Question: Problem 17-1 Presented below is an amortization schedule related to Sheridan Company's 5-year, $160,000 bond with a 8% interest rate and a 6% yield, purchased

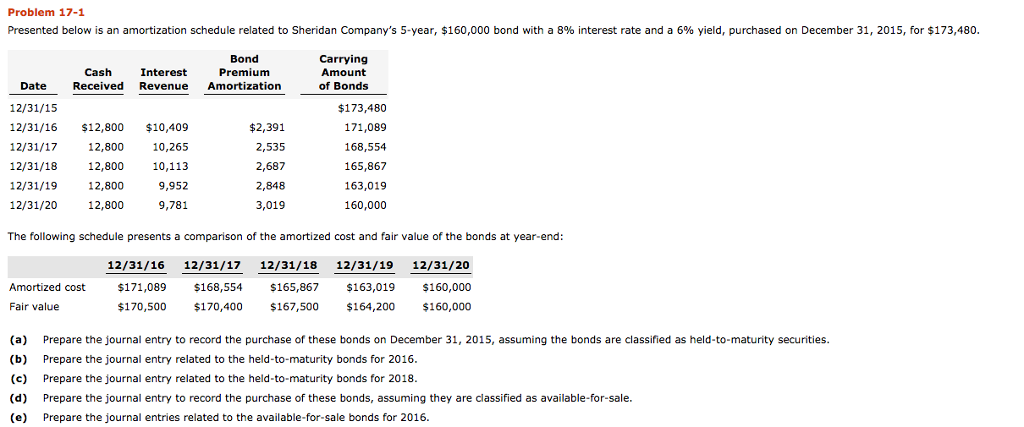

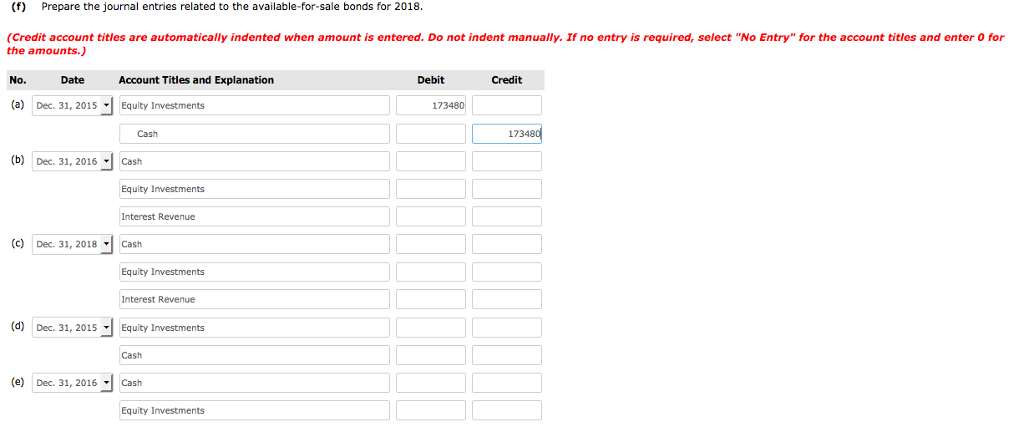

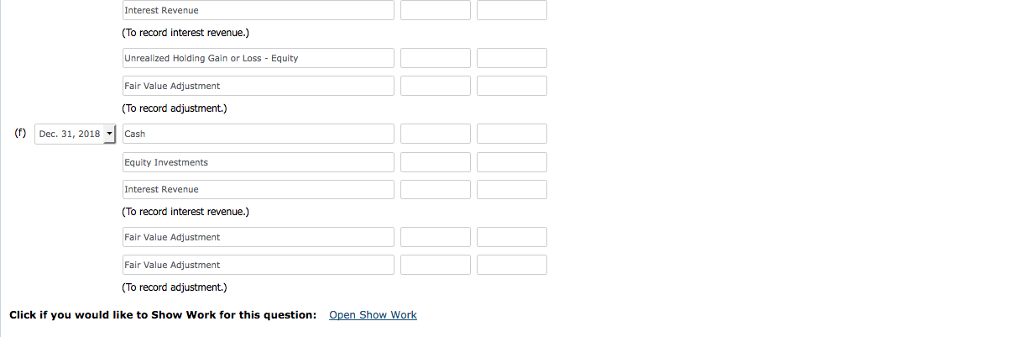

Problem 17-1 Presented below is an amortization schedule related to Sheridan Company's 5-year, $160,000 bond with a 8% interest rate and a 6% yield, purchased on December 31, 2015, for $173,480 Bond Premium Carrying Amount of Bonds Cash Interest Date Received Revenue Amortization $173,480 171,089 168,554 165,867 163,019 160,000 12/31/15 12/31/16 $12,800 $10,409 10,265 12,800 10,113 9,952 9,781 $2,391 2,535 2,687 2,848 3,019 ,800 12/31/1712 12/31/18 12/31/19 2/31/20 12,800 The following schedule presents a comparison of the amortized cost and fair value of the bonds at year-end: 12,800 12/31/16 12/31/17 12/31/18 12/31/19 12/31/20 $171,089 $168,554$165,867 $163,019 $160,000 $170,500 $170,400 $167,500 $164,200 $160,000 Amortized cost Fair value (a) Prepare the journal entry to record the purchase of these bonds on December 31, 2015, assuming the bonds are classified as held-to-maturity securities (b) Prepare the journal entry related to the held-to-maturity bonds for 2016 (c) Prepare the journal entry related to the held-to-maturity bonds for 2018 (d) Prepare the journal entry to record the purchase of these bonds, assuming they are classified as available-for-sale (e) Prepare the journal entries related to the available-for-sale bonds for 2016

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts