Question: Problem 17-16 (Algo) Comprehensivereporting a pension plan; pension spreadsheet; determine changes in balances; two years [LO17-3, 17-4, 17-5, 17-6, 17-7, 17-8] Skip to question [The

Problem 17-16 (Algo) Comprehensivereporting a pension plan; pension spreadsheet; determine changes in balances; two years [LO17-3, 17-4, 17-5, 17-6, 17-7, 17-8]

Skip to question

[The following information applies to the questions displayed below.] Actuary and trustee reports indicate the following changes in the PBO and plan assets of Lakeside Cable during 2021:

| Prior service cost at Jan. 1, 2021, from plan amendment at the beginning of 2019 (amortization: $5 million per year) | $ | 37 | million |

| Net loss-pensions at Jan.1, 2021 (previous losses exceeded previous gains) | $ | 55 | million |

| Average remaining service life of the active employee group | 10 | years | |

| Actuarys discount rate | 8 | % | |

($ in millions)

| PBO | Plan Assets | ||||||||

| Beginning of 2021 | $ | 250 | Beginning of 2021 | $ | 150 | ||||

| Service cost | 48 | Return on plan assets, | |||||||

| Interest cost, 8% | 20 | 8.0% (10% expected) | 12 | ||||||

| Loss (gain) on PBO | (3 | ) | Cash contributions | 103 | |||||

| Less: Retiree benefits | (15 | ) | Less: Retiree benefits | (15 | ) | ||||

| End of 2021 | $ | 300 | End of 2021 | $ | 250 | ||||

Assume the following actuary and trustee reports indicating changes in the PBO and plan assets of Lakeside Cable during 2022: ($ in millions)

| PBO | Plan Assets | ||||||||

| Beginning of 2022 | $ | 300 | Beginning of 2022 | $ | 250 | ||||

| Service cost | 43 | Return on plan assets, | |||||||

| Interest cost, 8% | 24 | 18% (10% expected) | 45 | ||||||

| Loss (gain) on PBO | 6 | Cash contributions | 35 | ||||||

| Less: Retiree benefits | (21 | ) | Less: Retiree benefits | (21 | ) | ||||

| End of 2022 | $ | 352 | End of 2022 | $ | 309 | ||||

Problem 17-16 (Algo) Part 7

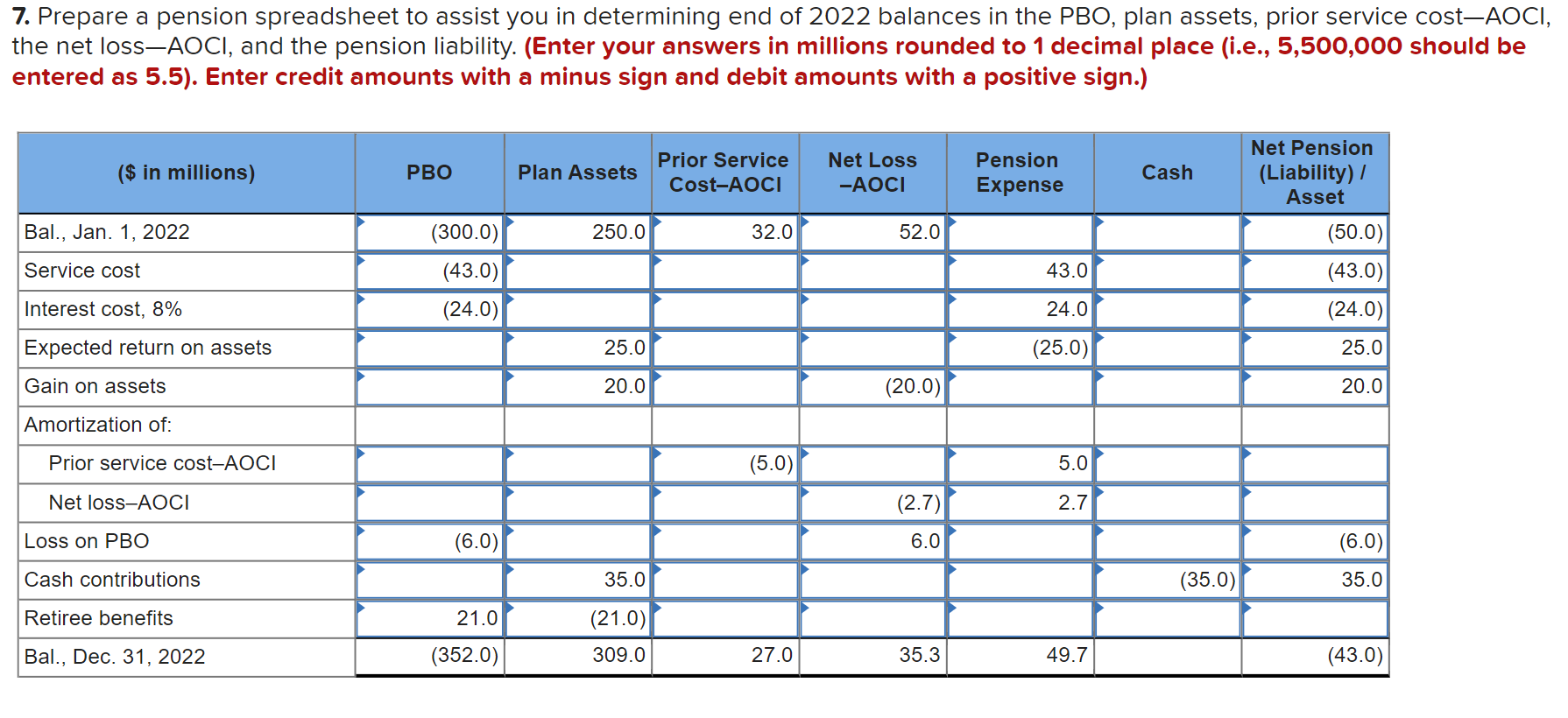

7. Prepare a pension spreadsheet to assist you in determining end of 2022 balances in the PBO, plan assets, prior service costAOCI, the net lossAOCI, and the pension liability. (Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5). Enter credit amounts with a minus sign and debit amounts with a positive sign.)

7. Prepare a pension spreadsheet to assist you in determining end of 2022 balances in the PBO, plan assets, prior service cost-AOCI, the net loss-AOCI, and the pension liability. (Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5). Enter credit amounts with a minus sign and debit amounts with a positive sign.) ($ in millions) PBO Plan Assets Prior Service Cost-AOCI Net Loss -AOCI Pension Expense Cash Bal., Jan. 1, 2022 250.0 32.0 52.0 Net Pension (Liability) Asset (50.0) (43.0) (24.0) (300.0) (43.0) (24.0) Service cost 43.0 Interest cost, 8% 24.0 Expected return on assets 25.0 (25.0) 25.0 Gain on assets 20.0 (20.0) 20.0 Amortization of: Prior service cost-AOCI (5.0) 5.0 Net loss-AOCI (2.7) 2.7 Loss on PBO (6.0) 6.0 (6.0) Cash contributions 35.0 (35.0) 35.0 Retiree benefits 21.0 (21.0) 309.0 Bal., Dec. 31, 2022 (352.0) 27.0 35.3 49.7 (43.0) 7. Prepare a pension spreadsheet to assist you in determining end of 2022 balances in the PBO, plan assets, prior service cost-AOCI, the net loss-AOCI, and the pension liability. (Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5). Enter credit amounts with a minus sign and debit amounts with a positive sign.) ($ in millions) PBO Plan Assets Prior Service Cost-AOCI Net Loss -AOCI Pension Expense Cash Bal., Jan. 1, 2022 250.0 32.0 52.0 Net Pension (Liability) Asset (50.0) (43.0) (24.0) (300.0) (43.0) (24.0) Service cost 43.0 Interest cost, 8% 24.0 Expected return on assets 25.0 (25.0) 25.0 Gain on assets 20.0 (20.0) 20.0 Amortization of: Prior service cost-AOCI (5.0) 5.0 Net loss-AOCI (2.7) 2.7 Loss on PBO (6.0) 6.0 (6.0) Cash contributions 35.0 (35.0) 35.0 Retiree benefits 21.0 (21.0) 309.0 Bal., Dec. 31, 2022 (352.0) 27.0 35.3 49.7 (43.0)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts