual interest is received. | |

| 7. | On December 31, the fair value of the bonds purchased February 1 and July 1 are 93 and 91, respectively. |

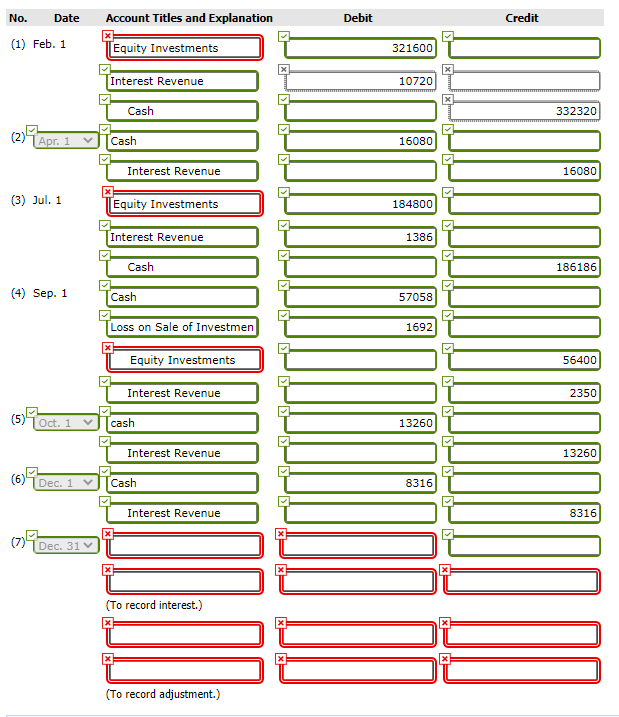

(a) Prepare any journal entries you consider necessary, including year-end entries (December 31), assuming these are available-for-sale securities. (Note to instructor: Some students may debit Interest Receivable at date of purchase instead of Interest Revenue. This procedure is correct, assuming that when the cash is received for the interest, an appropriate credit to Interest Receivable is recorded.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

No. Date Account Titles and Explanation Debit Credit x (1) Feb. 1 Equity Investments 321600 Interest Revenue 10720 Cash 332320 (2) Apr. 1 Cash 16080 Interest Revenue 16080 (3) Jul. 1 Equity Investments 184800 Interest Revenue 1386 Cash 186186 (4) Sep. 1 Cash 57058 Loss on Sale of Investmen 1692 Equity Investments 56400 Interest Revenue 2350 (5) oct. 1 cash 13260 Interest Revenue 13260 (6) Dec. 1 Cash 8316 Interest Revenue 8316 (7) Dec. 31 DO COMO DO CORDE (To record interest.) (To record adjustment.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts